Analysts See $250 Rally Ahead as Solana Holds Key Support and Trading Volume Surges

Solana (SOL) is back on the front foot after a choppy week, trading near $194 and holding a critical support band at $175–$186 that has repeatedly attracted dip buyers since August.

Price reclaimed the $190–$193 area after a sharp bounce from trendline support, with traders now eyeing a clean break over $200 to flip momentum.

On the charts, Solana remains inside a descending channel of lower highs and lows, but a sustained move above $202–$211 (a confluence of the 20/50-day EMAs and key Fibonacci levels) would mark a structure shift and open upside targets at $221–$222, then $235 and $250.

Volume Pops, Open Interest Climbs, Institutions Accumulate

Bullish undercurrents are building beneath the price. On-chain and market data show trading volumes surging to multi-month highs, while futures open interest has pushed above $8billion, signaling stronger participation and the potential for a larger directional move when volatility expands.

Spot flows turned positive, with close to $31.7million in net inflows recently pointing to accumulation at mid-range levels.

Institutional and corporate interest remains a durable pillar for Solana. A recent Grayscale analysis highlights the network’s high throughput, low fees, and expanding developer base. Meanwhile, ARK Invest reported $223 million in Q3 network revenue, ranking among the highest in the blockchain industry.

Additionally, corporate treasuries across digital-asset firms collectively hold over 20 million SOL, underscoring long-term institutional commitment. Staking yields of around 7% annually continue to attract holders, while scaling initiatives like Firedancer aim to improve throughput and network resilience.

Catalyst Watch: $200 Reclaim, Solana ETF Headlines, and Network Growth

Near term, the market wants confirmation. A daily close above $202–$211 would validate a trend reversal and strengthen the case for a measured grind toward $235–$250.

Analysts also flag ETF progress and regulatory headlines as potential catalysts, alongside macro risk appetite driven by rates and liquidity. Fundamentally, Solana’s momentum is buoyed by DeFi/NFT activity, rising DEX volumes, and enterprise experiments in payments and DePIN.

With support defended, volume rising, and institutional demand re-emerging, SOL’s setup skews constructive. If bulls reclaim the EMA cluster and hold over $190 with growing volume, a push to the $221–$222 zone, and ultimately a $250 extension, enters play.

Cover image from ChatgGPT, SOLUSD chart from Tradingview

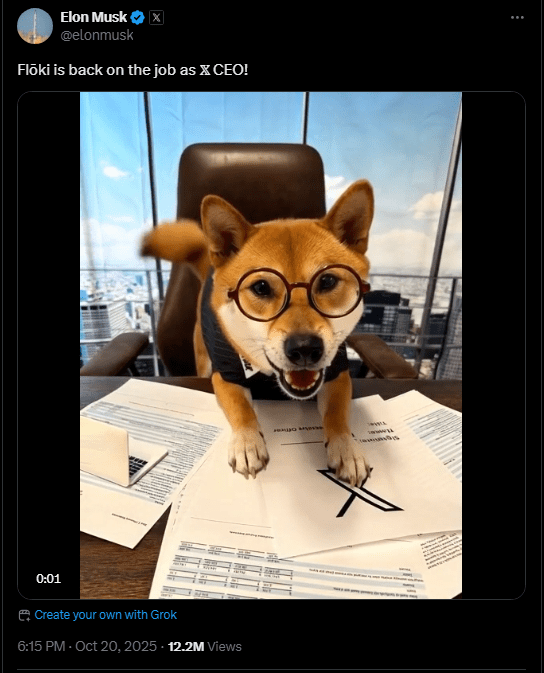

All It Took Was A Tweet: FLOKI Jumps 27% After Musk Mentions It

Elon Musk’s casual post about his dog sent shockwaves through meme-coin markets on Monday, with FLOK...

CryptoQuant’s Moreno Eyes Bitcoin At $195,000 If This Happens

Bitcoin’s violent futures deleveraging earlier this month reset market positioning but did not break...

Here’s What Happens To The Ethereum Price If Bullish Momentum Holds

Coming out of the weekend, the Ethereum price has seen a rise in its bullish momentum. While it is s...