Institutions Could Scoop Up 1.9 Billion Retail XRP, Driving Price to $20: Expert

Favorite

Share

Scan with WeChat

Share with Friends or Moments

A well-known voice in the XRP community, known as XRP Liquidity, believes institutions could soon snap up nearly all XRP still held by retail investors.

Notably, his comments come on the back of growing institutional interest in XRP amid the clearer regulatory atmosphere. XRP Liquidity pointed out that around 1.9 billion XRP currently sits in retail hands and warned that this supply might not last much longer if the current momentum continues.

Ripple and Institutions Could Gulp the Leftover Retail XRP Supply

According

to him, Ripple and institutional buyers could start acquiring this remaining supply, and they might push the price as high as $20 to convince everyday holders to sell. Notably, with XRP currently trading for $3.13, a rally to $20 would require a massive 538%.

Notably, investors holding 10,000 XRP, currently worth $31,300, would see their investments grow to a whopping $200,000 if XRP hits the $20 price mark. Interestingly, several analysts have also projected XRP to reach this $20 level. Most recently,

EGRAG predicted

a run to $20.

Meanwhile, XRP Liquidity also suggested that the public narrative would likely frame the forthcoming institutional demand as coming from new retail investors, even if large institutions are the real force behind the buying pressure.

Teucrium XRP ETF Points to Growing Institutional Interest

This prediction adds to growing optimism around XRP's future, especially after the recent success of a new exchange-traded fund tied to the asset. Teucrium Trading, a financial firm with a strong presence in the ETF market, recently launched the first-ever U.S.-listed leveraged XRP ETF.

The fund, called the

Teucrium 2x Long Daily XRP ETF

and trading under the ticker XXRP, officially went live on April 8, 2025. Rather than holding XRP directly, the fund tracks its performance through swap agreements and international XRP-based products. It offers investors double the daily movement of XRP's price.

Remarkably, despite XRP trading near a five-month low at launch, the fund

pulled in around $5 million

in volume on its first day, placing it among the top 5% of all ETF launches in terms of day-one activity. The strong debut showed that demand for XRP exposure remains high.

Most recently, Sal Gilberti, President and CEO of Teucrium Trading,

joined CNBC's Dominic Chu

to talk about the fund's rapid growth. He said the response had far exceeded expectations, calling it the company's most successful fund so far.

Gilberti explained that the product has attracted hundreds of millions of dollars since its launch, and he credited the XRP Army for fueling that momentum. This attracted a comment from Vincent Van Code, a software engineer and active member of the XRP community.

Specifically, Van Code described the ETF's strong performance as a sign that XRP is moving closer to full-scale mainstream adoption, leading to the suggestion from XRP Liquidity that institutions could gulp the leftover retail supply.

https://twitter.com/vincent_vancode/status/1950328264414941634

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/520049.html

Previous:比特币以太坊凌晨最新行情走向分析:7/31

Next:孙宇晨的而立之年:争议未远,传奇已立

Related Reading

Expert Says Don’t Understand Why People Are Complaining About XRP Price Now

Leading voices in the XRP community are pushing back against the persistent complaints about XRP’s s...

Bolivia Signs Crypto Cooperation Deal with El Salvador Amid Economic Crisis

Bolivia has signed a landmark agreement with El Salvador to advance crypto adoption.According to a...

