Bolivia Signs Crypto Cooperation Deal with El Salvador Amid Economic Crisis

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Bolivia has signed a landmark agreement with El Salvador to advance crypto adoption.

According to a recent press statement, Bolivia's Central Bank

signed

a memorandum of understanding (MoU) with El Salvador to deepen cooperation on crypto policy. The deal marks a turning point in Bolivia’s approach to digital assets.

Under the MoU, the two countries agreed to coordinate on crypto regulation and share technology tools. They also pledged to enhance financial access for underserved populations.

Bolivia’s Central Bank chief Edwin Rojas Ulo and El Salvador’s Digital Assets Commission president Juan Carlos Reyes García signed the agreement, which took effect immediately and will remain in force indefinitely. The move formalizes their partnership and reflects both governments’ commitment to integrating crypto into their financial systems.

Learning from El Salvador's Bitcoin Playbook

El Salvador, renowned for becoming the first country to adopt Bitcoin as legal tender, offers Bolivia a

practical case study

in navigating both the opportunities and hurdles of crypto regulation.

Through this collaboration, Bolivia aims to modernize its financial infrastructure. It also seeks to expand access to financial services for families and small businesses that have long been underserved.

From Ban to Boom

Bolivia’s crypto landscape has undergone a remarkable transformation. In June 2024, the government lifted a long-standing ban on crypto. Following this decision, cryptocurrency trading volume surged to $46.8 million within just three months, averaging $15.6 million per month. This marked a twofold increase over the monthly average of the previous 18 months.

The momentum has only accelerated in 2025. By June 30, total trading volume had reached $294 million, according to the Central Bank. This highlights the growing enthusiasm for digital assets among Bolivians.

This rising interest is evident not only in trading activity but also in everyday use. A growing number of Bolivians are now turning to cryptocurrencies, such as Bitcoin and stablecoins, for routine purchases.

Economic Crisis Fuels Digital Currency Pivot

The crypto push comes at a time of acute economic pressure. Bolivia’s foreign currency reserves have collapsed from $12.7 billion in 2014 to just $165 million as of April 2025, according to Trading Economics.

Amid severe U.S. dollar shortages, the government has even authorized state-owned oil and gas company Yacimientos Petrolíferos Fiscales Bolivianos (YPFB) to accept cryptocurrency payments for fuel imports.

In response, many local merchants have begun pricing goods in Tether (USDT). This reflects a growing reliance on stablecoins as a hedge against currency volatility.

Elections Could Define Crypto Future

This ambitious pivot toward digital finance is unfolding just weeks before Bolivia’s general elections on August 17. Many citizens see the vote as a referendum on the country’s long-standing socialist leadership.

According to Bolivia’s electoral rules, a candidate must win over 50% of the vote, or at least 40% with a 10-point lead over the nearest rival, to avoid a second round. If these conditions aren’t met, a runoff will take place on October 19.

Forecasts from crypto prediction platform Polymarket suggest an outright win is unlikely, placing the odds of a first-round victory at just 5%.

Political analysts and crypto market observers alike are watching closely, as the next government will likely determine whether Bolivia continues to embrace cryptocurrency or recalibrates its approach.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/520222.html

Previous:比特币以太坊空单再次止盈!

Related Reading

Analyst Says Shiba Inu Showing Bullish Potential as Recent Dip Leads to Cup and Handle Structure

Shiba Inu may be on a downward spiral, but analysts believe prices could rebound imminently as bulli...

