The post Will $6.45 Decide the Next Major Move for MYX Finance Price? appeared first on Coinpedia Fintech News

The MYX Finance price is gaining attention as early-year price action has been turning into a potential bullish setup, and on-chain tools are signaling improving market sentiment.

As already seen, following a strong January start, MYX Finance was consolidating in a symmetrical triangle until it, in the intraday session, broke out, hinting at strong accumulation beneath the surface while traders watch closely for a directional breakout in Q1 2026.

MYX Finance Price Structure Shows Early 2026 Accumulation

At the start of 2026, the MYX Finance price surged sharply, rising from $3.62 on January 1 to a monthly high of $7.32. However, rather than extending immediately, price action entered a consolidation phase between $4.80 and $6.20. This pause formed a well-defined symmetrical triangle on the MYX Finance price chart, often associated with accumulation during trend continuation phases.

Moreover, this pattern reflected an active tug-of-war, but such sideways structures typically suggest positioning rather than distribution, particularly following a strong impulsive move.

Key Resistance Levels Define the MYX Finance Price Forecast

From a technical standpoint, the $6.45 region stands out as the most immediate resistance. A sustained break above this zone could open the path toward $8.50 before the end of January 2026.

Conversely, downside risks still remain visible. If only bullish control weakens, a decline toward the rising trendline near $3.00-$3.50 could occur, extending the recovery timeline.

Nevertheless, current intraday strength, with MYX price reclaiming $6.20 and reaching a market cap near $1.55 billion, favors consolidation above key support rather than abrupt breakdowns.

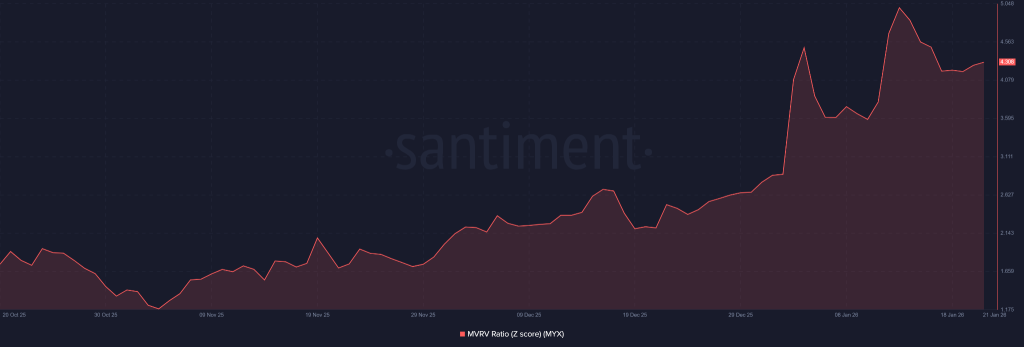

On-Chain Signals Add Context to MYX Finance Crypto Momentum

Beyond price action, on-chain data provides deeper insight into market behavior. The rising MVRV Z-score suggests MYX Finance crypto is transitioning from an undervalued accumulation phase into a momentum-driven phase.

This shift suggests that market value is increasingly outpacing realized value, a dynamic often seen during the “belief phase” of bullish cycles.

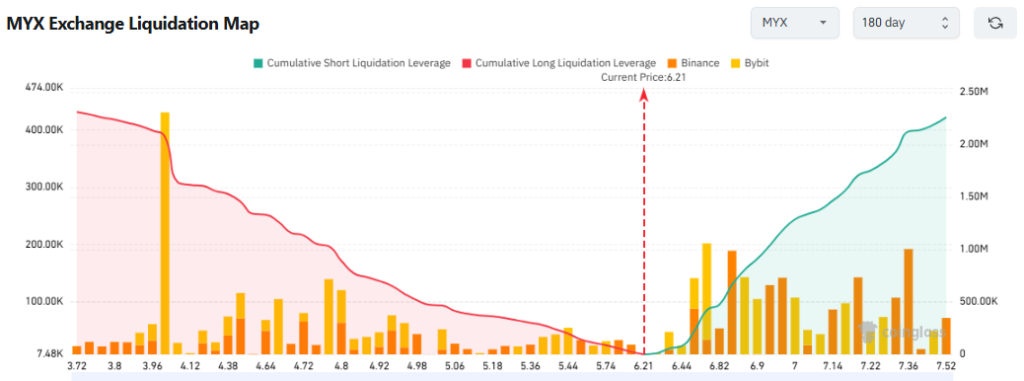

Derivatives Activity Highlights Liquidity Pressure Zones

Derivatives data further complements the MYX Finance price forecast . Over the past 180 days, cumulative short liquidation leverage has increased against long liquidations, confirming heightened speculative activity. The strongest support rests near $4.04, where a breakdown could trigger liquidation of approximately $2.07 million in long positions.

On the upside, clearing $6.45 and $6.88 could cascade into short liquidations worth $421,800, while a move above $7.36 may wipe out around $2.12 million in shorts.