Altcoin Rally To Commence When These 2 Signals Activate – Details

The altseason fanfare remains on the rise despite a broad altcoin rally two weeks ago that has quickly evaporated in a wider market correction. As investors continue to await a potential rebound from these price dips, a popular analyst with X user PlanD has highlighted the two crucial signals that may initiate an altcoin market surge.

Ethereum And USDT Market Key To Altseason Future

In an X post on August 1, PlanD shared an in-depth technical analysis of multiple markets, including Bitcoin (BTC), Ethereum (ETH), Bitcoin Dominance (BTC.D) , and USDT Dominance. In studying the ETH market, PlanD highlights that the prominent altcoin faces major resistance at the $4,000, which has acted as the upper resistance level of a three-year symmetrical triangle.

According to the presented analysis, Ethereum’s ability to effectively hold above the $4,000 price barrier is the first important developing situation for the altseason. Being the largest altcoin with a market cap of $424.48 billion, a successful breakout beyond this familiar price ceiling would encourage a rally by lower-cap alts to potentially initiate an altseason. Meanwhile, PlanD also draws attention to the USDT Dominance chart, which has just registered the breakout of a bearish flag. While there is potential to retest the breakout point at 4.71%, the analyst tells investors to monitor a potential fall to 3.81% which aligns with the breakout of a 1.5-year descending triangle and 3.21% i.e., the price target of the bearish flag. In particular, PlanD states a fall in USDT Dominance to 3.21% which suggests significant rotation of capital to other volatile assets is the “strongest signal” for an altcoin rally.

Related Reading: If Dogecoin Loses This Level, Expect A Major Crash: Analyst WarnsBTC.D Potential Rise Possesses Risk To Altcoin Market

In analyzing the Bitcoin Dominance chart, PlanD notes this metric has twice successfully retested a key support at a three-year rising wedge at 60.30%; therefore, there is intense potential for a rebound. The top analyst notes that if BTC.D rises to retest the pivotal market levels at 64.60% and 64.80%, the altcoin market may see a general price loss ranging from 10%-20%. Meanwhile, PlanD is also backing Bitcoin to maintain its bullish form in the coming weeks with a projected price target of $160,000. Interestingly, the trading expert notes that there are two paths to this price, noting that Bitcoin may first find support at the $113,000, propelling a rebound beyond $118,700 and an eventual surge to $160,000. Alternatively, Bitcoin’s present correction may halt around $108,000 before rising towards the specified bull target. In this case, altcoins may also witness an initial 10-20% widespread price decline.

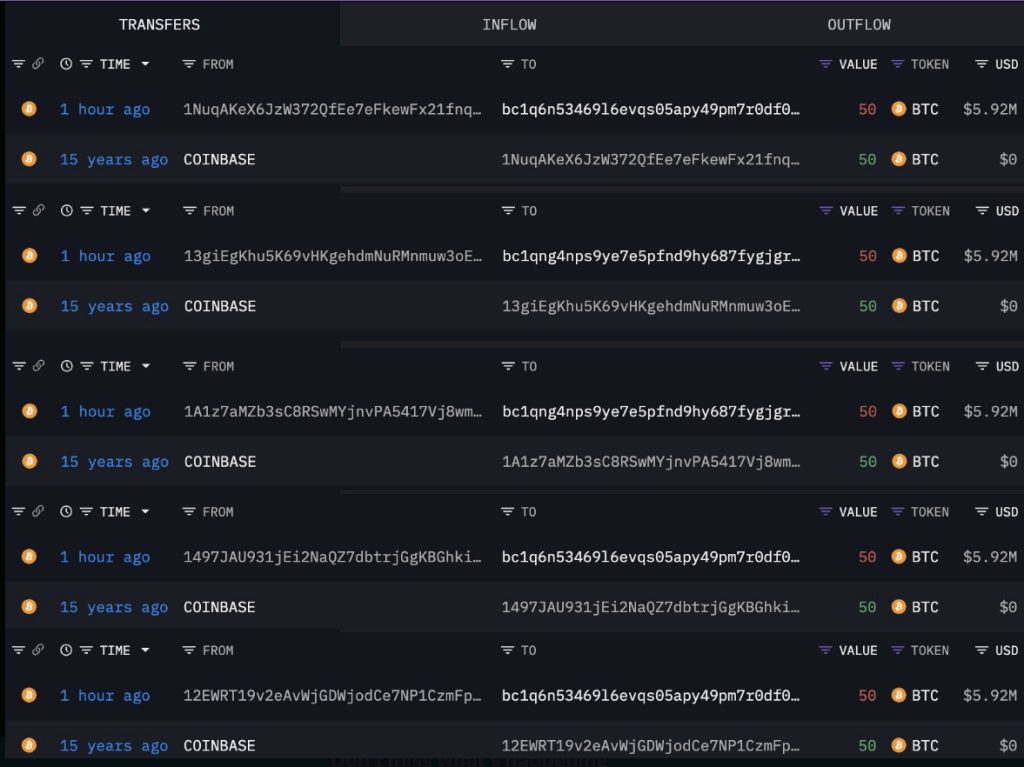

Bitcoin From 2009 Awakens—Is The $30-M Move A Warning Sign?

