Ethereum ETPs Drive $572M Crypto Investment Inflows as US Retirement Policy Sparks Rally

Favorite

Share

Scan with WeChat

Share with Friends or Moments

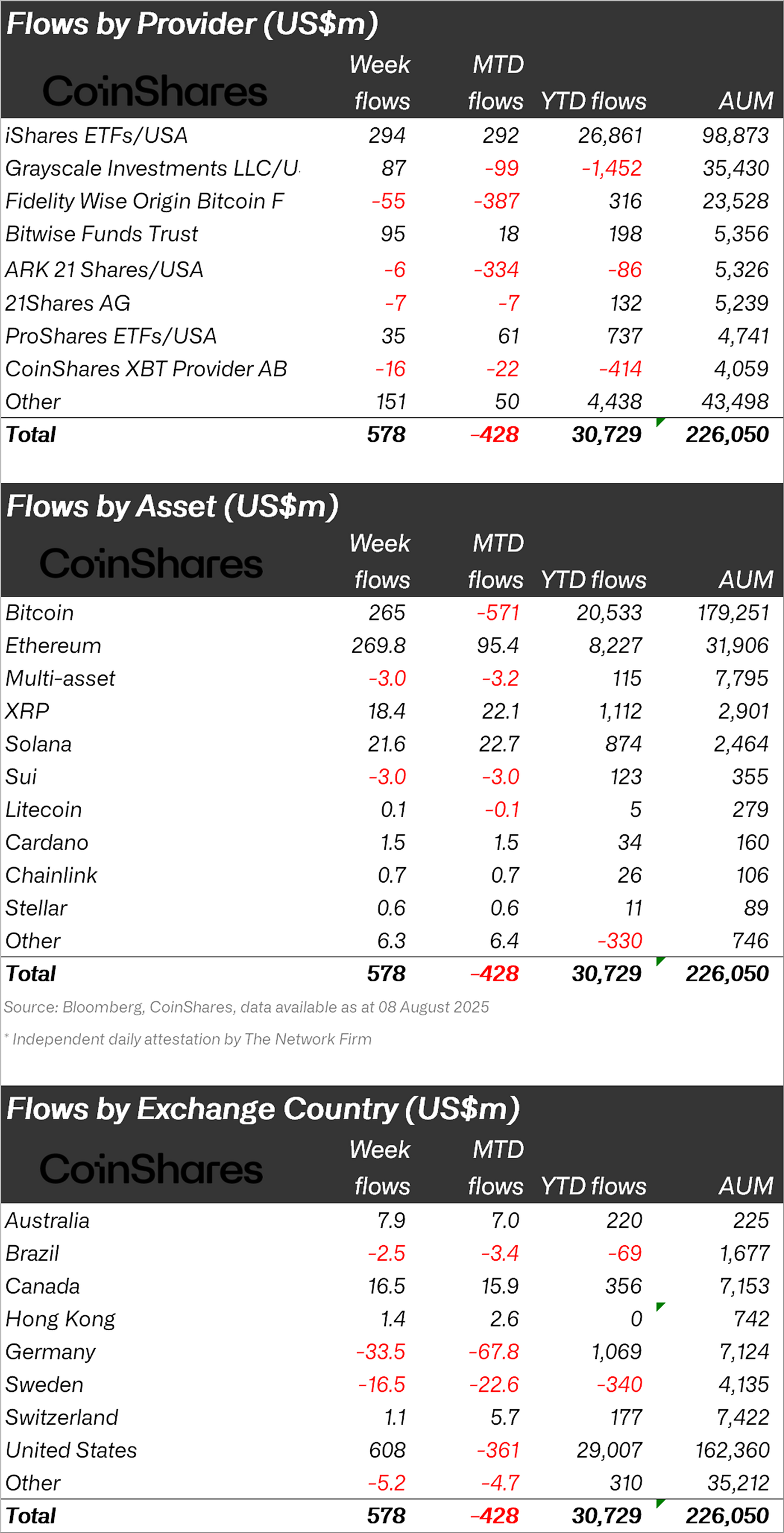

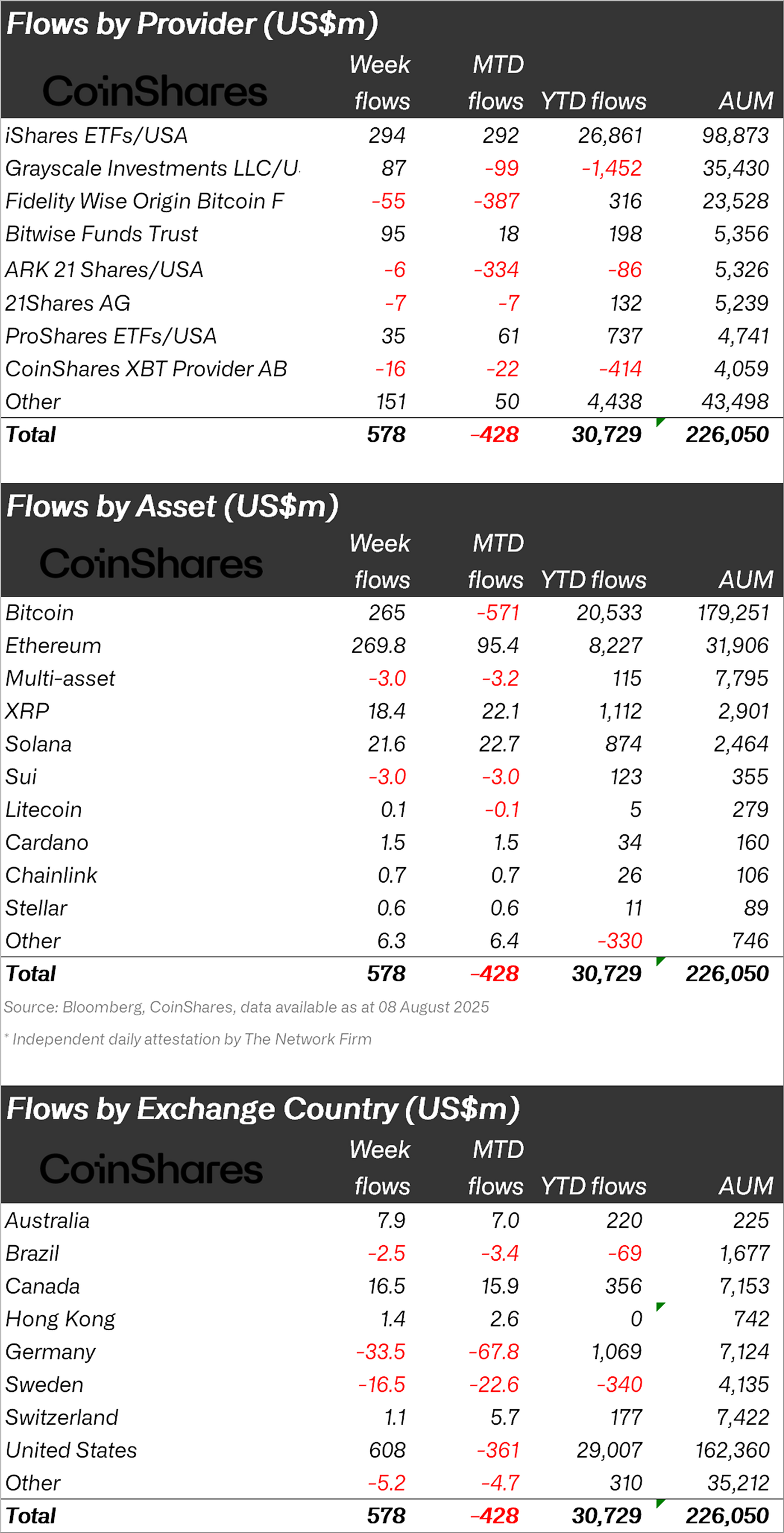

Crypto investment products swung back into positive territory last week, recording $572 million in net inflows, with Ethereum taking the lead after a volatile start.

Fresh

figures

from CoinShares show the week opened on a cautious note, with $1 billion exiting the market following weaker-than-expected U.S. payroll data. However, sentiment flipped midweek after the U.S. government confirmed that 401(k) retirement plans could include digital assets.

In particular, President Donald Trump

signed an executive order

to that effect. The move unleashed $1.57 billion in inflows during the latter part of the week, reversing the early losses.

US Powers Growth While Europe Lags

North America was the major driver of gains in the overall market. The U.S. alone brought in $608 million, lifting its year-to-date inflows past $29 billion. Canada followed at a distance with $16.5 million, bringing its year-to-date inflows to $356 million.

However, Europe’s picture was far less optimistic. Germany registered $33.5 million in outflows, while Sweden saw $16.5 million in negative flows, bringing its year-to-date flow to negative $340 million. Notably, Switzerland saw a positive inflow of $1.1 million, with its year-to-date flow reaching $177 million.

Elsewhere, Hong Kong registered a weekly inflow of $1.4 million, while Australia saw $7.9 million in new investments.

Ethereum Hits Record-Breaking Inflows and AUM

Amid the positive developments from the U.S. government, Ethereum-based exchange-traded products saw their strongest weekly inflow of the year at $270 million. This new record pushed total year-to-date inflows to $8.23 billion.