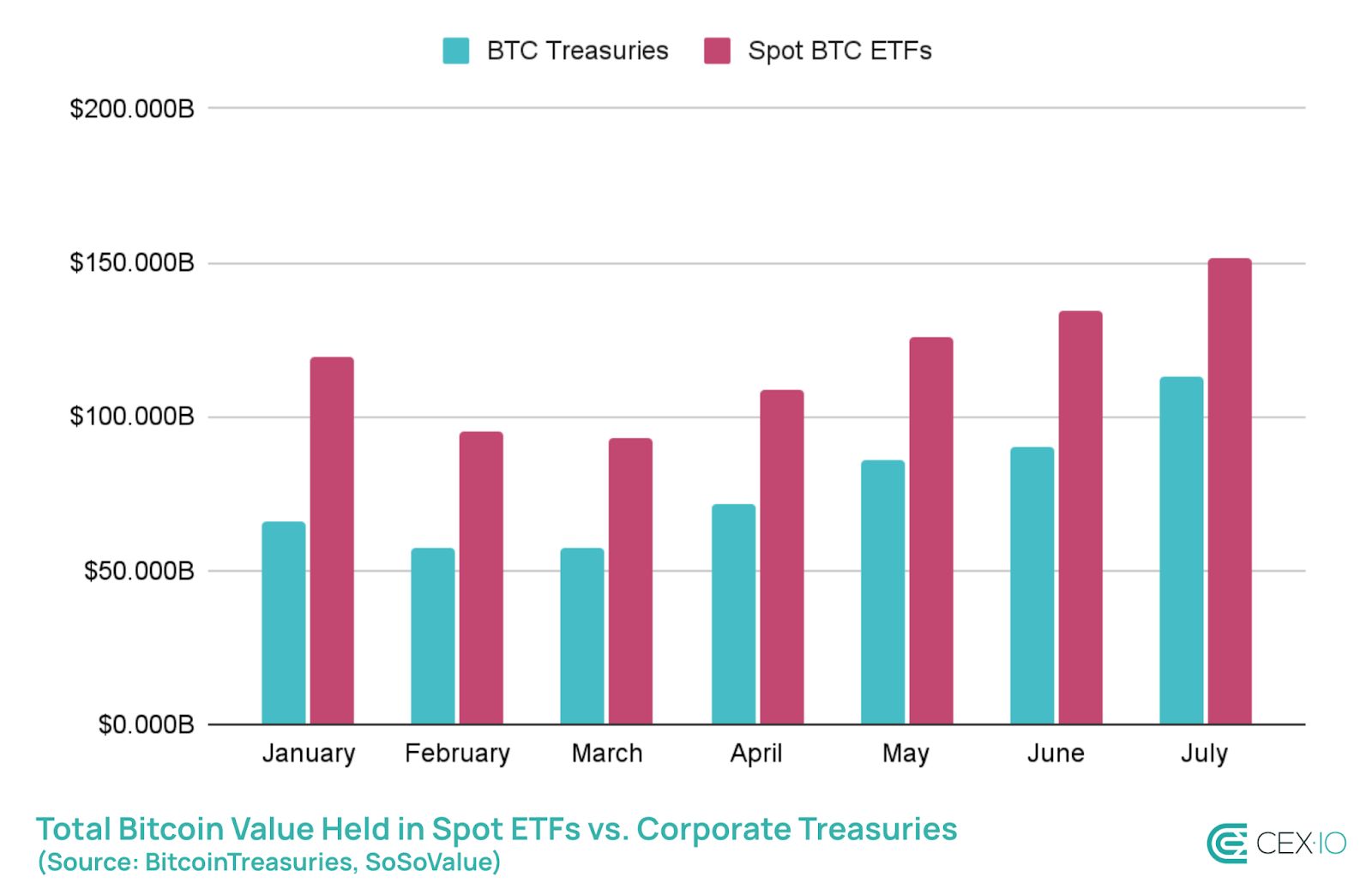

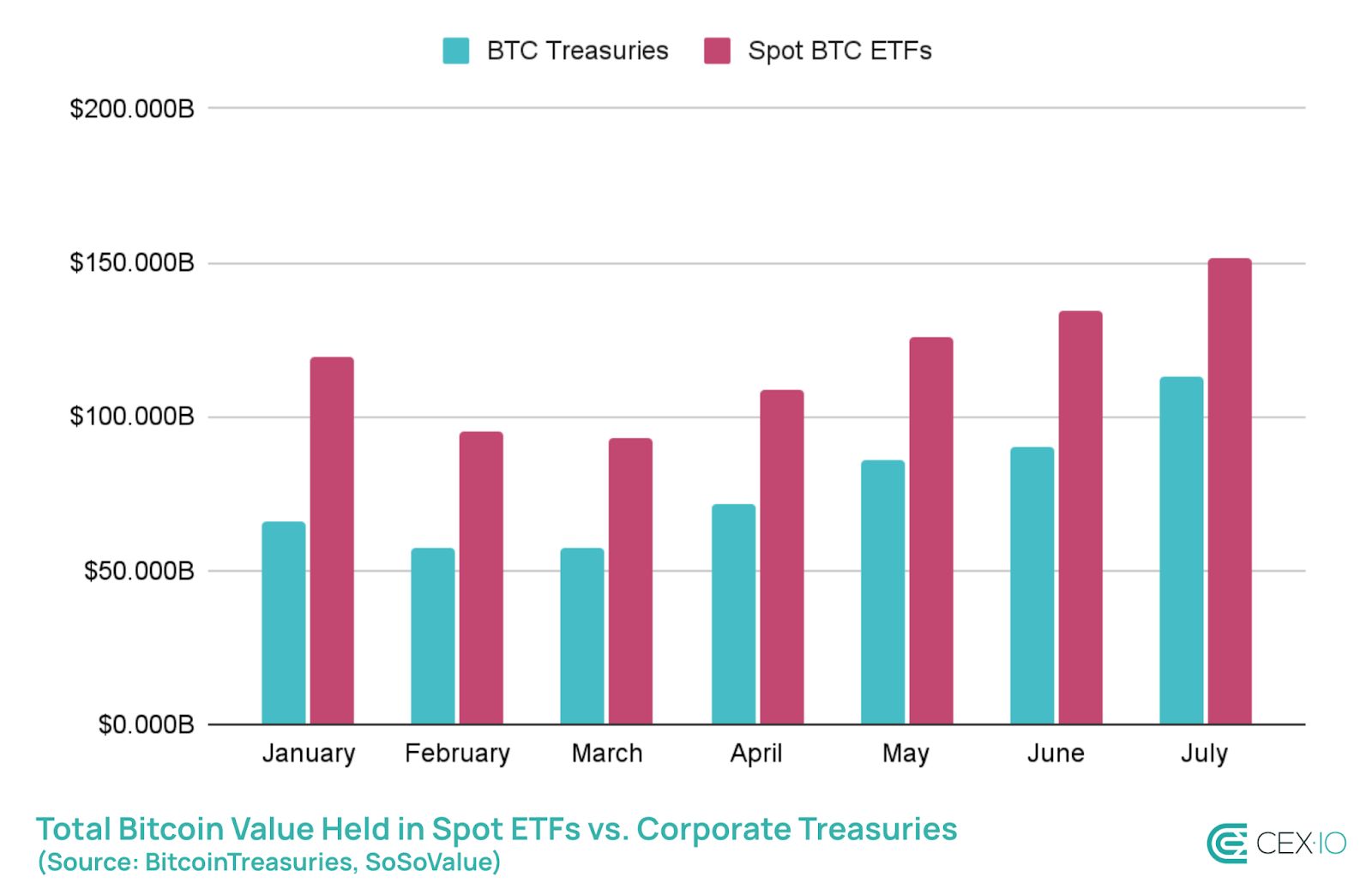

Public Companies Invest $47 Billion in Bitcoin in 2025, Outpacing ETF Inflows

Corporate Bitcoin adoption is entering a new era of acceleration, despite the firstborn crypto asset...