Ethereum Nears $4K as $4B Supply Overhang Looms: Analysts Fear Deeper Losses

Ethereum (ETH) is struggling to hold above $4,200 after a sharp sell-off triggered widespread liquidations across the crypto market. It has dropped nearly 9% over the past week, with traders bracing for a potential retest of the $4,100 level.

Data from CoinGlass shows that more than $178 million in positions were liquidated in the past 24 hours, with ETH long traders suffering the biggest blow, over $127 million wiped out.

A notable case saw one Hyperliquid trader lose nearly $6.2 million after re-entering ETH longs too aggressively, turning months of gains into heavy losses within just two days.

This volatility comes as Ethereum’s exit queue for staking withdrawals has surged to 910,461 ETH, worth about $3.91 billion, signaling an upcoming wave of supply that could pressure prices further.

Institutional Investors Step in Despite Market Jitters

Despite retail pain, large institutional players appear to be buying the dip. Bitmine Immersion , the biggest publicly traded ETH holder, recently added 52,475 ETH, bringing its holdings to nearly $6.6 billion.

SharpLink followed suit, purchasing 143,593 ETH at $4,648, though its position is now underwater.

Blockchain trackers also flagged new inflows from FalconX-linked wallets worth over $38 million. This suggests that while short-term sentiment remains shaky, big-money investors continue to accumulate ETH, betting on its long-term value.

Ethereum (ETH) Analysts Warn of Deeper Losses Before RecoveryMarket experts caution that Ethereum may remain under pressure as macroeconomic uncertainty looms ahead of the U.S. Federal Reserve’s Jackson Hole meeting. Pessimistic tone from Fed Chair Jerome Powell could trigger further risk-off sentiment across crypto and equities.

On-chain activity has also weakened. Active Ethereum addresses have dropped nearly 28% in August, signaling waning retail participation. Network growth has slowed as well, raising questions about near-term demand.

Still, analysts see long-term upside once the market absorbs the $4B staking unlock. Some forecasts remain bullish, with Ethereum projected to reach between $6,000–$8,000 by year-end if institutional flows persist.

For now, however, the critical question remains: can ETH defend $4,000, or will supply pressure drag it into a deeper correction?

Cover image from ChatGPT, ETHUSD chart from Tradingview

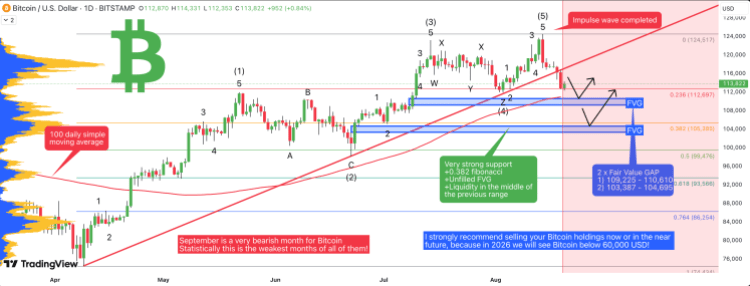

Analyst Warns Investors To Avoid Bitcoin At All Cost As Price Is Going Below $60,000

Bitcoin has entered a precarious situation after falling below $114,000, and sellers continue to mou...

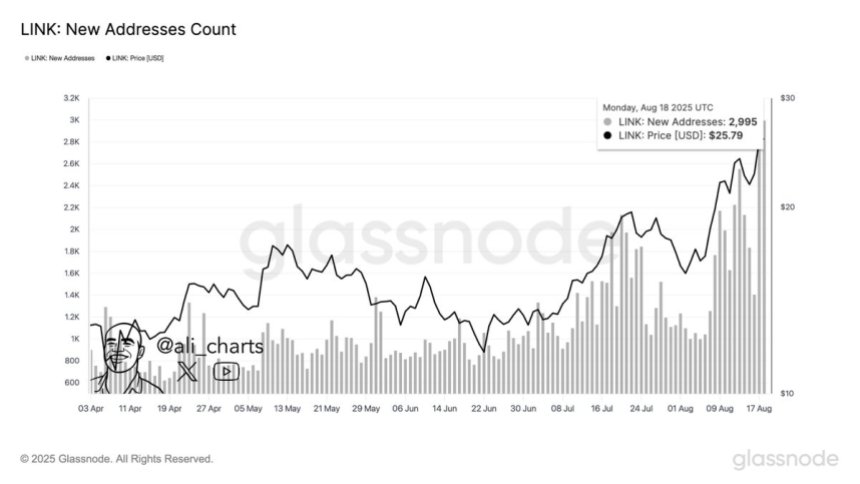

Chainlink Eyes Crucial Resistance After $25 Reclaim – Breakout Or Breakdown Next?

Chainlink (LINK) is attempting to reclaim a crucial area after recovering 10%, surpassing most of th...

Lummis Fast-Tracks Crypto Market Structure Bill To Reach Trump’s Desk Before Thanksgiving

In a recent address, pro-crypto Senator Cynthia Lummis revealed her efforts to expedite the passage ...