Western Union to Buy Ripple ODL Partner Intermex in $500 Million Deal

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Western Union has struck a $500 million deal to buy Intermex, a user of Ripple's On-Demand Liquidity (ODL) service.

The move gives Western Union direct access to

Ripple's technology

through Intermex, while also expanding its retail footprint across North America and strengthening its position in fast-growing remittance corridors.

Western Union to Acquire Intermex

Under the

agreement

, Western Union will pay $16.00 in cash for each Intermex share, valuing the company at roughly 50% above its recent average trading price. Both companies' boards have signed off on the deal, and they expect to close it by mid-2026, pending regulatory and shareholder approval.

For Western Union, this acquisition represents a major step in its growth strategy. Intermex serves about six million customers each year, with operations spanning the United States, the United Kingdom, Spain, Italy, Canada, and Germany, and over 60 destination countries.

The company has built its reputation by focusing on the Latin American corridor, where it runs a network of strong agent relationships and delivers reliable, high-volume remittance services.

Western Union plans to integrate Intermex's expertise with its own scale and technology to expand market coverage, boost digital adoption, and improve operational efficiency.

The firm expects the deal to deliver around $30 million in yearly cost savings within two years and to add more than $0.10 to adjusted earnings per share in the first full year after closing. They also see room for revenue growth by combining Western Union's global platform with Intermex's strong foothold in key markets.

Intermex Has Been a Long-Term Ripple ODL Partner

The connection to Ripple's ODL service is also quite important. For context, Intermex

partnered

with Ripple in early 2020 to explore faster and cheaper cross-border payment solutions.

While the company limited ODL use in its core Mexico market, it set up the technology in newer regions where it could present a competitive edge. With the acquisition of Intermex, Western Union will now have an active ODL user under its umbrella, something it has not fully embraced despite running trials of Ripple's technology as far back as 2015.

Those earlier tests showed the potential to cut settlement times from days to seconds and slash costs by as much as 60%. However, Western Union never rolled out the technology on a broad scale.

The acquisition changes this, giving the company a ready-made opportunity to bring ODL into its operations if it chooses to do so. Western Union now has the chance to pair its unmatched global reach with Intermex's agility and Ripple-powered payment capabilities.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/521923.html

