Options Point to Bitcoin Below $80,000 Bets

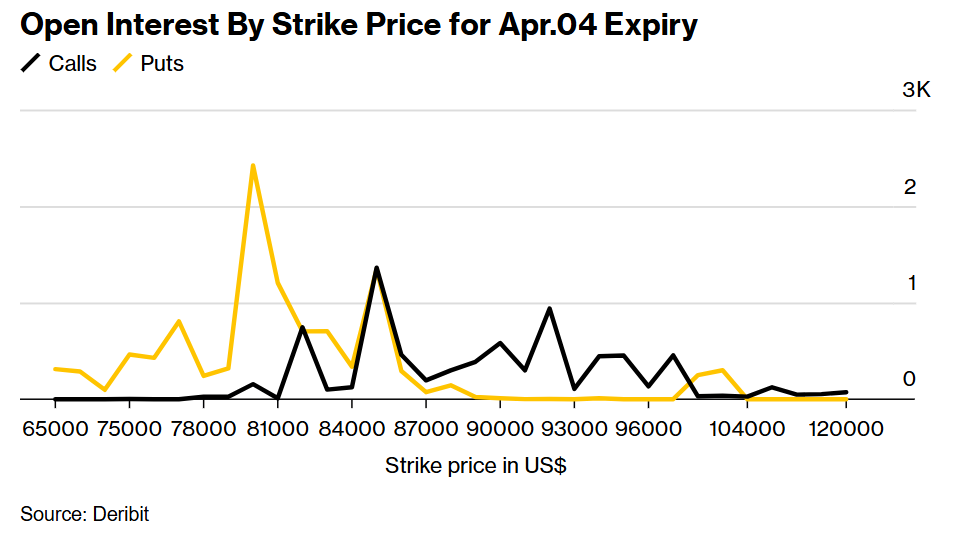

Deribit options exchange data shows that the largest number of existing contracts, or open interest, for put options with a $80,000 strike price are among contracts expiring on April 4, two days after Trump's expected announcement on global reciprocal tariffs.

There is a rising need for downside protection, as there has been a stampede into puts, which grants holders the right to sell at a specified price within a specified period.

Orbit Markets co-founder Caroline Mauron claims that the risk-reversal, which is the spread between 25-delta calls and puts, is highest for the April 4 expiry, further indicating negative sentiment.

Buying a call option and selling a put option with the same expiration date is called a risk reversal strategy. Its purpose is to restrict the downside risk.

There is a clear bias towards put options, which hedge against price falls, as indicated by the put-call ratio of 1.4 for the April 4 expiry on Deribit.

Bitcoin hit a new high of $109,241 in January, thanks in part to Trump's prior trade successes. However, the biggest digital token has since fallen more than 20 percent due to the historic test of Trump's export model with reciprocal tariffs.

The latest decline in Bitcoin prices is very similar to last year's correction following the SEC's surge in ETF approvals.

Last year's consolidation phase lasted about seven months before Trump's crypto embrace and US election victory revived cryptos' flavour again among investors.

Gold Bets Surge Amid Trump's Rhetoric

Rising anxiety is also seen in other markets, like gold, which hit a fresh record high on Monday, above $3,100 for the first time ever.

Supported by rising haven demand in a risk-off market environment, gold prices surged nearly 1% to above $3,115/oz, surpassing the previous all-time high set on Friday, when it recorded a fourth weekly gain.

Gold has hit at least 15 new all-time highs this year during a roughly 18% surge.

Central banks' purchases and the need for safe-haven assets in the face of growing geopolitical and macroeconomic uncertainty have driven the rally.

Even while swaps traders have reduced their bets on the Federal Reserve easing this year to two quarter-point rate decreases, those drivers have supported prices.

Low interest rates are usually good for non-yielding bullion.

This month, Goldman Sachs Group increased its prediction for the precious metal to $3,300 an ounce by year-end, joining other major banks in raising their price estimates.

No Respite for Stocks

In the days before Donald Trump's expected announcement of further tariffs this week, global markets have fallen for a fourth consecutive day as investors fret over the trade war's potential economic effects.

Globally, asset managers are hesitating to take large positions or de-risk their portfolios due to concerns about the introduction of the so-called reciprocal tariffs and their potential effects on the economy.

Due to trade restrictions' negative impact on momentum, Goldman Sachs Group's economists now expect the Federal Reserve and the European Central Bank to slash interest rates three times this year.

The economy is suffering due to the Trump administration's erratic and forceful policy shifts. The talk of a US recession is getting louder and louder, drawing a scary picture from the global trade wars.

