Binance Compliance Chief Tigran Gambaryan Exits Exchange After Nigeria Detention

Tigran Gambaryan, Binance's head of financial crime compliance who was detained for eight months in Nigeria last year, is leaving the world's largest cryptocurrency exchange, according to a Bloomberg report on Friday.

Gambaryan, a former US Internal Revenue Service agent known as the "Crypto Wizard" for his expertise in tracing illicit digital transactions, told Bloomberg that Friday marks his last day at Binance. He joined the exchange in 2021 to help strengthen its anti-money laundering protocols amid increasing global regulatory scrutiny.

The executive's departure follows a harrowing ordeal that began in February 2024 when he traveled to Nigeria on behalf of Binance to address allegations that the exchange's operations had contributed to the country's currency crisis. Nigerian authorities detained Gambaryan and British-Kenyan colleague Nadeem Anjarwalla on charges of money laundering and currency manipulation.

Gambaryan was released in October on humanitarian grounds after his health severely deteriorated in custody. He reportedly suffered from malaria, pneumonia, and tonsillitis, while complications from a herniated disk left him wheelchair-bound and requiring urgent medical care outside Nigeria. The Nigerian government subsequently dropped the money laundering charges against him .

"Tigran has made a lasting impact on Binance, just as he did in his previous roles in law enforcement," a Binance spokesperson said. "We are deeply grateful for his dedication in transforming our financial crimes compliance organization. Thanks to his tireless efforts, the crypto industry is safer for all."

The Nigeria incident occurred as Binance faced multiple regulatory challenges globally. The exchange and former CEO Changpeng Zhao pleaded guilty in November 2023 to violating anti-money laundering and US sanctions laws, with Binance agreeing to pay $4.3 billion in penalties. Zhao served four months in US prison after stepping down as CEO.

Nigeria continues to pursue legal action against Binance , seeking $79.5 billion in damages and $2 billion in back taxes, claiming the exchange caused economic losses to the country. The government has also faced separate defamation lawsuits related to bribery allegations made during the detention controversy.

Corporate Cash Exodus Continues as Metaplanet Targets Massive Bitcoin Holdings

Japanese firm's $5.3B plan to hold 1% of all Bitcoin highlights accelerating shift from traditional ...

Musk vs. Trump Sparks Liquidations – Why We Believe the Correction Will Extend

Your daily access to the backroom....

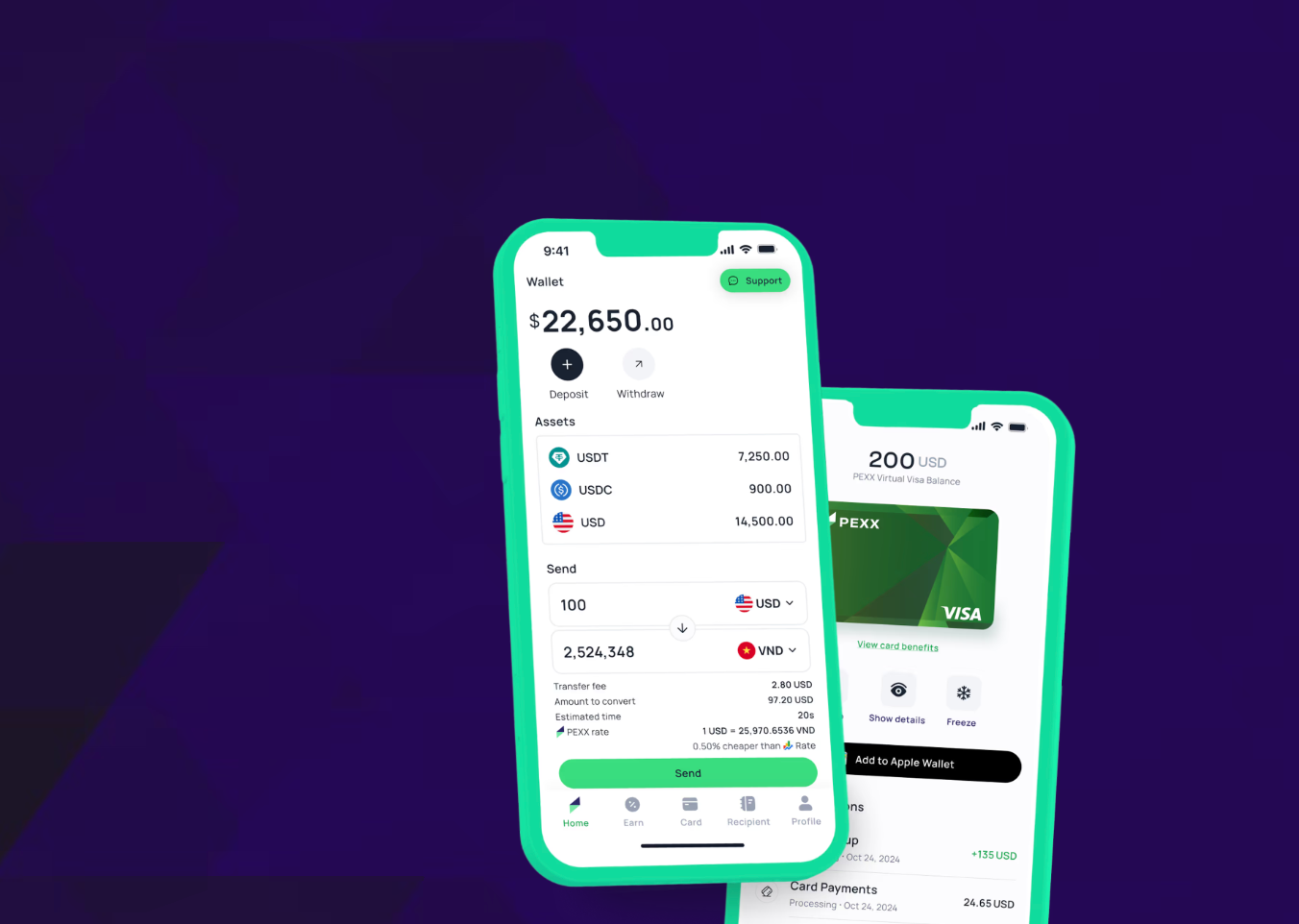

PEXX Launches Neobank, Bridging USD, Crypto for Global Users

Singapore-based fintech opens full banking suite across 50+ countries with stablecoin integration...