Five long-dormant Bitcoin wallets sprang back to life on July 31, moving a total of 250 BTC—nearly $...

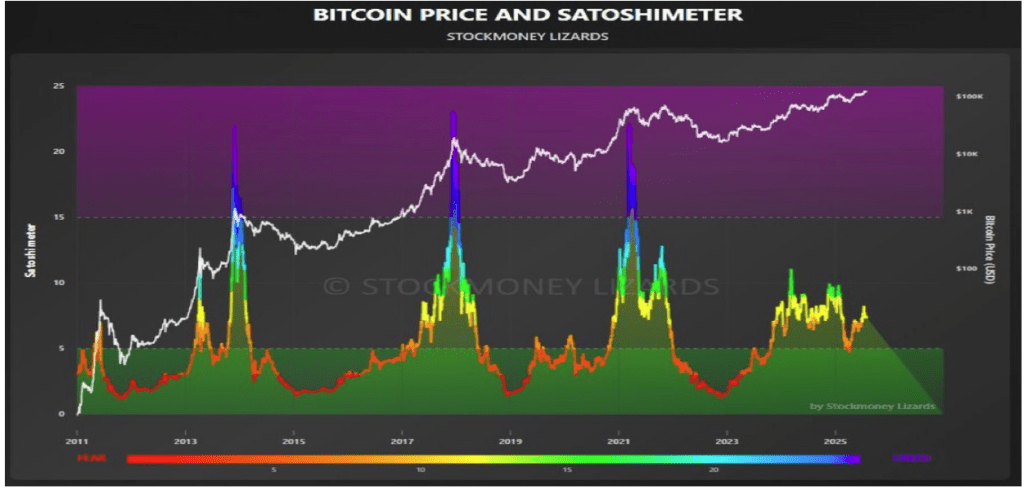

Satoshimeter Shows Where Bitcoin Price Is In This Cycle

The Bitcoin price surge above $120,000 has reignited speculation about where the flagship cryptocurr...

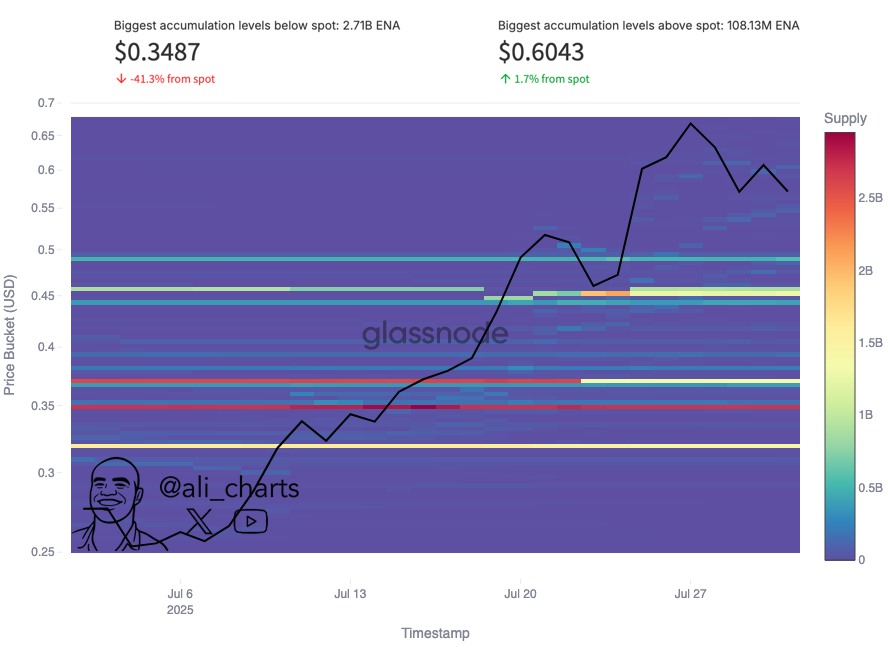

3 Key Ethena (ENA) Support Levels To Monitor – Analyst

Ethena (ENA) prices are presently in the red zone during a broader crypto market correction. Accordi...