Bitcoin’s Creator Just Took A $20 Billion Hit — If He’s Still Watching

Satoshi Nakamoto’s Bitcoin stash lost more than $20 billion as markets pulled back this month, erasing a chunk of paper wealth tied to the anonymous founder’s early coins. The drop came after Bitcoin skimmed record highs and then tumbled in a fast, wide sell-off that hit many traders and funds.

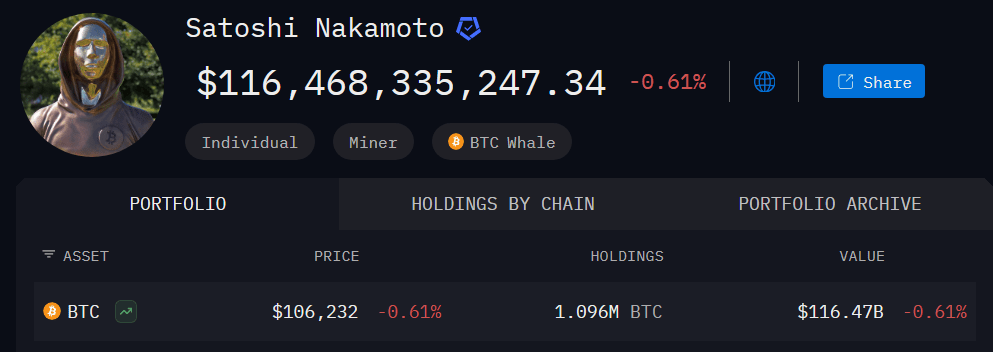

Satoshi’s Holdings And Recent Value Change

According to on-chain tracking and Arkham-linked estimates, the set of addresses attributed to Satoshi contains about 1.096 million BTC. That pile of coins reached a peak valuation above $136 billion when Bitcoin traded at just over $126,000 in early October. Reports have disclosed that the same stash is now roughly $20 billion smaller in headline value than at those highs.

Market data show how the math works: a swing of several thousand dollars per coin becomes tens of billions of dollars against a million-plus BTC balance. The loss is unrealized — the addresses tied to the creator were not reported to have moved — but the headline number grabbed attention because it highlights how volatile valuations can be for the largest holders.

What Triggered The Sell-Off

Based on reports from market analysts and mainstream outlets, the crash was set off by a mix of political shocks and exchange-level stress. US President Donald Trump’s tariff announcement and related trade threats shook risk markets, and at the same time a rare pricing glitch and thin liquidity on some venues amplified selling pressure. The resulting cascade forced automatic liquidations of large margin positions, which analytics firms put at roughly $19 billion over a short span.

Bitcoin’s price briefly fell into the low $104,000s during the worst of the rout on Friday before partial recoveries arrived the next days. That sharp move wiped out gains that had accumulated over recent months and created a rapid re-ranking of the richest-by-paper-wealth lists.

Trading desks said the event exposed weaknesses in market plumbing. Orders that would have been absorbed in calmer conditions instead interacted with each other in thin markets, causing price gaps across exchanges. Many traders who had used borrowed capital to amplify bets were forced to exit, which made the slide steeper and quicker.

Market Significance And What To Watch NextAnalysts caution that a headline loss for Satoshi Nakamoto is mainly a measure of how much value moved on paper; it is not cash that changed hands from the founder. Still, the episode matters because it removed a layer of speculative excess and tested whether major supports hold as flows settle.

Featured image from Getty Images, chart from TradingView

Bitcoin’s Moment? Analyst Urges Traders To Swap Gold For Crypto

A well-known crypto analyst is urging investors to rethink the old trade of gold for Bitcoin, callin...

Bitcoin Price: 7 Vital On-Chain Signals Spotted From Recent Crash

In the last week, Bitcoin prices fell from around $115,000 to below $105,000 amid a widespread crypt...

