Biconomy , a crypto exchange based in Canada, today announced the listing of XDC Network on its digital asset trading platform. According to the announcement made today, spot trading for the XDC/USDC is now available for customers to participate in various financial transactions.

Powered by its native (BIT) token, Biconomy exchange is an Ontario-based cryptocurrency trading and investment platform that allows people to seamlessly purchase, sell, swap, trade, and store crypto assets. Since its launch in 2019, the exchange has continued to expand its global presence and serves users across the international scene. Its decision to add the XDC token to its trading platform sends a powerful signal about the capability of this altcoin.

Biconomy Allows Users to Leverage XDC for Trading

The listing of the XDC Network on Biconomy’s trading platform means that the cryptocurrency has passed Biconomy’s stringent due diligence process, which examines factors such as security, project capability, and regulatory compliance. The listing offers immediate legitimacy of the XDC token and its visibility to the public market.

By adding XDC Network, a Layer-1 blockchain designed for trade finance, RWA tokenization, and payments, into its trading platform, Biconomy allows crypto enthusiasts to engage with the XDC token through investing, trading, and staking activities. The listing on Biconomy further increases the token’s visibility and liquidity within crypto and DeFi ecosystems to drive the asset’s widespread utility.

XDC Listing Fuels Market Momentum

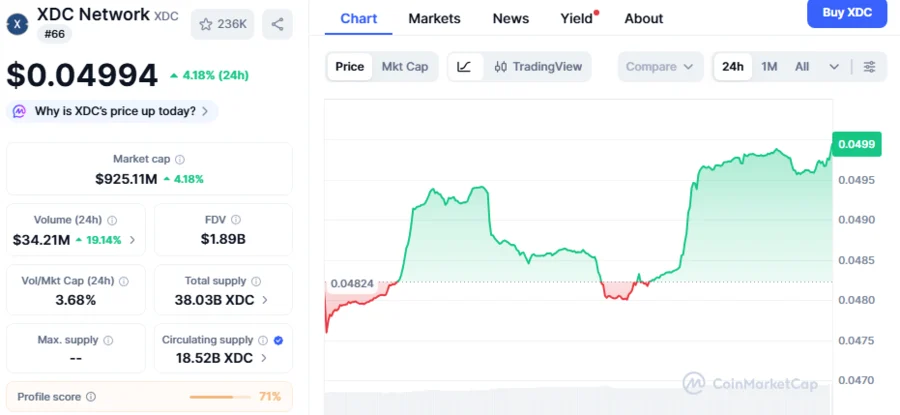

Today, XDC surged its price by 5.9%, making it currently trading at $0.04994, potentially catalyzed by its token listing on Biconomy. The decision for Biconomy to list XDC comes after Bybit integrated XDC (yesterday, December 9, 2025) into its centralized cryptocurrency exchange to allowing its customers to enjoy low-cost transactions and fast payment settlements powered by the XDC Network.

The XDC Network is recognized for its low-cost and rapid transactions. Its transaction fees are much lower than other blockchain platforms, making it more cost-efficient for customers. In late August, Circle, a stablecoin issuer, integrated its USDC payment rails into the XDC Network to improve trade finance, RWA settlements, and DeFi applications.

The latest three integrations above highlight XDC’s positioning itself as a prominent blockchain network for rapid, low-cost global financial trade, real-world asset tokenization, and cross-border payments.

The XDC Network’s TVL, which currently stands at $23.48 million, is proof of its rapidly growing Layer-1 blockchain. This points out a shift towards utility-driven infrastructure that thrives amid the stablecoin boom, rising tokenized real-world assets, and surging on-chain institutional inflows.