Trump ended rumours that he could limit the initial scope of tariffs expected to be announced on April 2 by saying he expects to start his reciprocal tariff effort with "all countries."

The president imposed a 25% tariff on all non-US cars last week, describing his impending actions as a "Liberation Day."

Based on the magnitude of the announcements, Bloomberg Economics predicts that the United States' gross domestic product (GDP) might take a hit and prices could be jolted upward in the years to come due to the potential for steep tariff increases on imports from some countries.

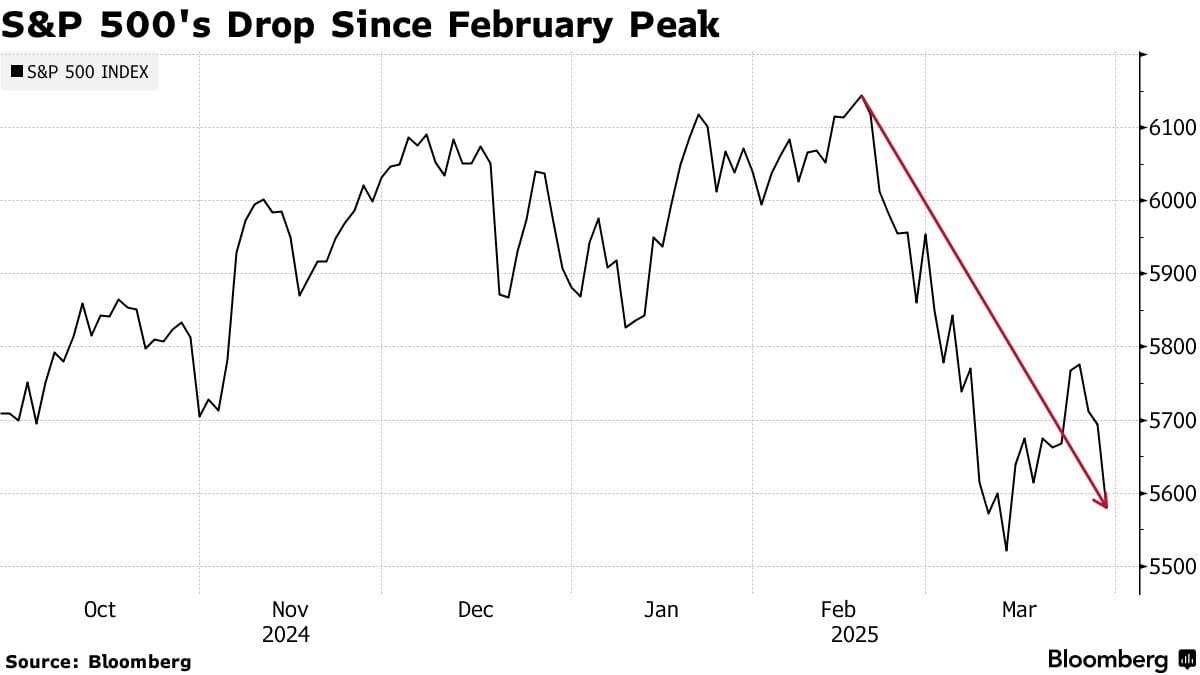

Trump's economic plan optimism sent the S&P 500 soaring to a new high in February. After that, the index fell and is now on track to have its worst quarterly performance since 2022.

Since Monday marks the end of the first quarter, more volatility is expected.

Elsewhere

? For a limited time, we’re letting early subscribers test drive B.R.O. If you want in, now’s the time.

Better Returns Only – Because that’s the real goal. Not hype, just strategy.

Blockcast

Blockcast 56 | Lombard Co-Founder Jacob Phillips on Bitcoin DeFi's Challenges and Innovations

Jacob Phillips entered crypto in 2018, co-founded Lombard in 2024, focusing on Bitcoin liquidity and staking solutions to bridge DeFi and CeFi. In this Blockcast episode, Jacob reflects on Lombard's core mission to enable secure, permissionless Bitcoin staking and liquidity through its liquid staking token, LBTC. He highlights the challenge of trustless Bitcoin DeFi and the importance of balancing decentralization with institutional security.

Previous episodes of Blockcast can be found on Podpage , with guests like Samar Sen ( Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!

Subscribe on LinkedIn

Will Crypto Play a Role in Ending the Dollar's Dominance?

The world of finance is changing. As countries worldwide look for better ways to settle their financ...

Sei Foundation Pursues 23andMe Acquisition, Highlighting Data Privacy as a Core Objective

23andMe's recent bankruptcy filing has raised questions about the future of the company's extensive ...

Weak Rebound Meets Tariff Risks – Why We’re Sticking to a Cautious Strategy

Your daily access to the backroom....