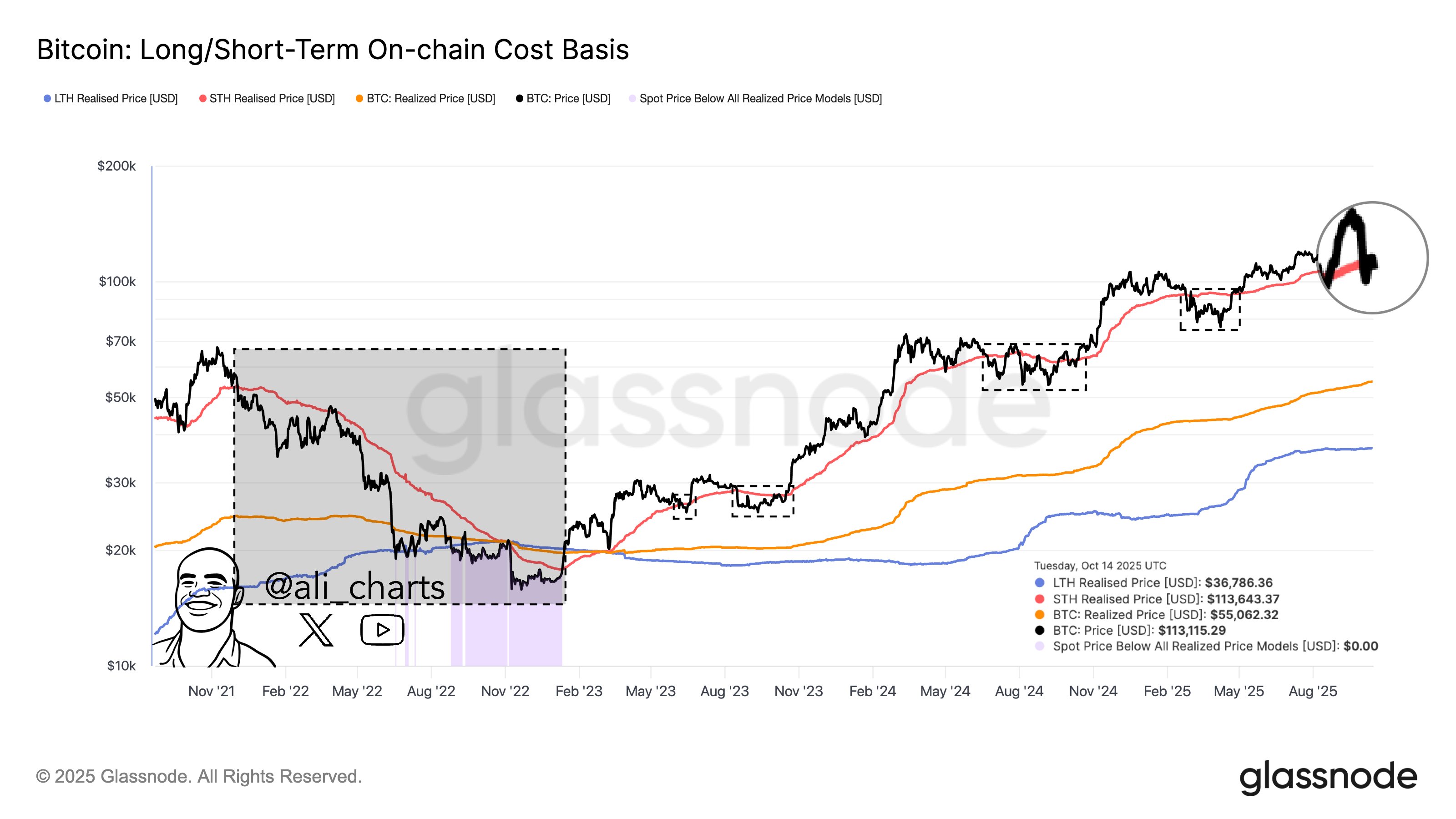

Bitcoin Slips Below STH Cost Basis – Why This Could Be A Buy Signal?

Bitcoin price has continued to hover in the range of $106,000-$108,000 over the last 24 hours. The p...