Dormant Bitcoin Waking Up: Over 600K BTC Moved Onchain In Weeks

Bitcoin is trading at a critical level after several days of tight consolidation between $115,000 and $110,000. The price action reflects a tense standoff, with bulls working to regain ground while mounting selling pressure keeps gains in check. Despite the cautious mood, momentum appears to be leaning bullish, as buyers continue to defend key support zones and prepare for the next decisive move.

Adding weight to this outlook, top analyst Maartunn shared new insights showing that dormant Bitcoin coins are beginning to move onchain. This activity suggests that long-term holders, who typically sit through volatility, are repositioning themselves, marking a significant shift in market dynamics. Importantly, these flows also align with the broader trend of capital rotation between Bitcoin and Ethereum, a pattern that has gained traction throughout this cycle.

Such behavior is often seen at key inflection points, where profit-taking and reallocations set the stage for the next phase of the market. For Bitcoin, the movement of dormant supply could indicate growing conviction that liquidity will continue to fuel upside. As BTC hovers within this narrow range, the interplay between long-term holders and shifting capital flows may decide whether the breakout resolves higher.

Bitcoin Supply Awakens: What It Means for the Market

According to analyst Maartunn, a remarkable 604,549 BTC aged between three and five years have moved onchain since March 9, 2025. This is not just a minor adjustment—it represents one of the largest shifts in long-term holder behavior in recent memory. Dormant coins of this age bracket typically belong to holders who have sat through multiple cycles, signaling deep conviction in Bitcoin’s long-term value. When these coins move, the market pays close attention.

The reasons behind this sudden activity are still debated. Some analysts argue this is clear profit-taking behavior. After holding for several years, these investors may see the recent rally toward $115,000 as an opportune moment to secure gains. Large holders, sometimes referred to as whales, are known to time exits strategically, often around cycle peaks or when volatility increases. Their activity could explain some of the selling pressure observed in recent weeks.

Others, however, interpret these moves differently. Rather than a sign of weakness, they see it as capital rotation—a reallocation from Bitcoin into Ethereum and select altcoins. This aligns with the broader trend of diversification as institutions and high-net-worth investors explore opportunities outside BTC. With Ethereum’s strong fee generation and rising adoption across DeFi and layer-2 ecosystems, such shifts could represent strategic positioning for the next growth wave.

Regardless of the motive, the data confirms that long-term holders are actively reshaping the market landscape. Whether this results in temporary selling pressure or sparks a new phase of capital distribution across the crypto sector, one thing is clear: Bitcoin’s dormant supply is no longer idle, and its reawakening marks a critical development for this cycle.

Price Consolidates Below Key Resistance

Bitcoin is currently trading around $113,897, showing signs of recovery after bouncing from lows near $110,000 earlier this month. The daily chart highlights a constructive rebound, with BTC now testing key resistance levels. The 50-day SMA at $114,587 sits just above the current price, acting as the first major hurdle for bulls to clear. A decisive break above this level could open the door toward $116,000 and eventually retest the cycle high at $123,217, marked as the major resistance zone.

On the downside, the 100-day SMA at $112,204 is providing short-term support, while the 200-day SMA at $102,077 remains a crucial long-term floor. As long as BTC holds above $112,000, the bias leans toward continuation higher, with buyers steadily regaining confidence.

The structure suggests that Bitcoin is building momentum for another push, though overhead resistance remains heavy. If bulls fail to reclaim the 50-day SMA convincingly, price could slip back into the $112,000–$110,000 range, keeping consolidation in play.

Holding current levels and breaking above the short-term moving averages would strengthen the bullish case, while rejection could prolong the sideways chop before any larger breakout attempt.

Featured image from Dall-E, chart from TradingView

Solana Treasury Player SOL Strategies Goes Public On Nasdaq

SOL Strategies Inc., the company that grew out of Cypherpunk Holdings, made its Nasdaq debut this we...

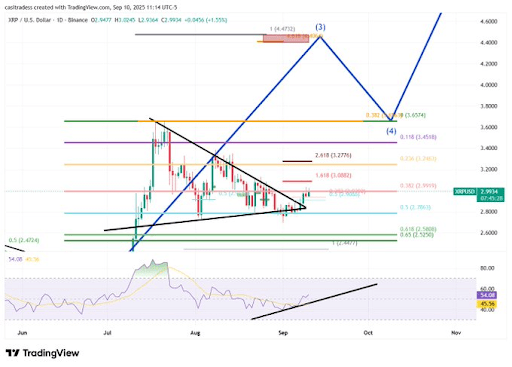

Pundit Reveals What XRP Price Will Be If Ethereum Hits $25,000

Crypto analyst Whale Guru has outlined his targets for altcoins on their next massive pump to the up...

XRP Price Is Ready To Break Out, But You Should Watch Out For $3.13

The XRP price is drawing attention this week as traders watch for signs of a potential upward move. ...