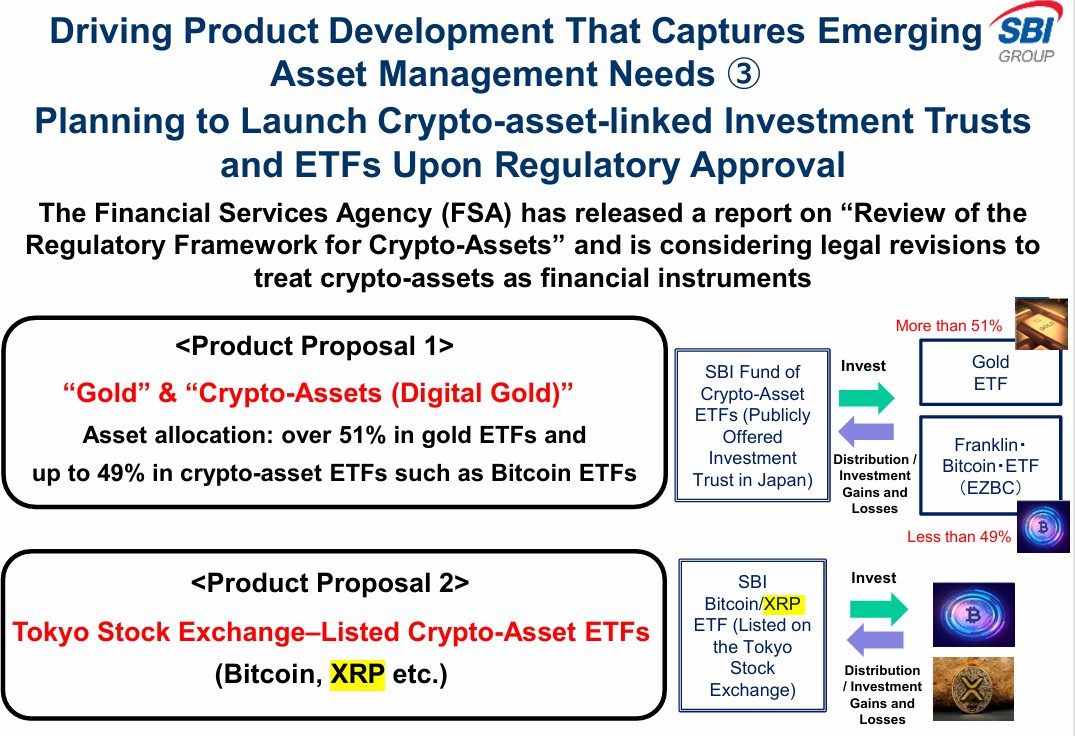

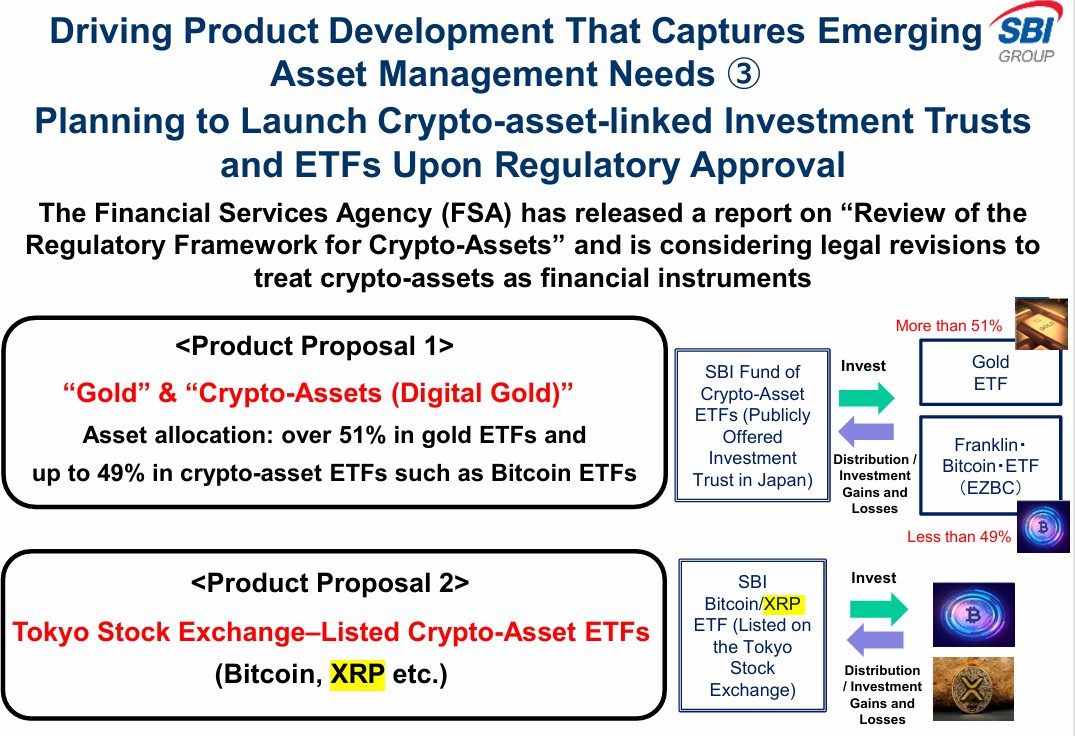

Japanese Financial Giant Reveals Major XRP and Ripple Plans: ETFs, RLUSD, and IPO Hints

Japanese financial giant SBI Holdings has released a new investor presentation revealing significant...

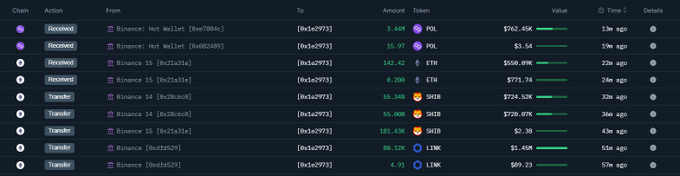

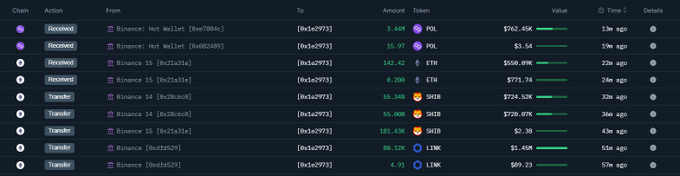

Shiba Inu Team Reacts as New Wallet Withdraws Over 110B SHIB From Binance

Lucie, the lead marketer for the Shiba Inu ecosystem, expresses excitement at reports of a new block...