Here’s Why Your Biggest Mistake Could Be Selling XRP Too Early

Favorite

Share

Scan with WeChat

Share with Friends or Moments

XRP has taken the limelight as a prominent figure in the investing community has called attention to the dangers of selling promising investments too soon.

He

warns

that the biggest mistake most investors make is selling a big winner prematurely. This caution comes from the veteran investor behind the popular X account "Invest In Assets," which has built a reputation for helping people grow wealth through insights on quality stocks and Bitcoin.

While the market analyst did not mention XRP or any other asset, the message resonated with XRP advocates, who have long championed patience over short-term profit-taking.

Even Selling XRP at $10 May Be Too Soon

In numerous posts on X, pro-XRP crypto educator Edoardo Farina has warned that selling XRP too early could cost investors life-changing gains. He

believes exiting even at $10,

a psychological level many see as a reasonable profit point, could become a decision holders regret for years.

Farina recalls how, in November 2024, XRP broke past $1 for the first time in over three years. Many expected a pullback to $0.50, but the retracement never came, and the token surged to $2. Those who sold early missed out as the coin continued its climb to $3.66 this year.

With widespread hopes of XRP surpassing double or even triple digits, advocates like Farina believe the pattern of premature selling and regret could repeat on a much larger scale in coming market cycles.

Lessons from Bitcoin, Berkshire Hathaway, and Apple

Notably, the long-term case for XRP often draws parallels to other legendary investments. Farina

likens buying XRP at $2

to buying Bitcoin below $100. For context, this investment for BTC holders would now be worth over 100,000% more.

Similarly, American wealth mentor Linda Jones has compared XRP’s current phase to the

early days of Berkshire Hathaway,

when only patient shareholders recognized its future value.

Berkshire Hathaway stock has returned more than 292,000% since its inception. Jones suggests that XRP’s true worth might only become clear after years of adoption in global payments.

Likewise, XRP influencer John Squire has

likened

selling XRP today to offloading Apple stock just before the iPhone’s launch. He argues that XRP’s current price doesn’t reflect its full potential, given Ripple’s growing partnerships, cross-border utility, and rising adoption.

Apple’s stock soared by over 8,500% after the iPhone launched in 2007. XRP advocates believe similar catalysts, like ETF approvals, potential use in U.S. digital reserves, and corporate adoption, could send XRP from $3 to triple-digit price levels or beyond.

The “Buy Back Lower” Trap

Meanwhile, Farina has also cautioned against the strategy of selling to buy back at a lower price. He stresses that geopolitical events, market manipulation, and sudden institutional news can send prices soaring overnight, leaving sellers locked out.

His personal strategy is to sell only small portions at $10, $50, and $100 while keeping most of his XRP for lending once regulations allow institutional borrowing. He believes this approach will generate income without giving up the asset entirely.

Ultimately, as Invest In Assets puts it, the biggest mistake investors make is not missing the bottom but selling too early, at what turns out to be only the beginning.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/521895.html

