VivoPower to Acquire 211M XRP At 86% Discount: Details

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Nasdaq-listed VivoPower has announced plans to acquire shares of Ripple as part of its XRP-focused crypto treasury strategy.

In an interesting update, VivoPower disclosed it would acquire $100 million worth of privately held shares of Ripple. The acquisition would make it the first US publicly traded firm offering exposure to both Ripple and XRP.

VivoPower to Buy Millions of XRP at Premium Discount

Specifically, the solar power firm would make the purchase after two months of due diligence, it noted in a

press release

. It plans to acquire a portion of Ripple’s 41 billion XRP holding at an 86% discount from its current price, pending approval from the Ripple board.

For context, Ripple received its stash from the initial 100 billion mined at the genesis block and releases 1 billion XRP monthly to regulate the token’s supply and maintain stability.

Meanwhile, VivoPower would acquire $100 million worth of Ripple shares. Interestingly, the fund would have acquired 30 million XRP at $3.29; instead, it accrued 211 million XRP, averaging a cost price of $0.47. This premium discount saw the stash’s value skyrocket to $696 million.

Further, this means that for every $10 million of Ripple shares acquired, VivoPower shareholders will record a growth of $5.15 per share. The Nasdaq-listed firm further clarified that the acquisition was not through a special-purpose vehicle but a direct purchase of Ripple shares from existing shareholders.

Ripple Shares Custody and Trading Partner

VivoPower employed crypto infrastructure and custody firms to enhance its Ripple share treasury strategy. It tapped BitGo to custody the shares and Nasdaq Private Market, which is Ripple’s preferred partner, to handle transactions.

Reacting to the announcement, VivoPower executive chairman Kevin Chin noted that the new strategy twist combines Ripple shares and XRP tokens to optimize the yield of investors. It would also reduce the average cost of XRP for holders, ensuring better profitability.

For context, VivoPower will require approximately $19 billion to acquire Ripple’s 41 billion XRP bag, which was worth $135 billion at the time of release. This is a staggering 86% deduction exclusively for VivoPower shareholders.

Moreover, it also gives VivoPower a share in Ripple’s business, including the RLUSD stablecoin and other units like Hidden Road, Rail, and Metaco.

The move joins a growing number of XRP treasury companies. For context, Trident Digital Tech Holdings

announced

that it would create an XRP treasury and plans to raise $500 million to fuel this venture.

China’s Webus also filed for an XRP treasury, committing to raising $300 million to buy the token.

Wellgistics Health

and Hyperscale Data, among others, are also in the long list of firms allocating their treasury to holding XRP.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/521922.html