Related Reading

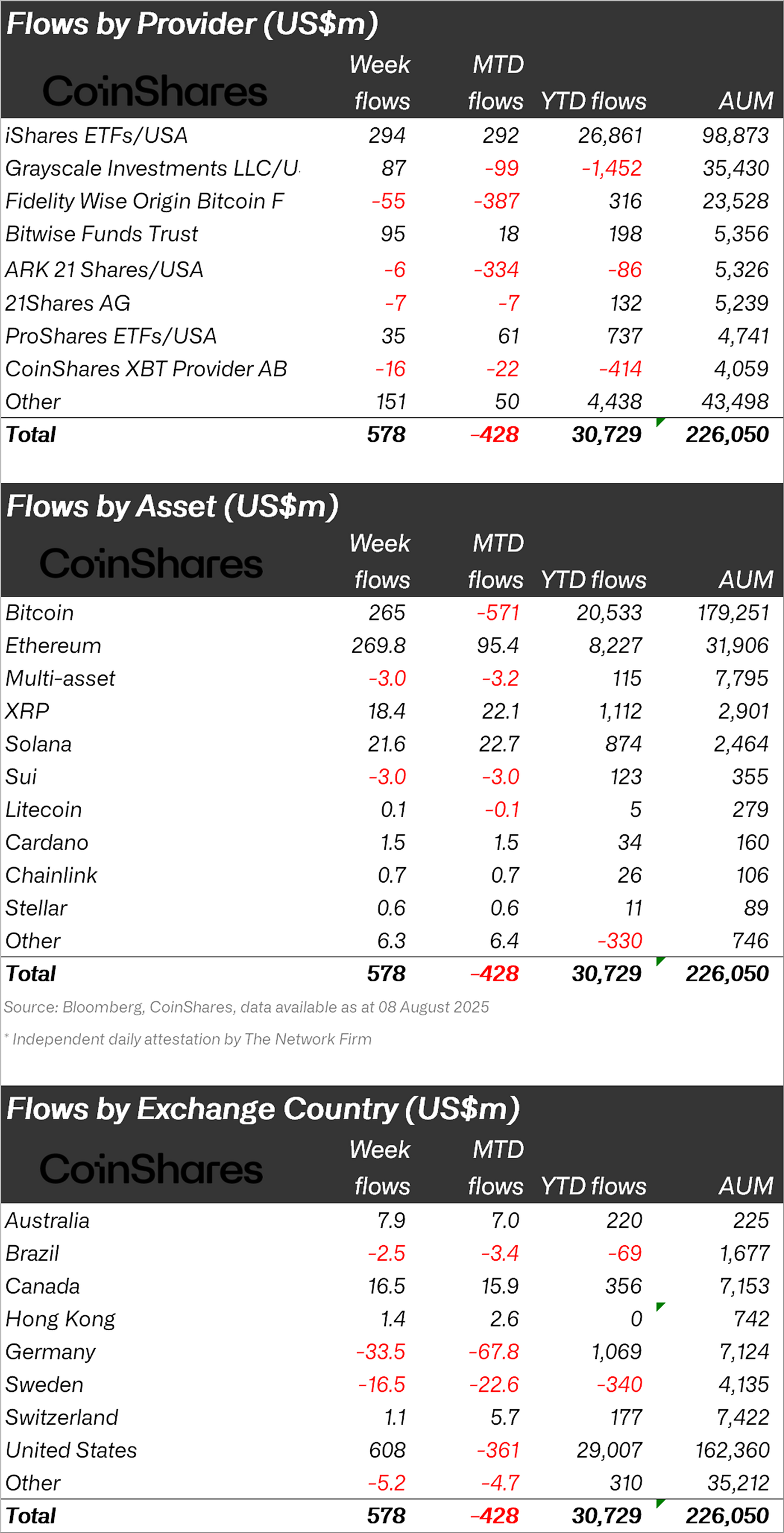

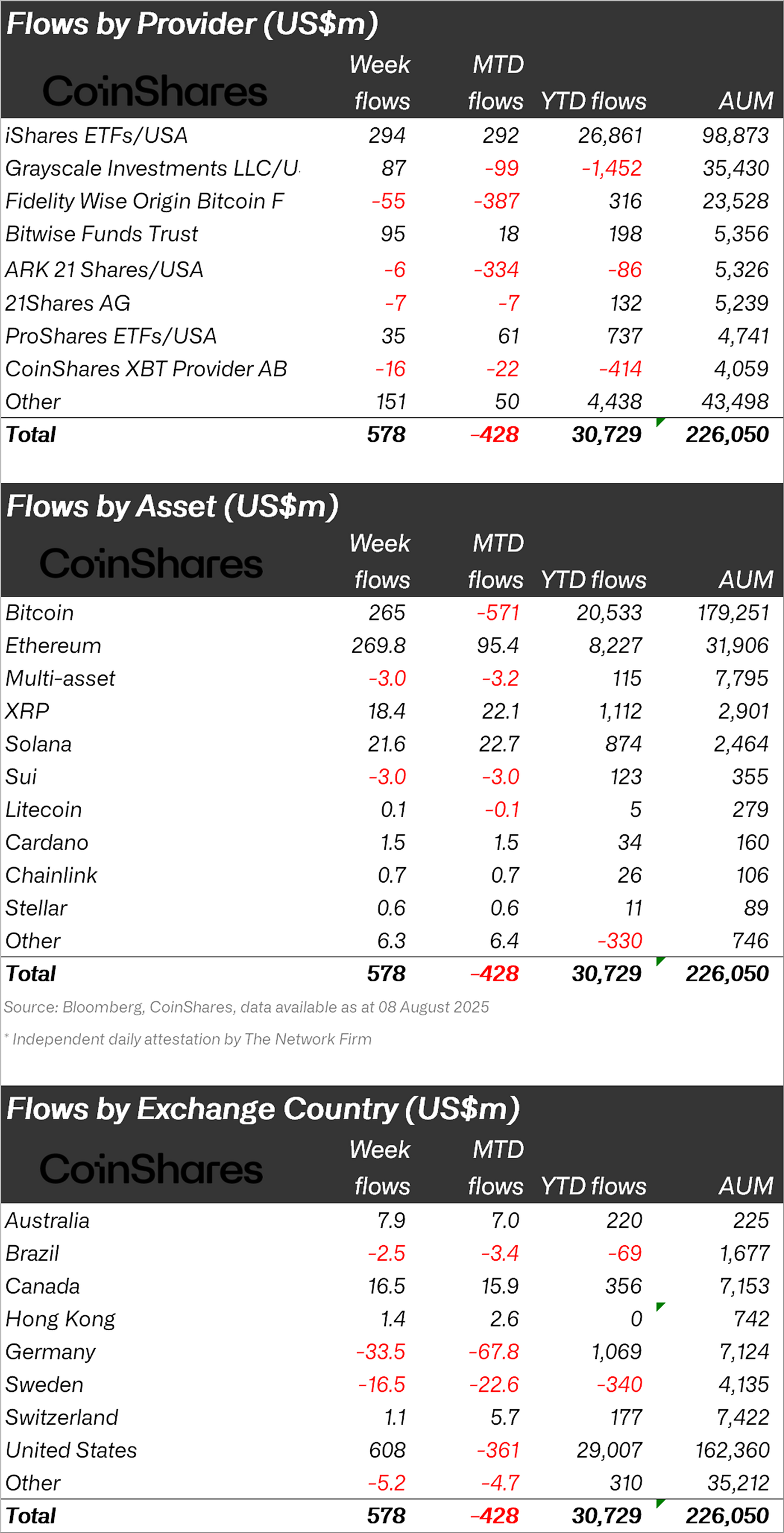

Ethereum ETPs Drive $572M Crypto Investment Inflows as US Retirement Policy Sparks Rally

Crypto investment products swung back into positive territory last week, recording $572 million in n...

VivoPower to Acquire 211M XRP At 86% Discount: Details

Nasdaq-listed VivoPower has announced plans to acquire shares of Ripple as part of its XRP-focused c...

Here’s Why an XRP ETF Could Outperform Ethereum ETFs, According to Canary Capital CEO

Optimism around an XRP ETF (exchange-traded fund) is surging with the long-running SEC case against ...