Bitcoin Adoption Takes Another Mainstream Step

Trust in Bitcoin has grown faster than that of any asset in history. While Bitcoin is a form of money, its rate of adoption mirrors that of the Internet.

Bitcoin is fast emerging as the next global reserve asset.

The latest to support that surge in Bitcoin adoption is JP Morgan Chase's decision to allow shares of Bitcoin ETFs as collateral for loans .

JP Morgan will pioneer BlackRock's Bitcoin ETFs as collateral for giving away loans. The lender based in New York will incorporate cryptocurrency assets into its net-worth assessments.

The bank had previously evaluated this form of financing individually, considering each case on its own merits.

Blackrock's fund is dominant, representing over 50% of the $125 billion spot Bitcoin ETF market. Its $67 billion Bitcoin reserve has led some to suggest it may soon surpass Satoshi Nakamoto as the top Bitcoin holder.

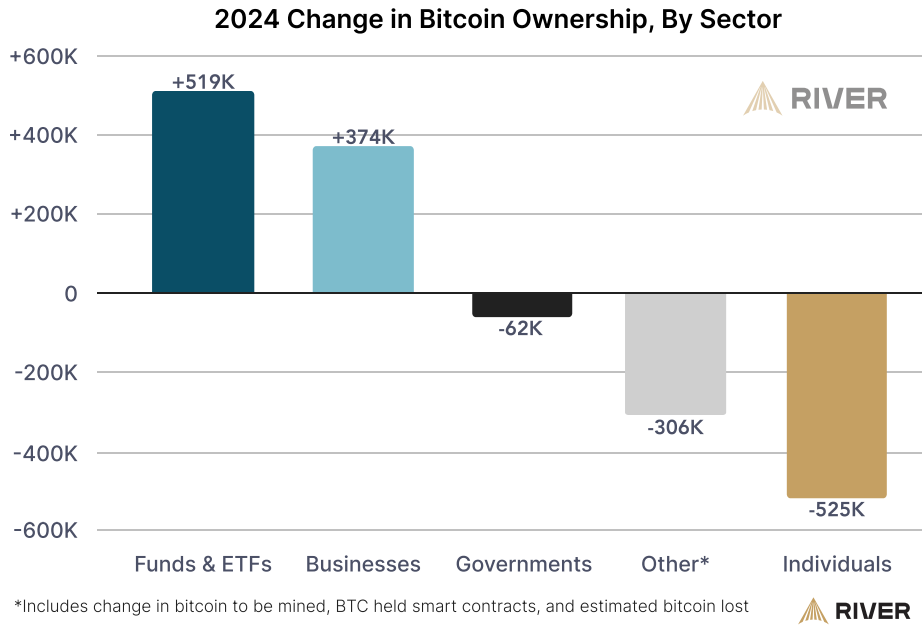

ETFs and businesses have become the primary buyers, with a dramatic shift in Bitcoin accumulation since last year.

Institutional investors have driven Bitcoin's price since last year, with over half of top hedge funds and RIAs owning the OG token.

Since the launch of Bitcoin ETFs, the surge in adoption is clear.

JP Morgan's shift in its policy, similar to that of US President Donald Trump , is dramatic.

Previously, Jamie Dimon, the CEO of JP Morgan, had referred to Bitcoin as a "fraud," "worthless," and a " pet rock ."

"If I were in a position of authority, I would take decisive action to halt it," he had stated to Congress in 2023.

While JP Morgan explored private blockchains and the tokenization of real-world assets, it maintained a cautious distance from Bitcoin.

However, Dimon started to adjust his perspective last year.

Whether Dimon's shift in view was driven by Trump's U-turn towards cryptos or a coincidence is debatable.

At a business summit, JP Morgan's CEO changed his stance, stating, "I don't know what Bitcoin itself is for, but I defend your right to buy a cigarette; I'll defend your right to buy a Bitcoin."

