Exclusive: Ethereum Skyrockets on ETF Boom, Analyst Says Bitcoin Is Losing Ground

The post Exclusive: Ethereum Skyrockets on ETF Boom, Analyst Says Bitcoin Is Losing Ground appeared first on Coinpedia Fintech News

Ethereum recently broke into fresh all-time highs, and the debate around what is fueling this rally has taken center stage. To get a clearer picture, we sat down with Lennaert Snyder, crypto analyst and official partner at Bybit, to understand what’s really happening behind Ethereum’s surge and how institutions are looking at ETH versus Bitcoin.

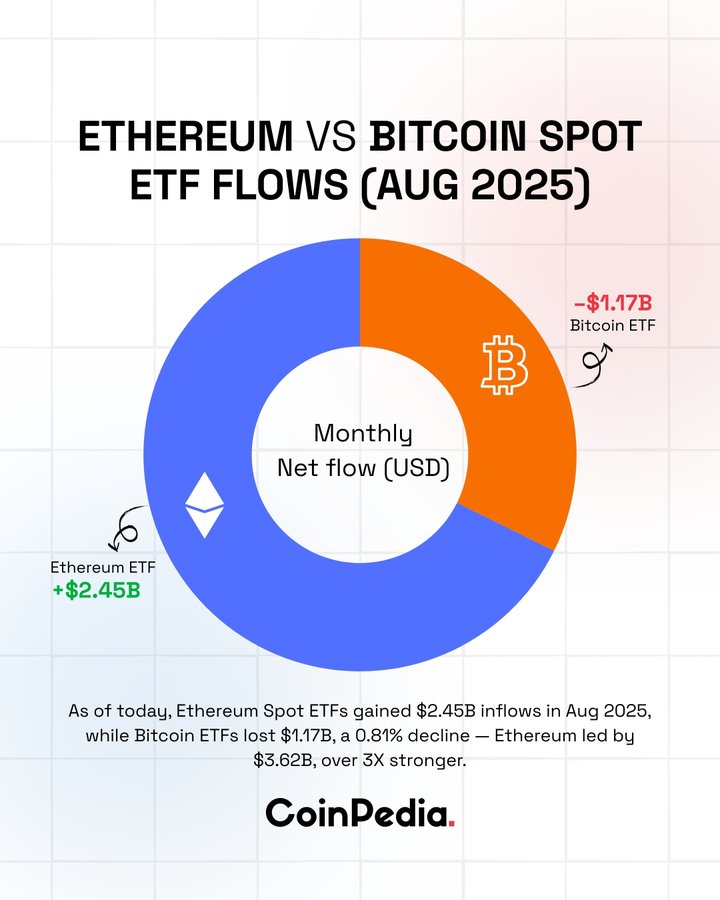

His take offers a window into how much of Ethereum’s rally is powered by institutional flows and how much is supported by activity on the chain itself. Spot ETH ETFs have already made headlines, pulling in $2.9 billion in a single week, a figure that even surpassed Bitcoin ETF inflows.

‘On-chain metrics also show growing demand: high bridge inflows and rapidly increasing stablecoin supply shows strong activity in DeFi and the stablecoin ecosystem,” he said in an interview with Coinpedia.

Stablecoin supply is expanding, DeFi protocols are thriving, and bridge inflows remain strong. Snyder estimates that roughly 60 to 70 percent of Ethereum’s price movement can be attributed to ETF inflows, while 30 to 40 percent comes from organic usage like staking and DeFi participation.

Institutional Appetite for Ethereum

The latest market behavior reveals a growing institutional preference for Ethereum. Snyder opened up about Ethereum’s unique advantage: multiple revenue streams. Beyond being an asset to hold, ETH offers smart contract functionality, staking rewards, and access to a vast DeFi ecosystem. These features appeal to funds seeking returns beyond the store of value narrative.

This institutional turn is evident in the data. ETH ETFs are currently outperforming their Bitcoin counterparts, and Ethereum-focused treasuries such as Bitmine are actively accumulating ETH.

However, he also said, “That said, I think Bitcoin still remains the default choice for more conservative institutions looking for “digital gold” with slightly lower volatility.”

Bitcoin will continue to serve as the anchor, while Ethereum offers a more dynamic growth story. Institutions may begin with BTC for stability but increasingly diversify into ETH for yield and innovation.

Morgan Stanley Flips Forecast, Now Sees Fed Rate Cuts in September & December

The post Morgan Stanley Flips Forecast, Now Sees Fed Rate Cuts in September & December appeared firs...

Kraken Wants Wall Street on Blockchain: SEC Discussion Heats Up

The post Kraken Wants Wall Street on Blockchain: SEC Discussion Heats Up appeared first on Coinpedia...

Spark Price Tests Key Support, Will the Bulls Eye $0.0759?

The post Spark Price Tests Key Support, Will the Bulls Eye $0.0759? appeared first on Coinpedia Fint...