No Gold? No Problem: Why XRP Stands Strong On Its Own—Analyst

Reports have disclosed that XRP community commentator Versan Aljarrah says XRP could gain a link to gold without actually holding bullion. According to Aljarrah, XRP would simply move gold-backed stablecoins across the XRP Ledger.

The commentator argues that this role would give XRP a “synthetic connection” to tokenized assets like gold and oil, even though XRP itself would not carry any gold reserves.

How XRP Bridges Gold Token

According to Aljarrah, XRP only needs to power the on-chain movement of gold-pegged coins. Based on reports, each gold token on the XRPL would represent one gram of real gold. Custodians such as MKS Pamp and Imperial Vaults would hold the physical bars.

XRP would then step in to provide liquidity and settle trades on the ledger’s built-in exchange. Aljarrah sees this setup as a way for the altcoin to stay useful in global finance.

$XRP doesn’t need to be backed by gold. It just needs to move it.

When gold-pegged stablecoins live on $XRPL , XRP bridges them.

And in doing so, it becomes synthetically linked to gold, oil, and every asset they tokenize. pic.twitter.com/q0Ti2pQuDp

— Versan | Black Swan Capitalist (@VersanAljarrah) July 27, 2025

Meld Gold Leads The Charge

Meld Gold is the only issuer currently close to launching a gold token on the XRPL. Reports have disclosed that Meld plans to back each token with one gram of physical gold. The firm says it will work with major vault operators.

So far, no other gold token projects, including PAX Gold (PAXG), have moved onto XRP’s network. Supporters hope that more issuers will follow once Meld proves the concept.

Technical And Regulatory HurdlesReports note that issuing gold tokens is more than writing code. Each issuer must tie its token to audits, legal contracts and insured vaults. On top of that, XRP’s fixed supply and decentralized consensus system make direct asset backing tricky.

Matt Hamilton, a former Ripple developer, has said the crypto asset can’t be backed by gold in a traditional way. Analysts add that its price moves with adoption, legal clarity and market mood, not by hype.

Institutional Moves Remain Unseen

Institutional Moves Remain Unseen

Meanwhile, Aljarrah says big names like JPMorgan, BlackRock, the Bank for International Settlements and the IMF have made private plans to use XRP as a bridge. Yet no public evidence supports that claim.

Most large asset managers have focused on blockchains with clear rules. Until the Ripple-SEC lawsuit ends, top institutions are likely to hold back. That case could decide if XRP is treated like a security, and that will affect any tokenized assets on the XRPL.

According to analysis, a bridge role alone won’t peg XRP’s price to the spot gold rate of $2,950 that some in the community mention. Instead, if gold-pegged tokens take off, the altcoin could see more trading volume and tighter spreads.

That might nudge its price upward, but it would still trade on its own merits as a liquidity tool for cross-border payments.

Featured image from Pexels, chart from TradingView

Altcoin Rally To Commence When These 2 Signals Activate – Details

The altseason fanfare remains on the rise despite a broad altcoin rally two weeks ago that has quick...

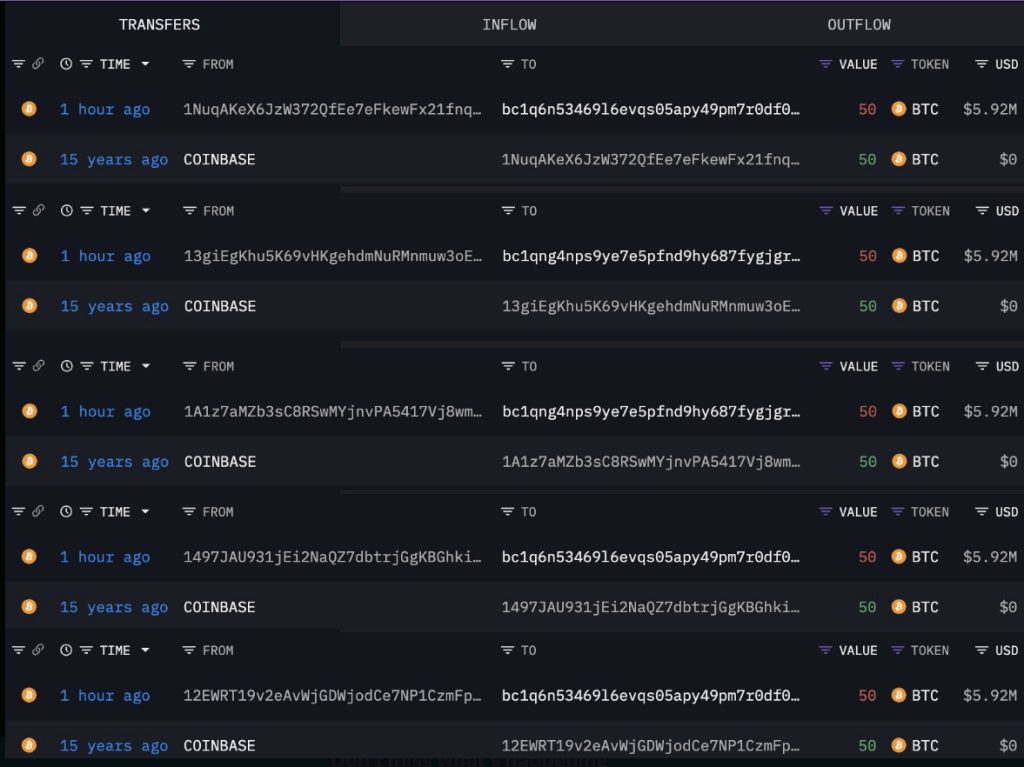

Bitcoin From 2009 Awakens—Is The $30-M Move A Warning Sign?

Five long-dormant Bitcoin wallets sprang back to life on July 31, moving a total of 250 BTC—nearly $...

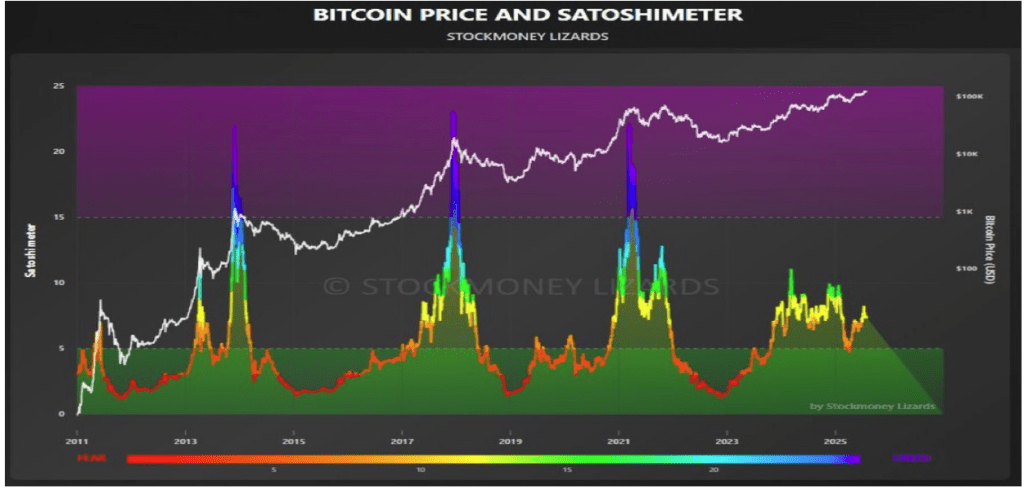

Satoshimeter Shows Where Bitcoin Price Is In This Cycle

The Bitcoin price surge above $120,000 has reignited speculation about where the flagship cryptocurr...