Bitcoin From 2009 Awakens—Is The $30-M Move A Warning Sign?

Five long-dormant Bitcoin wallets sprang back to life on July 31, moving a total of 250 BTC—nearly $30 million at today’s rates. That’s money mined on April 26, 2010, during Bitcoin’s earliest tests. Traders saw the shift and paused, wondering if a massive sell-off was coming after more than 15 years of silence.

Early Coins Stir

According to on-chain observers , these coins came from wallets active before the famous “Patoshi pattern” ended. That pattern, often linked to Bitcoin’s creator, slowed down around May 2010. Moving coins from that era can send a jolt through the market, even when the total is small.

Around 250 BTC made a splash in today’s headlines. Yet Bitcoin’s circulating supply tops 19 million coins. So far, none of the funds have shown up on public exchanges. That means any real impact on prices may be low—unless the coins suddenly head for the exit in bulk.

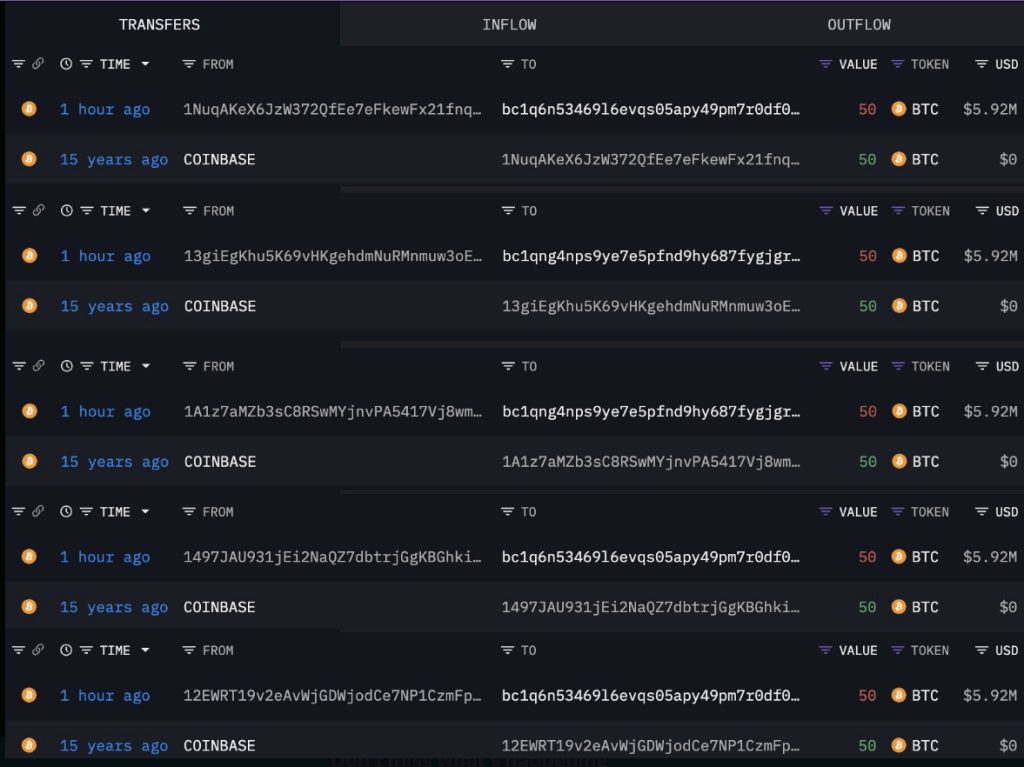

5 miner wallets woke up after being dormant for over 15 years and transferred 250 $BTC ($29.6M) out an hour ago.

These miner wallets earned 50 $BTC each from mining on Apr 26, 2010.

Wallets: 1NuqAKeX6JzW372QfEe7eFkewFx21fnqd3 12EWRT19v2eAvWjGDWjodCe7NP1CzmFphT… pic.twitter.com/vGttaE6MxY

— Lookonchain (@lookonchain) July 31, 2025

Traders and analysts have begun tracking the addresses that received the BTC. If those wallets start funneling coins into exchanges or over-the-counter desks, panic could spread.

But wallet shuffles without selling are common among early miners who just want to consolidate or upgrade their security.

Clues Point Away From Satoshi

Based on reports from Whale Alert, these movements don’t match the nonce patterns tied to the roughly 1.12 million BTC once mined by “Satoshi Nakamoto” across blocks up to number 54,316.

Experts note the mining speed and nonce range differ from what’s been linked to Bitcoin’s creator. That makes it far more likely these funds belong to other early adopters.

Tightening Crypto Rules

Tightening Crypto Rules

Meanwhile, reports have disclosed that Japan’s Financial Services Agency (FSA) has moved oversight of crypto-asset exchanges into a more powerful unit.

