Best Crypto to Buy as Fed Cuts Interest Rates to 3-Year Low: Which Coins Will Explode?

The Federal Reserve cut interest rates 25 basis points yesterday, bringing the federal funds rate to 3.75%-4.00% – the lowest we’ve seen in three years. Bitcoin plunged as Chair Powell hinted at potentially pausing further cuts – but that short-term reaction doesn’t tell the whole story.

Lower interest rates make bonds and savings accounts even less attractive. So, institutions and retail traders start hunting for higher returns, and crypto becomes the obvious play.

Just look back at 2020. The rate cuts then sent Bitcoin from $4,000 in March to $29,000 by December as investors chased returns that traditional finance couldn’t match.

And right now feels similar. Risk-on sentiment is building, the dollar is softening, and projects with speculative momentum are attracting attention. After sizing up the recent developments, we’ve identified four of the best cryptos to buy that could see big gains in the coming weeks.

Fed Cuts Rates to 3-Year Low – What It Means for Crypto

The Federal Reserve cut its benchmark rate yesterday to a three-year low, reshaping how investors think about risk. Yet many market participants don’t actually understand why rate cuts are considered bullish for crypto.

Here’s why: lower interest rates flood the financial system with cheaper money. Institutions and retail can borrow at lower costs, and that capital needs somewhere to go. Bonds yielding next to nothing aren’t as appealing anymore, so riskier assets (like crypto) become more popular.

Rate cuts also tend to weaken the dollar , which usually boosts Bitcoin’s appeal as a store of value. And if inflation begins to creep up from looser monetary policy, BTC starts looking like a genuine hedge.

DeFi protocols and crypto mining operations get breathing room too – cheaper debt costs mean they can invest and expand without being hampered by interest payments. All in all, the setup right now looks good for crypto, with the real gains likely showing up in the coming weeks.

4 Best Cryptos to Buy After the Fed Rate Cut

Cheaper borrowing costs and risk-on sentiment create the ideal environment for strategic crypto investments. Here are four tokens primed to capitalize on yesterday’s rate cut:

1. Bitcoin Hyper (HYPER)

Bitcoin Hyper (HYPER) is attracting a lot of attention, and the Fed’s rate cut timing lines up well with its presale momentum. This Layer-2 solution aims to bring Solana-like speed to Bitcoin by integrating the Solana Virtual Machine (SVM) . That means parallel transaction processing on top of Bitcoin’s security.

Users bridge BTC to Bitcoin Hyper’s Layer-2, mint wrapped BTC, and access DeFi platforms, NFT marketplaces, and tokenized RWAs. It’s all the programmability Bitcoin has never had natively.

The HYPER token powers this Layer-2 ecosystem through transaction fees, staking rewards with high APYs, and governance participation as the network decentralizes. Bitcoin Hyper’s presale has already raised over $25.2 million, with HYPER tokens available to buy for just $0.013195.

With cheaper borrowing costs potentially flooding liquidity into low-cap altcoin projects, Bitcoin Hyper’s meme coin branding and Layer-2 infrastructure make it one of the best cryptos to buy today. Visit Bitcoin Hyper Presale .

