BlackRock Launches European Bitcoin Fund

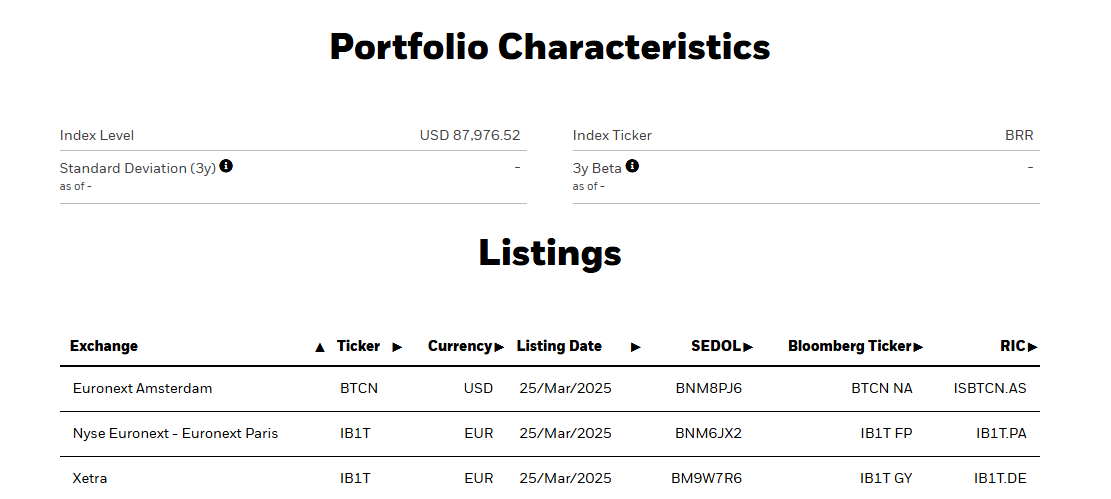

BlackRock has launched a new Bitcoin exchange-traded product (ETP) in Europe through its iShares fund service.

Managing over $4.4 trillion in ETFs globally, the world's largest asset manager has already amassed $58 billion in assets through its US Bitcoin ETF.

Now, the new iShares Bitcoin ETP ( IB1T ) is listed on stock exchanges in Germany, France, and the Netherlands.

"The ETP securities aim to provide investment exposure to Bitcoin. Each ETP security corresponds to a specific amount of Bitcoin, known as the cryptoasset entitlement (the “Cryptoasset Entitlement”)," the iShares website states. Coinbase Custody will hold the ETP's Bitcoin as the issuer's custodian.

The move comes as BlackRock expands its products beyond US borders. Last month, BlackRock introduced its iShares Bitcoin ETF to the Canadian market by listing the product on Cboe Canada.

Meanwhile, BlackRock's Bitcoin fund, iShares Bitcoin Trust (IBIT), has also been added to the company's model portfolio offerings.

For financial advisors utilizing BlackRock's widely followed model portfolios, encompassing a staggering $150 billion in assets, the inclusion of IBIT is a game-changer. BlackRock will permit a 1% to 2% allocation to IBIT within select target allocation portfolios designed for alternative investments.

While this initial allocation is measured, the sheer scale of BlackRock's model portfolio reach means that even this small percentage could translate to significant new demand for Bitcoin exposure over time.

Europe is becoming a hotbed for crypto activity with crypto exchanges OKX , Crypto.com , and Bitpanda recently receiving full Markets in Crypto Assets ( MiCA ) licenses.

Bitpanda received its license from the German Federal Financial Supervisory Authority (BaFin), while OKX and Crypto.com received theirs in Malta. Entities operating within the EU’s crypto market must comply with MiCA's rules governing transparency, disclosure, and governance. This includes stricter anti-money laundering protocols and requirements for stablecoin issuers to hold sufficient reserves to safeguard consumers.

Options Point to Bitcoin Below $80,000 Bets

There are significantly more put options being traded than call options, suggesting a prevailing exp...

Southeast Asia Blockchain Week Cancelled Due to Myanmar Earthquake

The Main Conference was set to be held at TRUE ICON HALL in Bangkok, Thailand, from April 2nd to 3rd...

Will Bitcoin Fall Back Below $80k? Options Bets Say Yes

Your daily access to the backroom....