The aim is to tighten rules, improve capital checks, and guard against money-laundering. This change brings crypto platforms under the same kind of scrutiny as banks and brokerages.

Moving coins from 2010 always raises eyebrows. Yet 250 BTC is a drop in Bitcoin’s ocean. And with clues pointing away from Satoshi, the market may shrug this off unless the funds hit exchanges fast.

Japan’s new rules show that regulators aren’t standing still—they’re making sure crypto firms meet tougher standards going forward.

Featured image from Meta, chart from TradingView

Altcoin Rally To Commence When These 2 Signals Activate – Details

The altseason fanfare remains on the rise despite a broad altcoin rally two weeks ago that has quick...

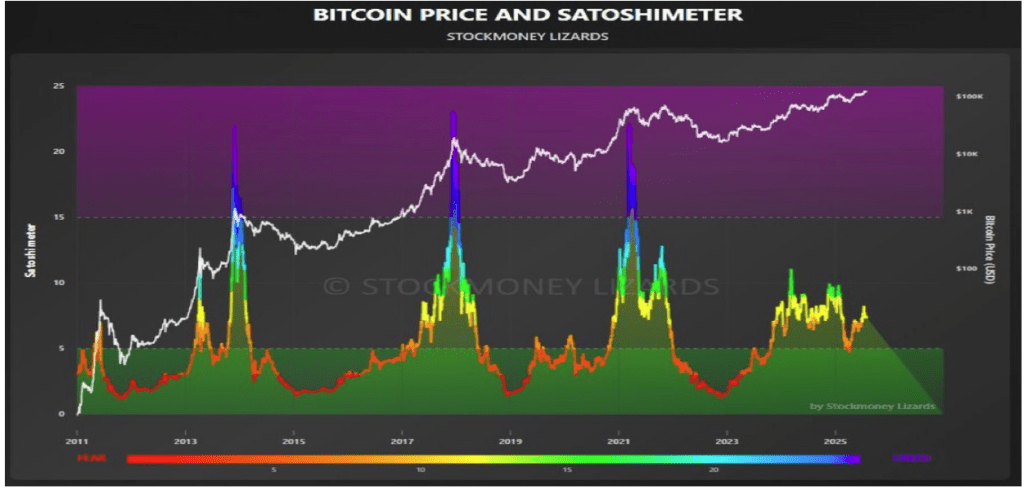

Satoshimeter Shows Where Bitcoin Price Is In This Cycle

The Bitcoin price surge above $120,000 has reignited speculation about where the flagship cryptocurr...

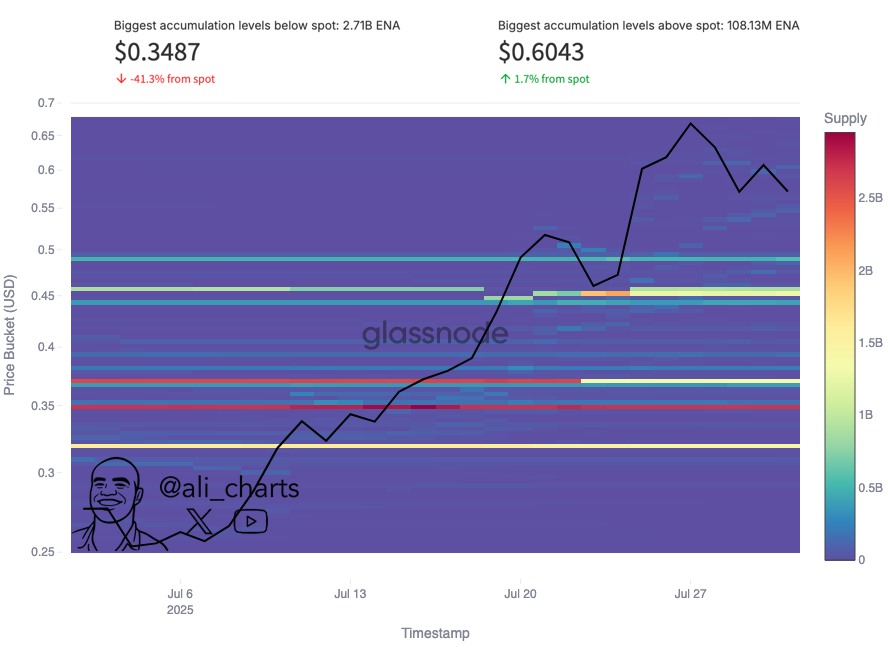

3 Key Ethena (ENA) Support Levels To Monitor – Analyst

Ethena (ENA) prices are presently in the red zone during a broader crypto market correction. Accordi...