Ethereum (ETH) Holds Strong as Analysts Target $4,400 Despite ETF Outflows

The cryptosphere is keeping a close eye on Ethereum (ETH), as the second-largest cryptocurrency by market cap demonstrates resilience amid market shakes.

While spot ETF outflows are causing concern in some quarters, underlying network fundamentals and technical charts are painting a cautiously optimistic picture, with analysts pointing to a potential move toward the $4,400 mark.

Ethereum ETF Outflows and Institutional Sentiment

Despite ETH’s recent price recovery, institutional sentiment appears to be on firmer ground even as exchange-traded funds (ETFs) tied to Ethereum record sizeable outflows.

Data show that Ethereum spot ETFs suffered a net outflow of approximately $508 million over the week, marking one of the largest weekly withdrawals in their history. This mirrors a broader shift in investor behaviour: while traditional crypto-fund inflows have tapered, margins of institutional conviction remain steady.

On the one hand, redemptions suggest a short-term cooling of enthusiasm for ETH amongst ETF investors. On the other hand, this rotation may reflect a more strategic recalibration rather than a wholesale withdrawal of institutional capital.

Strong ETH Price Support and Technical Setup

From a price-action standpoint, Ethereum shows signs of stabilisation. After a sharp weekly drop of around 12 %, the asset has rebounded above the $3,400 level. Analysts have identified key resistance near $3,720, with breakout targets in sight at approximately $4,400 and a further extension toward $4,955.

Key technical highlights include:

- Holding the $3,200–$3,350 liquidity zone as support before the rebound.

- The break of a bearish trend line near $3,350, alongside clearing the 50 % Fibonacci retracement of the recent decline.

- Momentum indicators, such as MACD and RSI, are entering bullish territory, suggesting that the upside could be favored if resistance levels are conquered.

Beyond price movements, Ethereum’s on-chain fundamentals offer reason for optimism. While some metrics are cooling, the total value locked (TVL) in the network has fallen by roughly 24% in the past 30 days to around $74.2 billion.

On the flip side, Ethereum’s revenue from applications hit record levels as recently as mid-October, driven by stable-coin activity and increasing usage of the network’s “economic machine.”

A key upcoming catalyst is the planned “Fusaka” upgrade , scheduled for early December, which is expected to enhance scalability and security in the Ethereum network, potentially boosting long-term value drivers.

While short-term challenges persist, including ETF outflows and macroeconomic uncertainty, the confluence of a strong technical setup, institutional interest, and network upgrades has led some analysts to feel comfortable pushing higher targets.

Cover image from ChatGPT, ETHUSD chart on Tradingview

Institutional XRP ETF Boom Looms as DTCC Adds Five Listings, Analysts Map $10 Path

Momentum for institutional adoption of XRP has surged as the Depository Trust & Clearing Corporation...