Related Reading

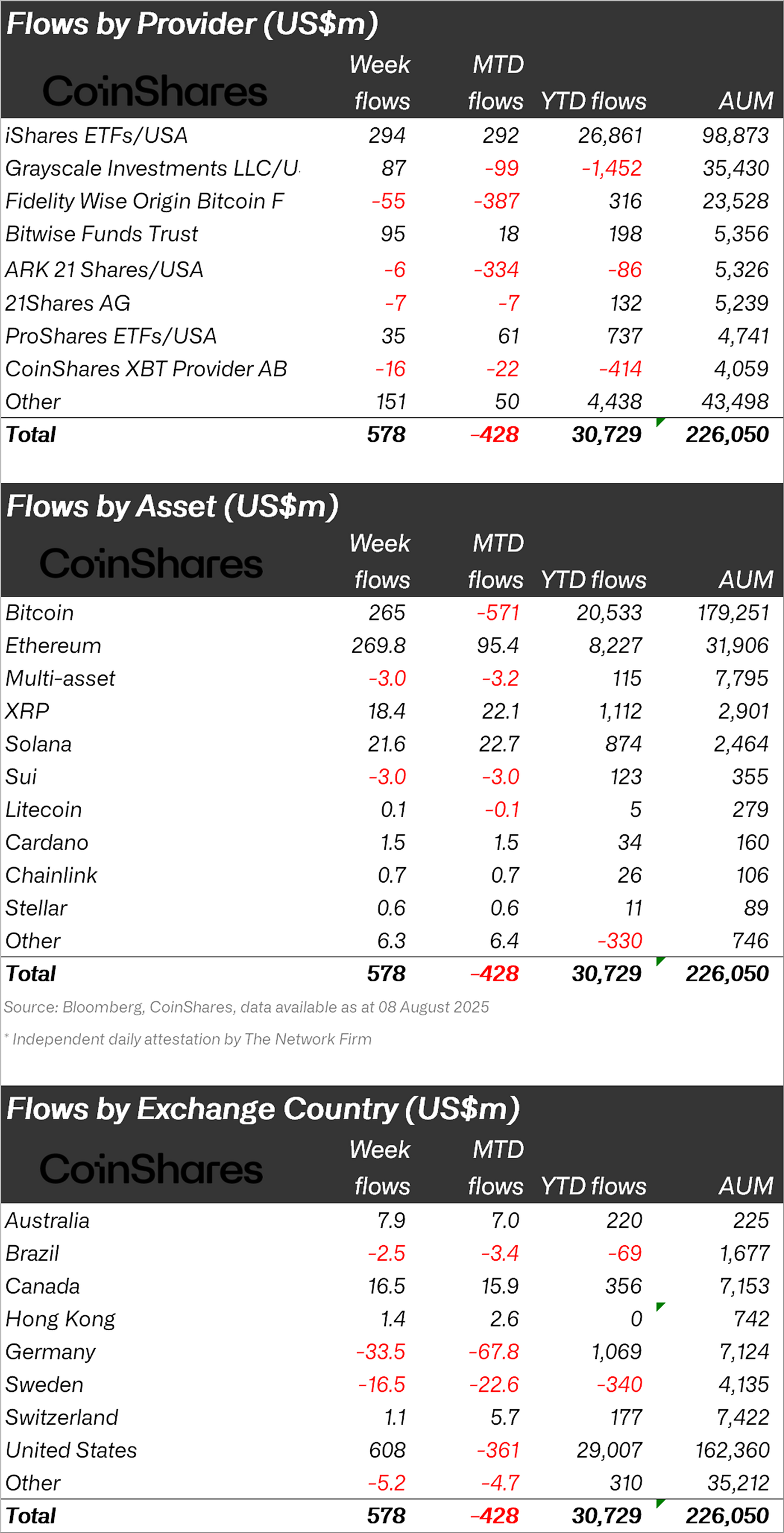

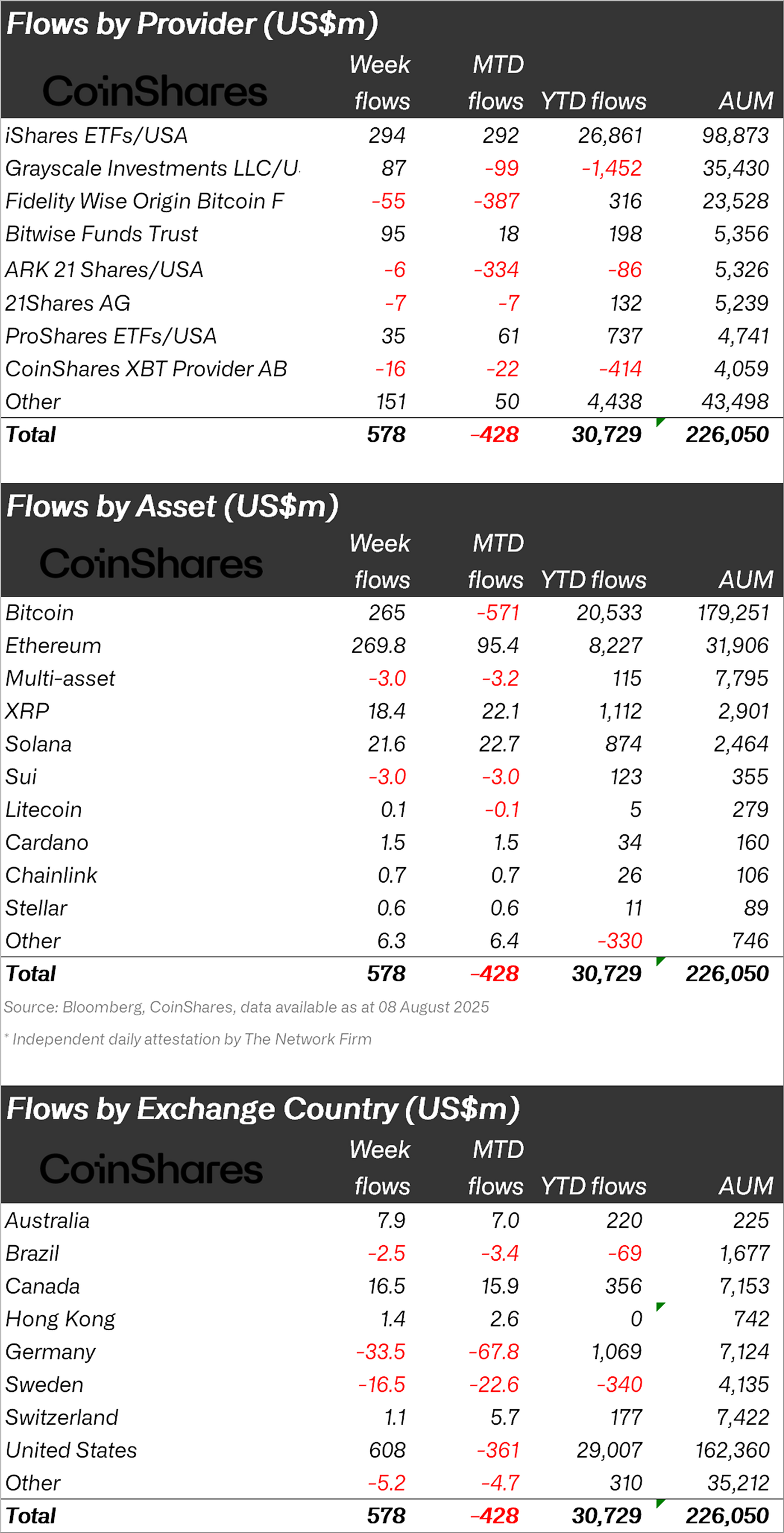

Ethereum ETPs Drive $572M Crypto Investment Inflows as US Retirement Policy Sparks Rally

Crypto investment products swung back into positive territory last week, recording $572 million in n...

Western Union to Buy Ripple ODL Partner Intermex in $500 Million Deal

Western Union has struck a $500 million deal to buy Intermex, a user of Ripple's On-Demand Liquidity...

Here’s Why an XRP ETF Could Outperform Ethereum ETFs, According to Canary Capital CEO

Optimism around an XRP ETF (exchange-traded fund) is surging with the long-running SEC case against ...