Currently, JP Morgan is adjusting to the increasing demand for cryptocurrency offerings in light of the regulatory easing anticipated under Trump.

The developments show how conventional finance is adopting—rather than dismissing—cryptos. Prominent financial institutions such as Charles Schwab and Morgan Stanley have also entered the cryptocurrency arena.

A significant portion of the momentum stems from the remarkable performance of Bitcoin ETFs, particularly BlackRock's IBIT. In just over 16 months, the fund has rapidly become one of the 25 largest ETFs.

With Trump Media & Technology's firm also listing for approval a fund called the Truth Social Bitcoin Fund, which is yet to be approved by the SEC, JP Morgan's decision to allow borrowings using Bitcoin ETFs as collateral looks like a path forward for Wall Street banks.

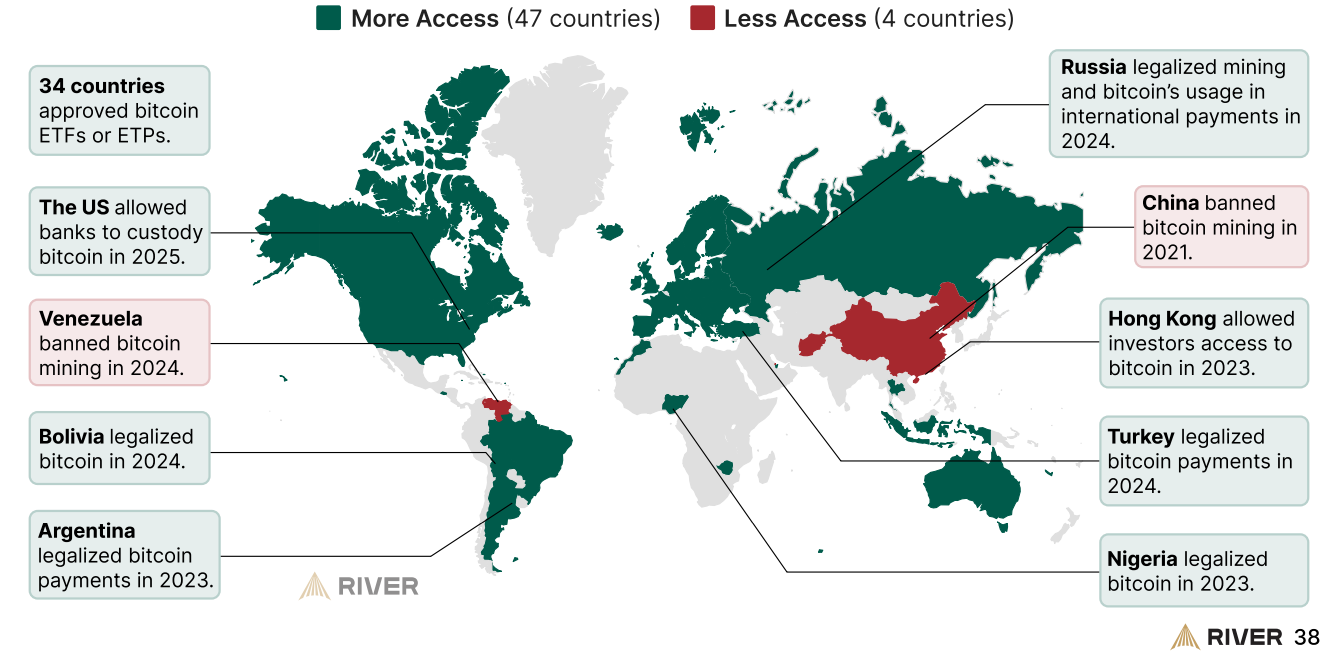

The global adoption of Bitcoin is also increasing rapidly. The regulatory changes to Bitcoin since 2020 have increased, with 34 countries approving Bitcoin ETFs and ETPs.