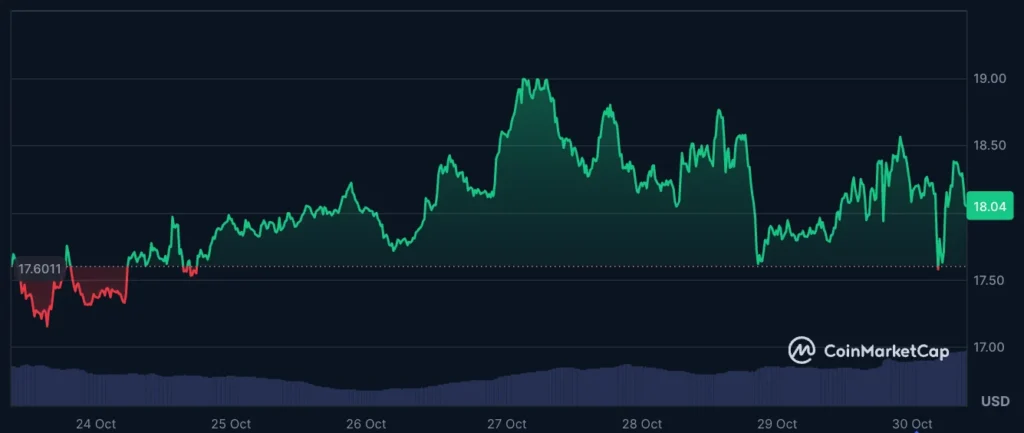

2. Chainlink (LINK)

Chainlink (LINK) powers the infrastructure that most of crypto runs on, and yesterday’s rate cut sets up a perfect liquidity injection for its next bull run. Its decentralized oracle network feeds real-world data – such as prices and events – into smart contracts, linking blockchains and off-chain data.Without these oracles, DeFi platforms like Aave and Compound can’t function, and Chainlink already secures most of the sector’s $153 billion in TVL. Currently, the native LINK token is trading at $18.03, up roughly 51% since last year.

Lower interest rates pump liquidity into DeFi borrowing and lending, thereby increasing oracle usage (and LINK demand) since nodes earn fees in LINK. With a capped 1 billion token supply and no inflationary pressure, Chainlink could be another altcoin about to take off.

3. PEPENODE (PEPENODE)

PEPENODE (PEPENODE) debuts a Mine-to-Earn system that’s generating lots of presale momentum – nearly $2 million raised and climbing fast. Users buy virtual mining rigs with PEPENODE tokens, upgrade them, and earn crypto rewards without dealing with physical hardware.

It’s basically a browser-based strategy game mixed with crypto mining, where top performers can rake in bonus meme coin airdrops in PEPE and FARTCOIN. Also, staking yields are estimated at 646%, offering another way for community members to earn.

What really sets PEPENODE apart is its burn mechanism. Every time users spend tokens on rig upgrades, 70% of those tokens are permanently destroyed. More engagement means fewer tokens in circulation – creating deflationary pressure that intensifies as the ecosystem grows.

Combine that with a massive chunk of PEPENODE already locked in staking, and you’ve got two clear scarcity drivers. That’s why investing in this token now might pay off as investors chase higher-yield opportunities. Visit PEPENODE Presale .

4. Pump.fun (PUMP)

Pump.fun (PUMP) turned Solana into the meme coin “factory” of 2025, and its native PUMP token is positioned to benefit from the liquidity brought about via the latest rate cut. The platform lets anyone launch a meme coin in seconds – with no coding required. Over 13.5 million tokens have been launched on Pump.fun so far, with daily trading volumes averaging around $1 billion in Q3. PUMP trades at $0.0049 today, up 31% since last week.

The token powers Pump.fun’s ecosystem through discounted launch fees, staking rewards, and governance access. Every launch fee flows back into PUMP buybacks and burns – lowering the supply as usage climbs. That’s why it’s one of the best cryptos to buy if you’re betting on another meme coin season.

XRP Faces Setbacks After ETF Delay, While Unich Captures Attention In The Pre-Market Space

XRP faces ETF delays amid the U.S. shutdown, pushing investors toward Solana-based Unich for early p...

Crypto Market Alert 2025: XRP Price Prediction Surges, Ethereum Live Price Updates, MoonBull Ignites 1000x Crypto Presale Frenzy

MoonBull ($MOBU) presale is live, igniting 1000x crypto excitement. Join early as XRP and Ethereum p...

EcoYield Crypto Presale Launches GLOBAL40 Bonus Code as GhostwareOS Hits All-Time High Ahead of Potential Binance Listing

EcoYield and GhostwareOS reflect two crypto paths. GHOST runs on hype, while EcoYield targets real y...