Bitcoin Market Sees Over 73,000 BTC Influx Into Wallets Younger Than 1 Month – Is A Rally Near?

As Bitcoin (BTC) continues to trade in the low $110,000 range, on-chain data shows that a fresh wave of demand has entered the market. Notably, the Net Position Change (NPC) of the youngest cohort of BTC holders has re-entered positive territory, raising hopes for the cryptocurrency to gain bullish momentum.

Bitcoin NPC Back In Positive Territory

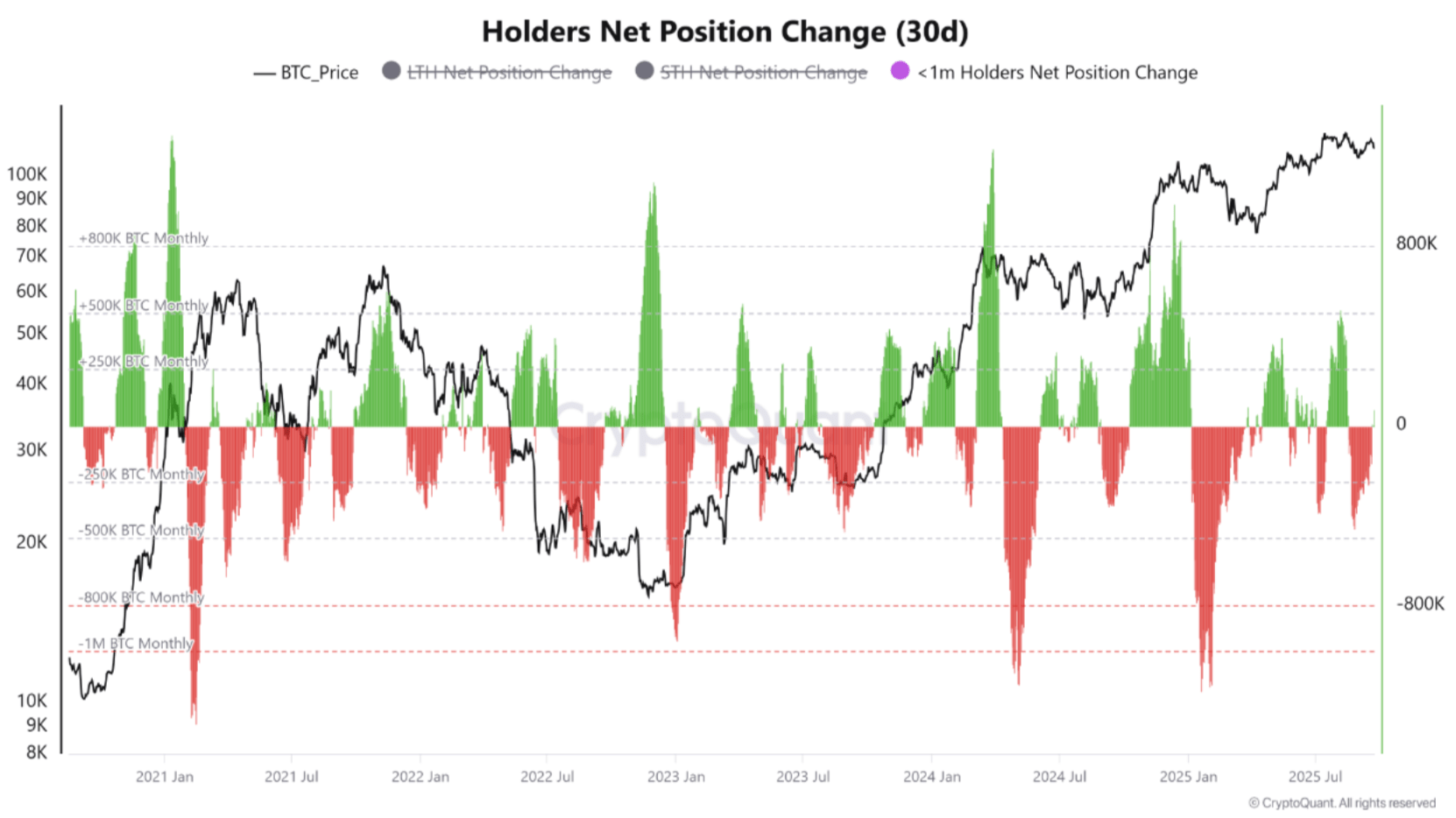

According to a CryptoQuant Quicktake post by contributor Crazzyblockk, the NPC of Bitcoin holders who have held the digital asset for less than one month has decisively flipped into positive territory. This change shows that new demand is flowing into the market at an accelerated rate.

Crazzyblockk highlighted that the 30-day change in supply held by wallets younger than one month has surged, hitting as high as +73,702 BTC on September 23. The following chart confirms the uptick following a period of negative action.

It is worth emphasizing that the influx of fresh capital into the Bitcoin market is beneficial in helping to absorb the supply being sold by long-term holders (LTH). Typically, LTH refers to holders who have held BTC for more than six months.

Currently, these LTH are selling their BTC at a rate of approximately -145,000 BTC, indicative of a typical bull market where early investors realize profits. The analyst added that the fact that selling pressure is being met with strong demand from new entrants is a sign of the rally’s sustainability.

The CryptoQuant contributor added that the accumulation is not limited to the newest cohort. Besides the less than one-month cohort, short-term holders (STH) – investors who have held BTC for less than six months – are also accumulating.

The STH NPC has changed to +159,098 BTC, cementing the robust demand for the top cryptocurrency by market cap across a spectrum of investors based on their time in the market. Crazzyblockk added:

The current dynamic – where profit-taking from long-term investors is being absorbed by a new and enthusiastic wave of buyers – is a classic characteristic of a strengthening bull market. The positive flip in the youngest holder cohort is a leading indicator of broadening market participation and suggests a strong conviction among new investors. This robust demand structure is highly supportive of continued price appreciation in the near to medium term.

Some Areas Of Concern For BTC

While the demand for BTC from young cohorts is encouraging, some concerns still linger about the digital asset’s near-term price action. For instance, BTC exchange inflows remain elevated, raising fears of greater selling pressure.

Similarly, recent on-chain data shows that BTC’s current rally is primarily being led by retail investors. Bitcoin whales – wallets with significant BTC holdings – are noticeably absent from the current rally.

That said, the digital asset’s fundamentals continue to strengthen as the Bitcoin network activity recently reached a new 2025 peak. At press time, BTC trades at $112,804, down 0.2% in the past 24 hours.

Bitcoin Will Soak Up Trillions From China And Russia, Billionaire Predicts

Pantera Capital founder Dan Morehead believes a geopolitical shift in reserve management will push a...

These Analysts Predicted The Bitcoin Price Crash And Their Forecasts Say It’s Not Over

The Bitcoin price crash began over the weekend and has since seen he digital asset break below the $...

Solana (SOL) Takes Hit – Is This Start of Bearish Move Toward $200?

Solana started a fresh decline from the $250 zone. SOL price is now showing bearish signs and might ...