Moreover, the rally in ETH’s price has driven assets under management for Ethereum products to an unprecedented $31.91 billion. This is an 82% increase in 2025 alone.

Spot market action mirrors the momentum. Today, ETH traded above $4,340 for the first time since 2021, fueling optimism of an imminent all-time high.

Bitcoin Bounces Back

Meanwhile, Bitcoin products ended a two-week outflow streak with $260 million in inflows. At the same time, short Bitcoin products shed $4 million, hinting at improving market confidence.

On the spot market,

Bitcoin

briefly hit $122,200 today, showing signs that it could start pushing beyond its previous peak after nearly a month of subdued trading.

Altcoin Products Also in the Green

Other altcoins also saw a return of investor interest. Solana attracted $21.8 million,

XRP

brought in $18.4 million, and Near Protocol secured $10.1 million. Products tied to other altcoins like Litecoin, Cardano, Chainlink, and Stellar also saw positive inflows for the week.

Negative figures were only recorded for multi-asset products and SUI, both individually shedding $3 million.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/521921.html

Related Reading

VivoPower to Acquire 211M XRP At 86% Discount: Details

Nasdaq-listed VivoPower has announced plans to acquire shares of Ripple as part of its XRP-focused c...

Western Union to Buy Ripple ODL Partner Intermex in $500 Million Deal

Western Union has struck a $500 million deal to buy Intermex, a user of Ripple's On-Demand Liquidity...

Here’s Why an XRP ETF Could Outperform Ethereum ETFs, According to Canary Capital CEO

Optimism around an XRP ETF (exchange-traded fund) is surging with the long-running SEC case against ...