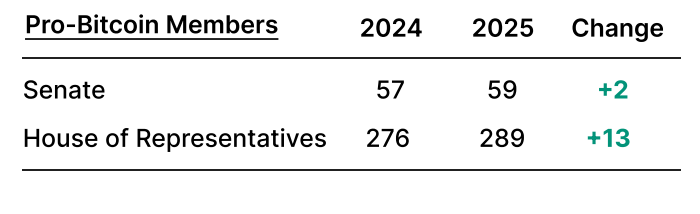

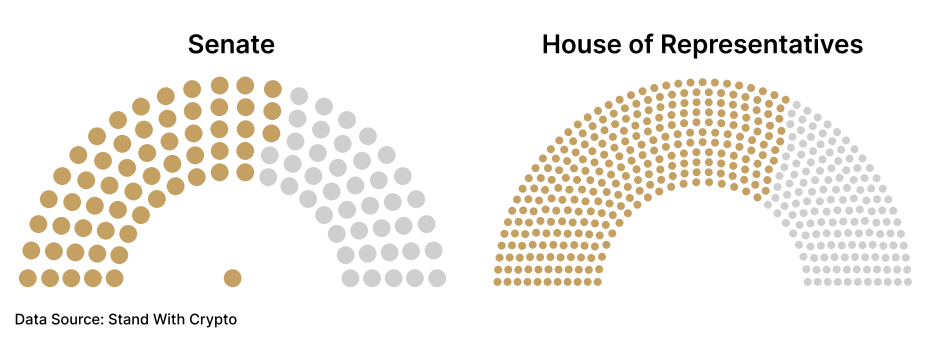

The advocacy group Stand with Crypto reports that after last November's election, most senators in the US Congress support crypto or Bitcoin.

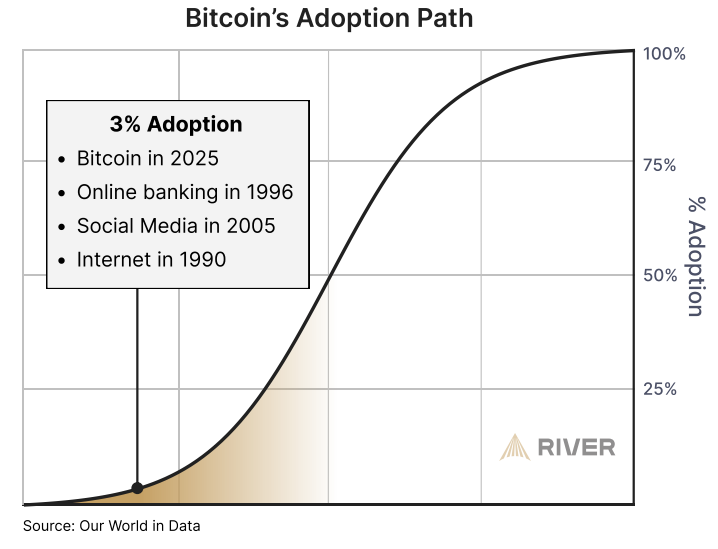

Still, despite the rise in Bitcoin adoption, according to Our World in Data, that rate is currently about 3% of its full potential.

The adoption metric is not mere ownership of the OG token but includes market value, institutional under-allocation, and global ownership.

The potential for that rate to surge is clear, and with leading Wall Street banks embracing crypto offerings, there are expectations for a higher adoption rate at a faster pace.

Played the Bounce, Avoided the Break – How Timing Beat Volatility

Our BTC overweight provided stability as volatility returned, while timely rotations in and out of E...

Corporate Cash Exodus Continues as Metaplanet Targets Massive Bitcoin Holdings

Japanese firm's $5.3B plan to hold 1% of all Bitcoin highlights accelerating shift from traditional ...

Binance Compliance Chief Tigran Gambaryan Exits Exchange After Nigeria Detention

Former IRS agent leaves crypto exchange following eight-month imprisonment and health complications....