Here’s Why Bitcoin And Ethereum Prices Are Crashing

The Bitcoin and Ethereum prices have crashed significantly in the last 24 hours. This follows developments on the macro end, which have sparked a bearish sentiment among investors, leading to a wave of sell-offs.

Why Bitcoin and Ethereum Prices Are Crashing

CoinMarketCap data shows that the Bitcoin and Ethereum prices are crashing, down over 3% and 2%, respectively, in the last 24 hours. This crash is partly thanks to U.S. Treasury Secretary Scott Bessent’s statement about the proposed Strategic Bitcoin Reserve . In a Fox Business Interview , he said that the country won’t be buying Bitcoin.

However, Bessent added that they have no plans to sell the Bitcoin they currently hold, which he claimed is worth between $15 and $20 billion. Instead of buying, the U.S. government plans to use only confiscated assets and opt against selling them. Investors viewed Bessent’s statement as bearish, considering that Donald Trump’s executive order establishing the strategic reserve said the U.S. would consider ways to buy more Bitcoin.

Furthermore, Bessent’s statement had also suggested that the U.S. Congress wasn’t going to follow through with Senator Cynthia’s BITCOIN Act . This bill proposes that the country will buy 1 million BTC over five years. The market has been pricing in the possibility of this happening, given its bullish implications for the Bitcoin price and the Ethereum price by extension.

However, a positive for the Bitcoin and Ethereum prices is the fact that Bessent’s statement about the current value of the U.S. BTC holdings shows that they haven’t sold their coins. There were earlier reports that the U.S. had sold a significant portion of its Bitcoin holdings after the U.S. Marshals said they held only 28,988.356 BTC in response to an FOIA request. Arkham data shows that the U.S. holds 198,022 BTC, worth around $23 billion.

U.S. PPI Data Contributes To Crash

The U.S. PPI data that was released yesterday also contributed to the Bitcoin and Ethereum price crash. Data from the Labor Department showed that PPI inflation rose to 3.3% year-on-year (YoY) in July, which was way above expectations of 2.5%. Meanwhile, the monthly PPI came in at 0.9%, also way above the expected 0.2%.

Bitcoin and Ethereum had witnessed a sharp drop following the release of the data. The PPI data is bearish for crypto prices because it could make the Fed reconsider cutting rates at the September FOMC meeting. Before the PPI release, CME Fedwatch data had shown that there was a 99% chance that the Fed would make a 25 basis point cut in September.

However, these odds have dropped to around 93%. Although this suggests that the Fed will still cut rates, rising inflation in the U.S. isn’t good for Bitcoin and Ethereum prices, since it could restrain how much investors can invest in these risk assets.

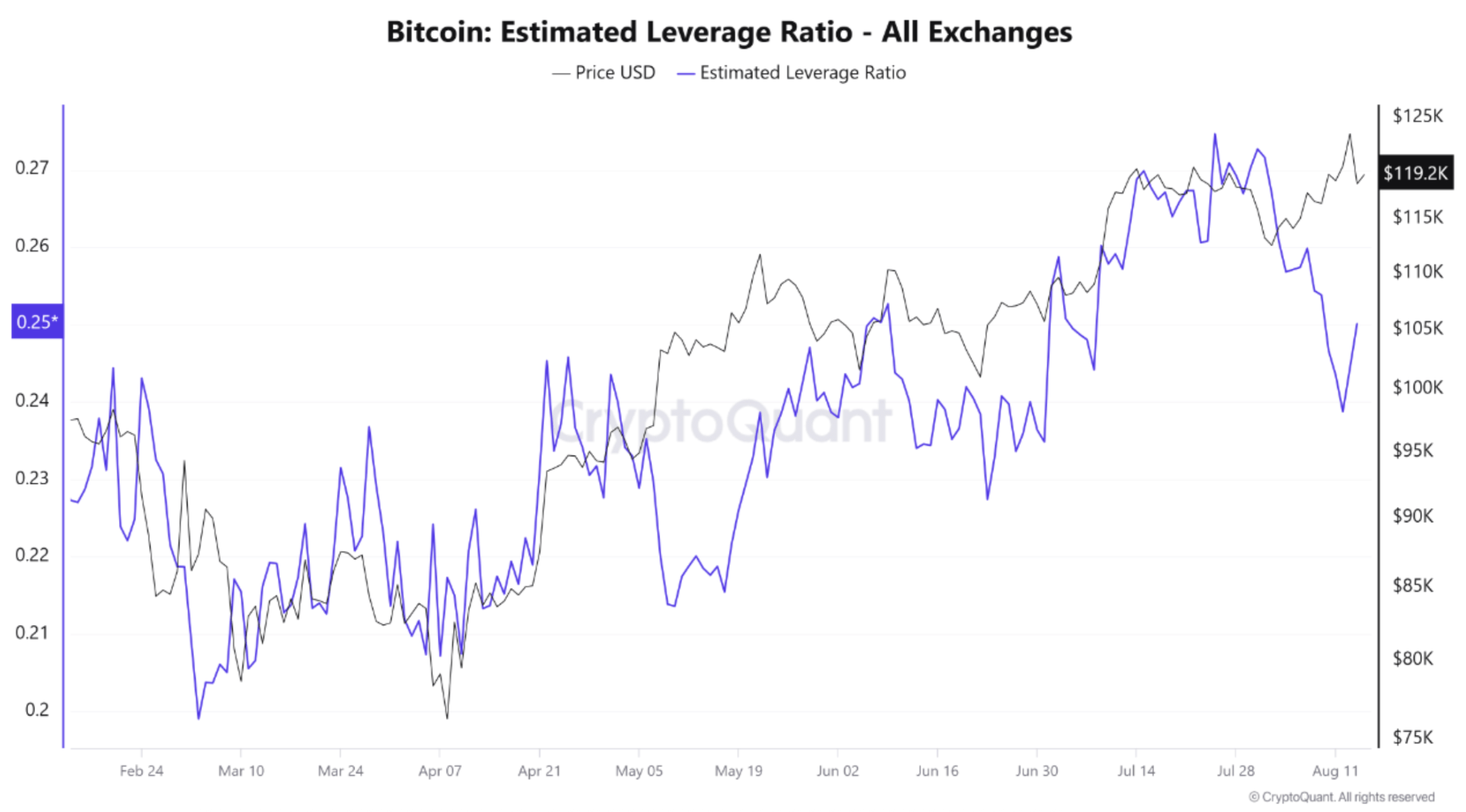

Bitcoin Holds Near $119,000 As Lower Leverage Reduces Correction Risk

Bitcoin (BTC) staged a mild rebound from yesterday’s inflation-driven drop to $117,180, climbing bac...

Market Expert Reveals Why XRP Price At $1,000 Is Not A Possibility

A leading market analyst is warning XRP holders that dreams of a $1,000 price tag are far from reali...

Tokenized Assets To Hit $100 Trillion — Ethereum Set To Be The Backbone

The global financial system is on the verge of a seismic shift. A prominent figure in the financial ...