SharpLink Raises $200M to Strengthen Ethereum Holdings, Eyes $2B Treasury Milestone

Favorite

Share

Scan with WeChat

Share with Friends or Moments

SharpLink Gaming, a Nasdaq-listed firm focused on Ethereum adoption, has secured $200 million in fresh capital through a registered direct offering led by four global institutional investors.

The

raise

, priced at $19.50 per share, comes as the company intensifies its ambition to become the world’s top corporate ETH holder.

The new capital will be directed toward expanding SharpLink’s Ethereum treasury, which could exceed $2 billion in value once the firm fully deploys the funds. The offering will close around August 8, 2025, pending customary conditions.

Strong Institutional Support

Notably, the firm structured the offering under an effective shelf registration statement filed with the SEC, with A.G.P./Alliance Global Partners serving as lead placement agent. Société Générale joined as co-placement agent, while Cantor Fitzgerald acted as financial advisor to SharpLink.

SharpLink’s Co-CEO, Joseph Chalom, noted that the involvement of globally recognized institutions further validates the company’s ETH-centric mission.

Mission to Accumulate, Stake, and Grow Ethereum Portfolio

The company’s ETH-per-share growth strategy rests on three pillars: Accumulate ETH, Stake ETH, and Grow ETH-per-share.

Essentially, SharpLink positions itself not just as a gaming innovator but as a long-term Ethereum treasury reserve institution. The company recently disclosed its acquisition of 83,561 ETH for approximately $264 million. The acquisition brought its total holdings to 521,939 ETH worth over $1.98 billion. Effectively, SharpLink stands as the second-largest corporate ETH holder,

trailing only BitMine.

With Ethereum increasingly regarded as the foundational layer of decentralized finance, SharpLink is betting that ETH’s long-term value will outperform traditional fiat-based reserves.

Expanding Corporate Investment in Crypto

With its aggressive accumulation strategy, SharpLink is setting a blueprint as Ethereum matures into a global settlement layer. The company is carving out a niche that offers equity investors indirect exposure to ETH via SBET shares.

This approach mirrors Michael Saylor’s strategy with Bitcoin, where many traditional investors gain

BTC exposure primarily through MicroStrategy stock.

In recent months, several public companies have disclosed building substantial positions in other digital assets like XRP, Solana, and Hyperliquid. Even meme coins like Dogecoin, as well as BNB, Litecoin, and newer entrants like Sui, have found their way onto corporate balance sheets.

Essentially, the institutional crypto investment landscape, once dominated by Bitcoin, has become noticeably more diverse.

With Ethereum increasingly regarded as the foundational layer of decentralized finance, SharpLink is betting that ETH’s long-term value will outperform traditional fiat-based reserves.

Expanding Corporate Investment in Crypto

With its aggressive accumulation strategy, SharpLink is setting a blueprint as Ethereum matures into a global settlement layer. The company is carving out a niche that offers equity investors indirect exposure to ETH via SBET shares.

This approach mirrors Michael Saylor’s strategy with Bitcoin, where many traditional investors gain

BTC exposure primarily through MicroStrategy stock.

In recent months, several public companies have disclosed building substantial positions in other digital assets like XRP, Solana, and Hyperliquid. Even meme coins like Dogecoin, as well as BNB, Litecoin, and newer entrants like Sui, have found their way onto corporate balance sheets.

Essentially, the institutional crypto investment landscape, once dominated by Bitcoin, has become noticeably more diverse.

With Ethereum increasingly regarded as the foundational layer of decentralized finance, SharpLink is betting that ETH’s long-term value will outperform traditional fiat-based reserves.

Expanding Corporate Investment in Crypto

With its aggressive accumulation strategy, SharpLink is setting a blueprint as Ethereum matures into a global settlement layer. The company is carving out a niche that offers equity investors indirect exposure to ETH via SBET shares.

This approach mirrors Michael Saylor’s strategy with Bitcoin, where many traditional investors gain

BTC exposure primarily through MicroStrategy stock.

In recent months, several public companies have disclosed building substantial positions in other digital assets like XRP, Solana, and Hyperliquid. Even meme coins like Dogecoin, as well as BNB, Litecoin, and newer entrants like Sui, have found their way onto corporate balance sheets.