Previous:分析师梁丘:8.11比特币/以太坊来回宽幅震荡 意欲何为

Related Reading

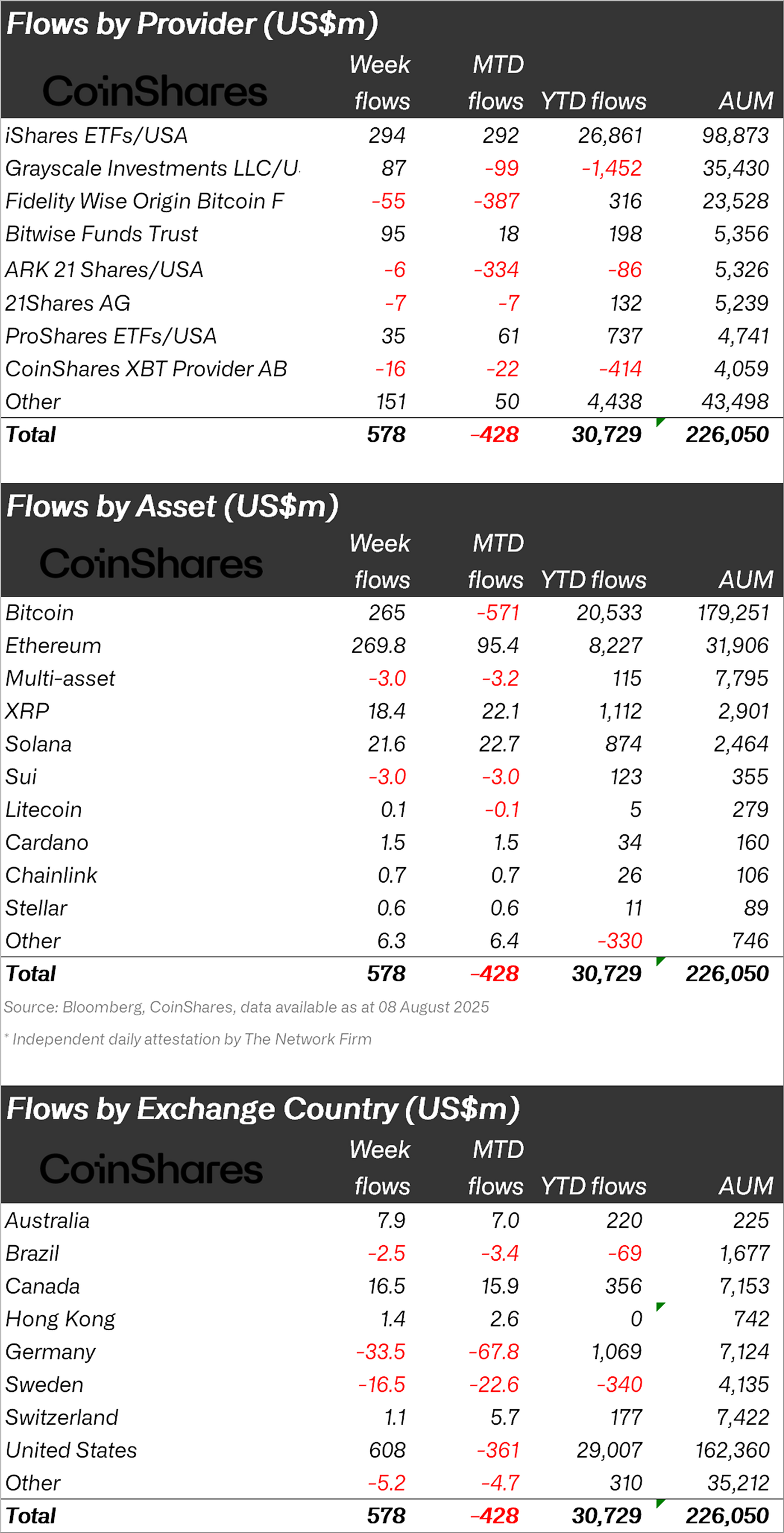

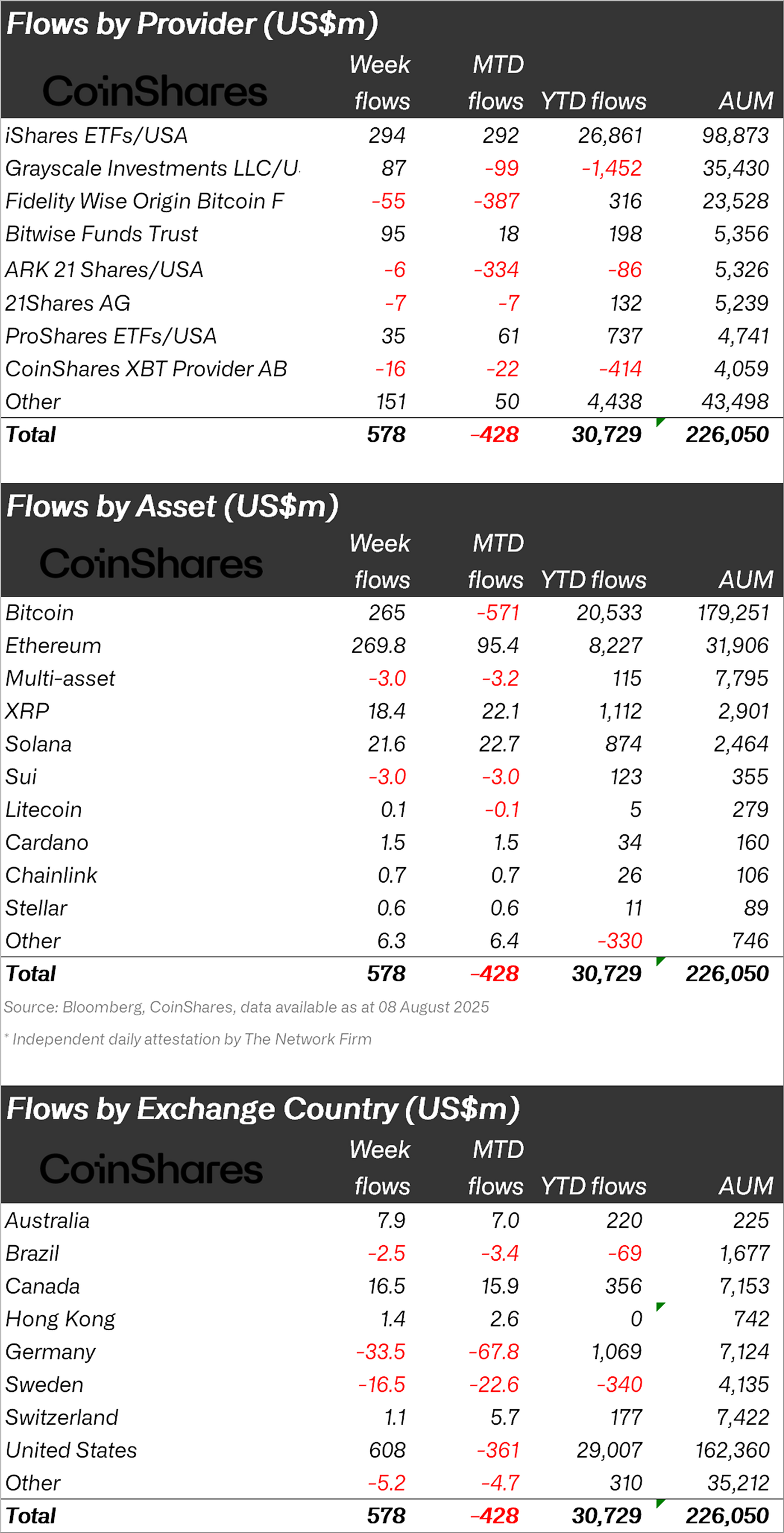

Ethereum ETPs Drive $572M Crypto Investment Inflows as US Retirement Policy Sparks Rally

Crypto investment products swung back into positive territory last week, recording $572 million in n...

VivoPower to Acquire 211M XRP At 86% Discount: Details

Nasdaq-listed VivoPower has announced plans to acquire shares of Ripple as part of its XRP-focused c...

Western Union to Buy Ripple ODL Partner Intermex in $500 Million Deal

Western Union has struck a $500 million deal to buy Intermex, a user of Ripple's On-Demand Liquidity...