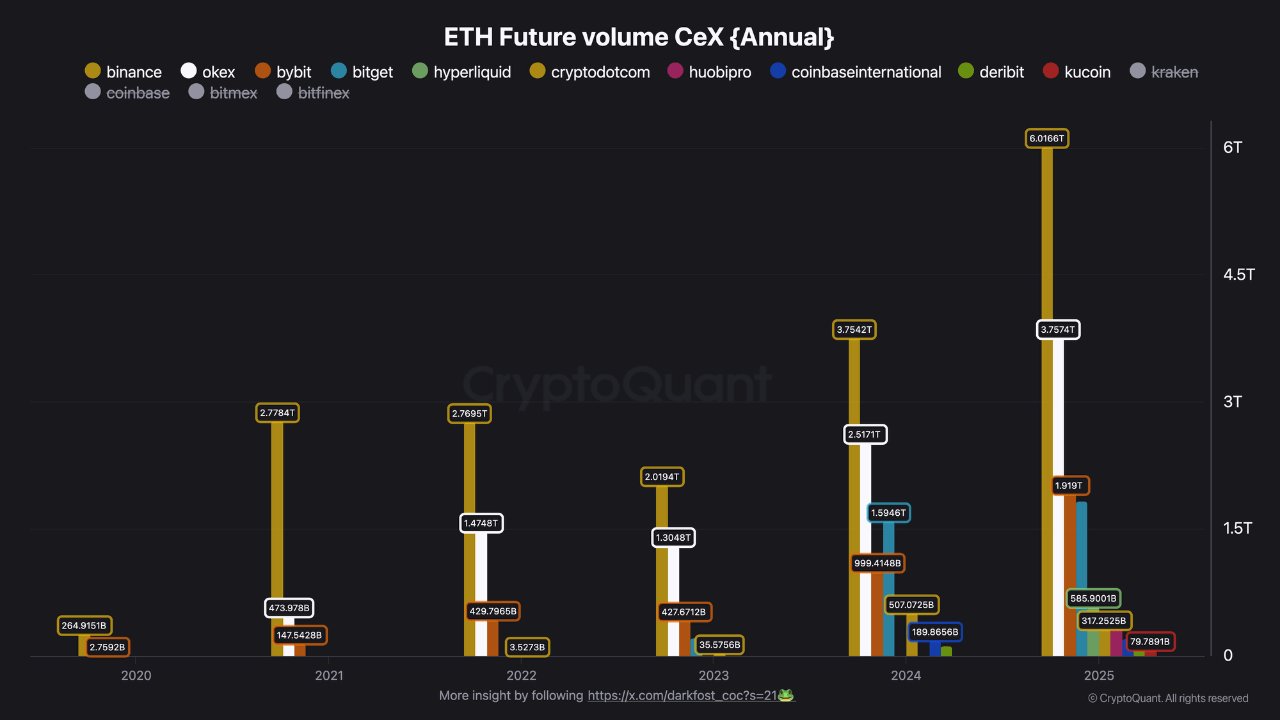

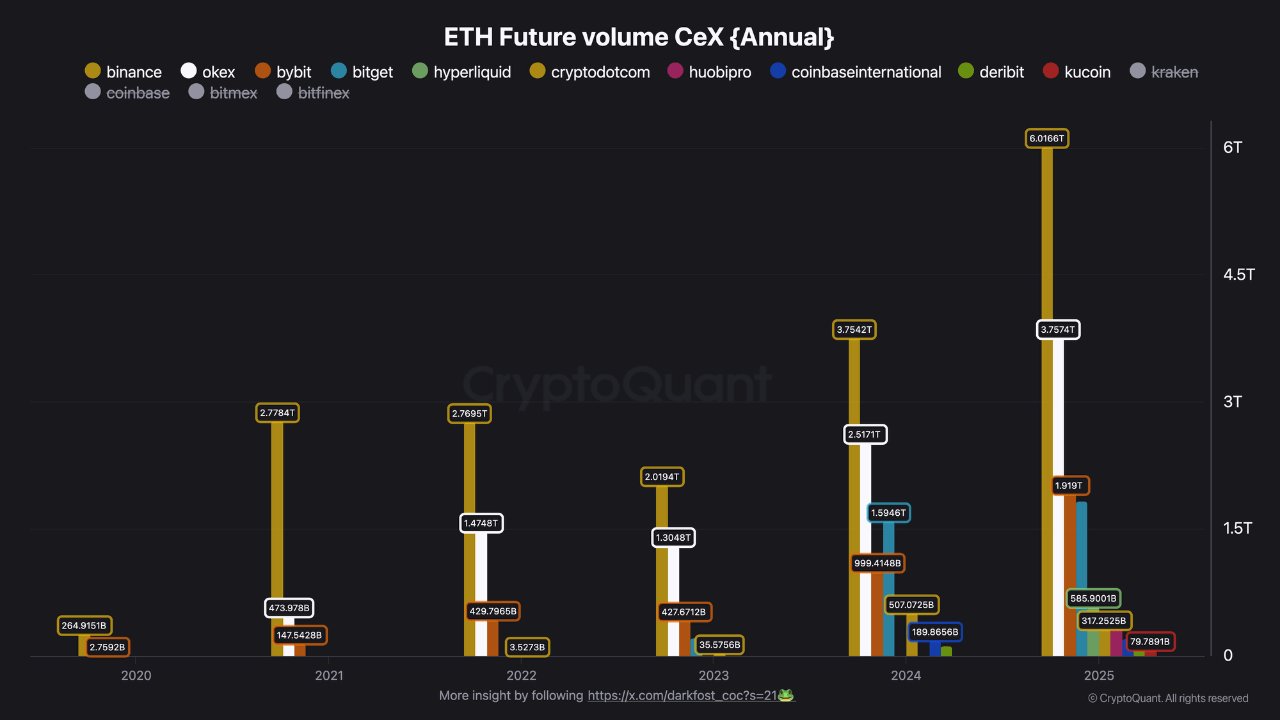

Ethereum Trading Volume On Binance Surpasses $6 Trillion: A Speculative Frenzy Unfolds

Ethereum has reclaimed key price levels after a volatile weekend, emerging as one of the strongest p...

Ethereum Trading Volume On Binance Surpasses $6 Trillion: A Speculative Frenzy Unfolds

Ethereum has reclaimed key price levels after a volatile weekend, emerging as one of the strongest p...