China Merchants Bank’s CMB International Launches Bitcoin and Crypto Trading Services

Favorite

Share

Scan with WeChat

Share with Friends or Moments

CMB International Securities, the investment arm of China Merchants Bank, has rolled out Bitcoin trading services for its clients.

According to a local

report

, the announcement came on August 18, 2025, making CMB International the first securities firm affiliated with a Chinese bank to launch digital asset trading in Hong Kong under a fully regulated framework.

Details of the Crypto Trading Service

Notably, per the report, the new service will allow clients to trade three crypto assets:

Bitcoin (BTC),

Ethereum (ETH), and Tether (USDT), with no details on whether the firm plans to expand the offering in the future.

The service is available through the company's mobile app and runs around the clock, giving clients direct access to crypto markets while keeping them within Hong Kong's regulatory standards.

To gain access, investors must complete full Know Your Customer and Anti-Money Laundering checks before trading, an effort to comply with the city's strict oversight of digital assets. CMB International secured the necessary licenses from the

Hong Kong Securities and Futures Commission

last year, as it prepared for the recent launch.

Moreover, the platform uses cold wallets, real-time risk monitoring, and independent audits to strengthen trust and safeguard client funds. CMB International has also formed a technical partnership with OKX Planet, which supplies liquidity and trading engine support. The company also plans to push further into blockchain-based products, including a tokenized money market fund.

Hong Kong Moving On as China Lags

Notably, this shows the contrast in the crypto regulatory atmosphere between Hong Kong and mainland China. While Hong Kong has embraced digital assets under clear regulatory rules, mainland authorities still ban cryptocurrency-related activities, calling them illegal financial transactions.

Industry lawyers have warned mainland residents to stay cautious, but they also note that CMB International's example shows how Chinese financial groups can expand offshore in a compliant way.

Global Institutional Bitcoin Adoption Soars

The launch mirrors a global trend where major banks are moving deeper into crypto. In the United States,

JPMorgan Chase

plans to let customers purchase digital assets through Coinbase in a recent collaboration, while

PNC Bank

announced a similar partnership last month. Standard Chartered has already started offering spot Bitcoin and Ether trading to institutional clients in the UK.

Morgan Stanley

, through E*Trade, is preparing to introduce crypto trading in 2026, and

Deutsche Bank

, together with Germany's savings banks, is building regulated custody and trading platforms set to go live by mid-2026.

Compared with Europe and the US, China has moved more cautiously, but Hong Kong's efforts to become an international hub are now encouraging its financial giants to act. Other firms, including Guotai Junan International and Tianfeng International, have already applied for license upgrades and may soon launch similar services.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/523114.html

Related Reading

Wyoming Launches First State-Issued Stablecoin in the U.S

Wyoming has officially rolled out the Frontier Stable Token (FRNT), becoming the first U.S. state to...

SoFi Launches Low-Cost Global Remittances Using Bitcoin Lightning Network

Nasdaq-listed SoFi has partnered with Lightspark to launch a new international remittance service po...

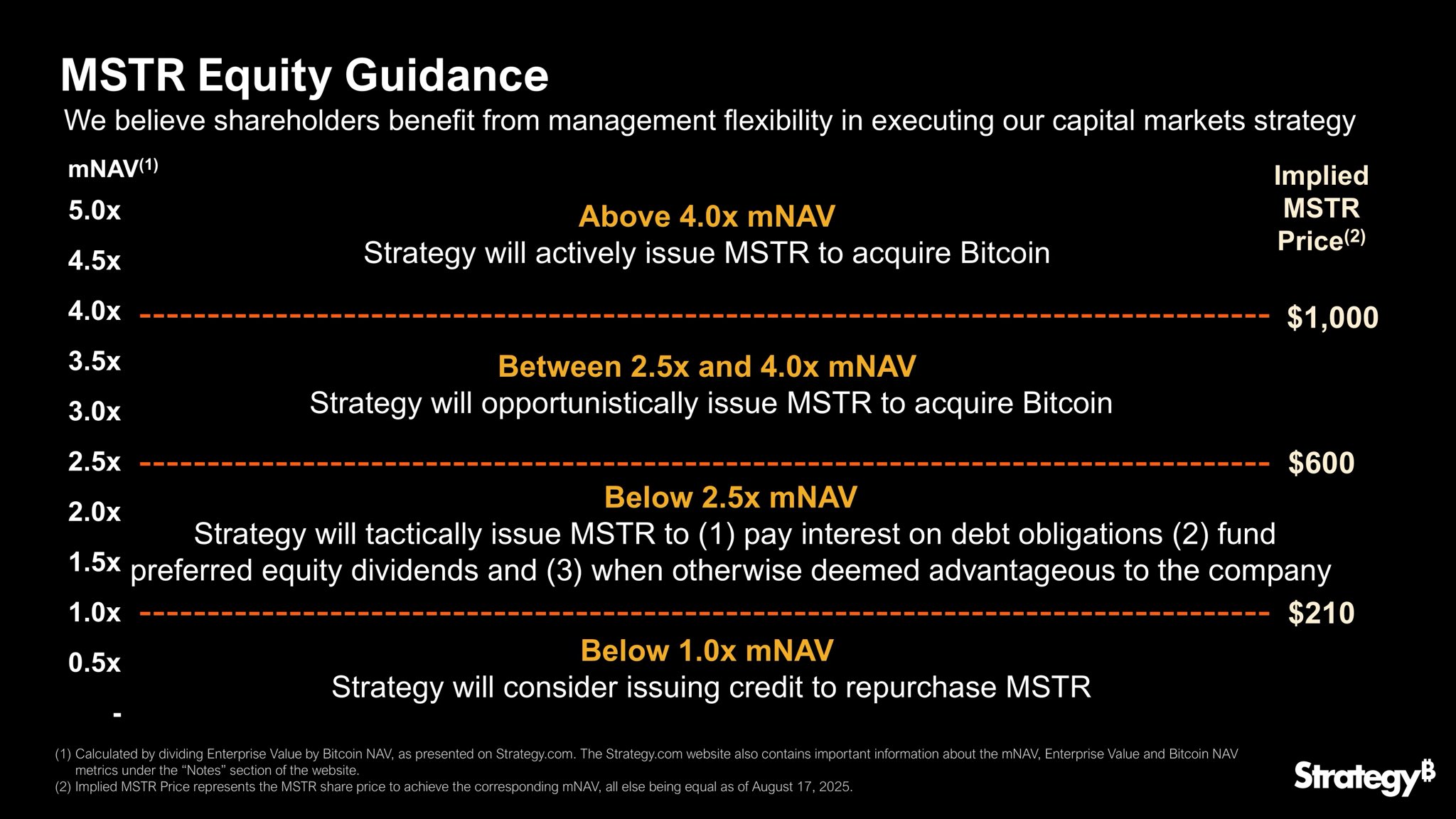

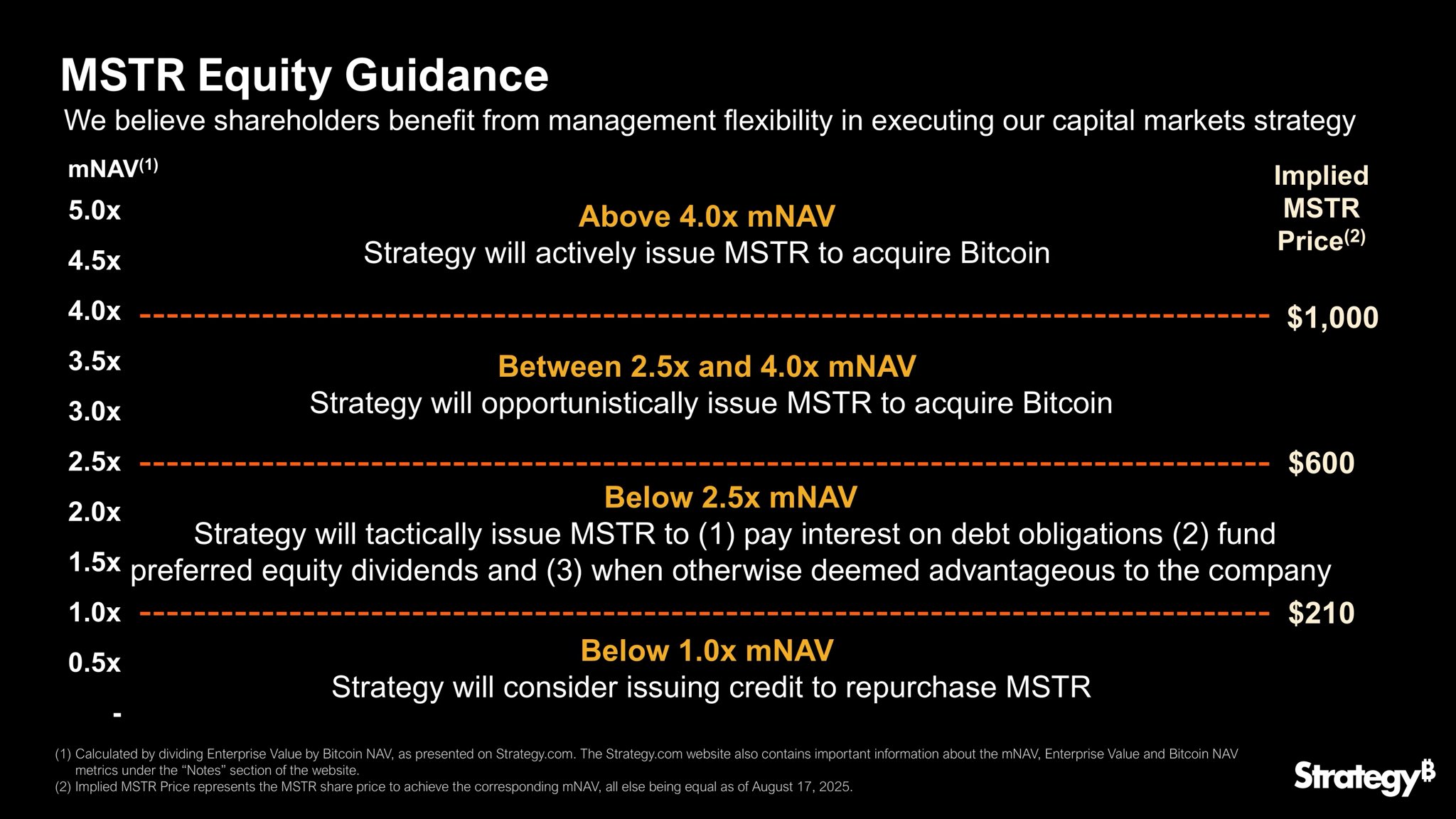

Expert Warns Strategy Could Face a Spiral of Doom for Its Bitcoin Bet Following New Equity Guidance

Strategy has again grown its already massive Bitcoin stash, but its latest financial update has trig...