Essentially, the institutional crypto investment landscape, once dominated by Bitcoin, has become noticeably more diverse.

With Ethereum increasingly regarded as the foundational layer of decentralized finance, SharpLink is betting that ETH’s long-term value will outperform traditional fiat-based reserves.

Expanding Corporate Investment in Crypto

With its aggressive accumulation strategy, SharpLink is setting a blueprint as Ethereum matures into a global settlement layer. The company is carving out a niche that offers equity investors indirect exposure to ETH via SBET shares.

This approach mirrors Michael Saylor’s strategy with Bitcoin, where many traditional investors gain

BTC exposure primarily through MicroStrategy stock.

In recent months, several public companies have disclosed building substantial positions in other digital assets like XRP, Solana, and Hyperliquid. Even meme coins like Dogecoin, as well as BNB, Litecoin, and newer entrants like Sui, have found their way onto corporate balance sheets.

Essentially, the institutional crypto investment landscape, once dominated by Bitcoin, has become noticeably more diverse.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/521143.html

Previous:天元国际社区:比特币以太坊行情回顾与后期走向分析:8/7

Related Reading

Shiba Inu to $0.01: Expert Dismisses “Impossible” Claim

A popular community figure has pushed back on skeptics who believe Shiba Inu’s potential surge to th...

Novogratz Says Trump’s Executive Order Could Unlock Billions for Bitcoin and Crypto

Galaxy Digital CEO Mike Novogratz believes that the upcoming executive order from Donald Trump could...

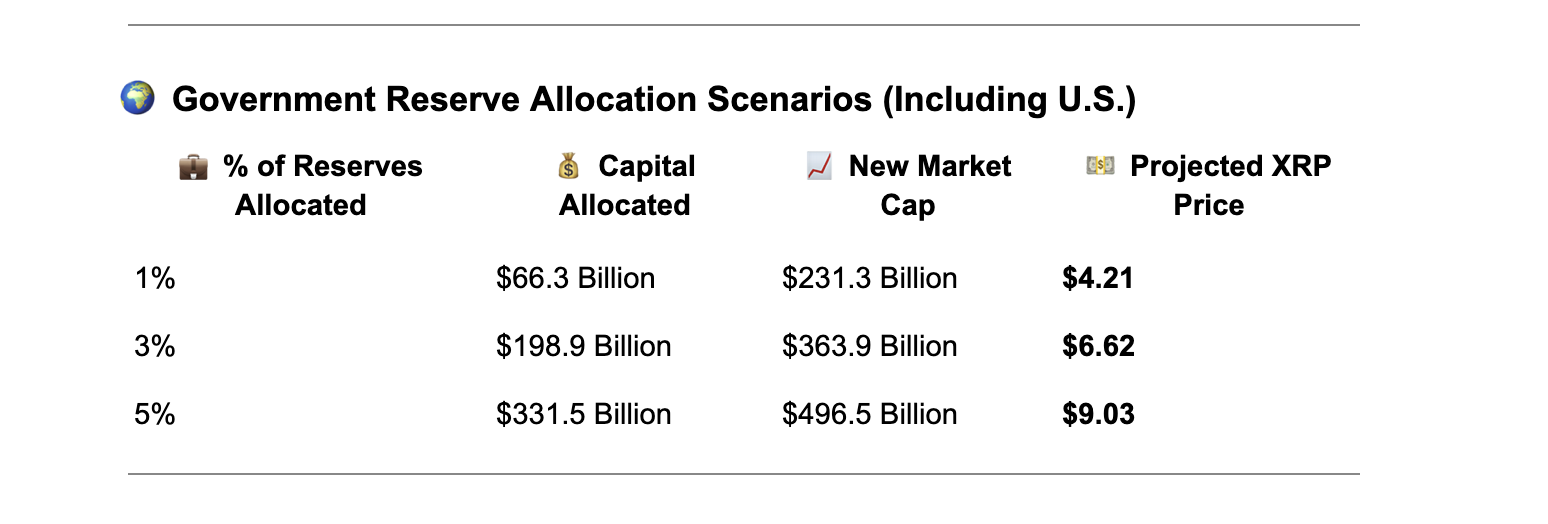

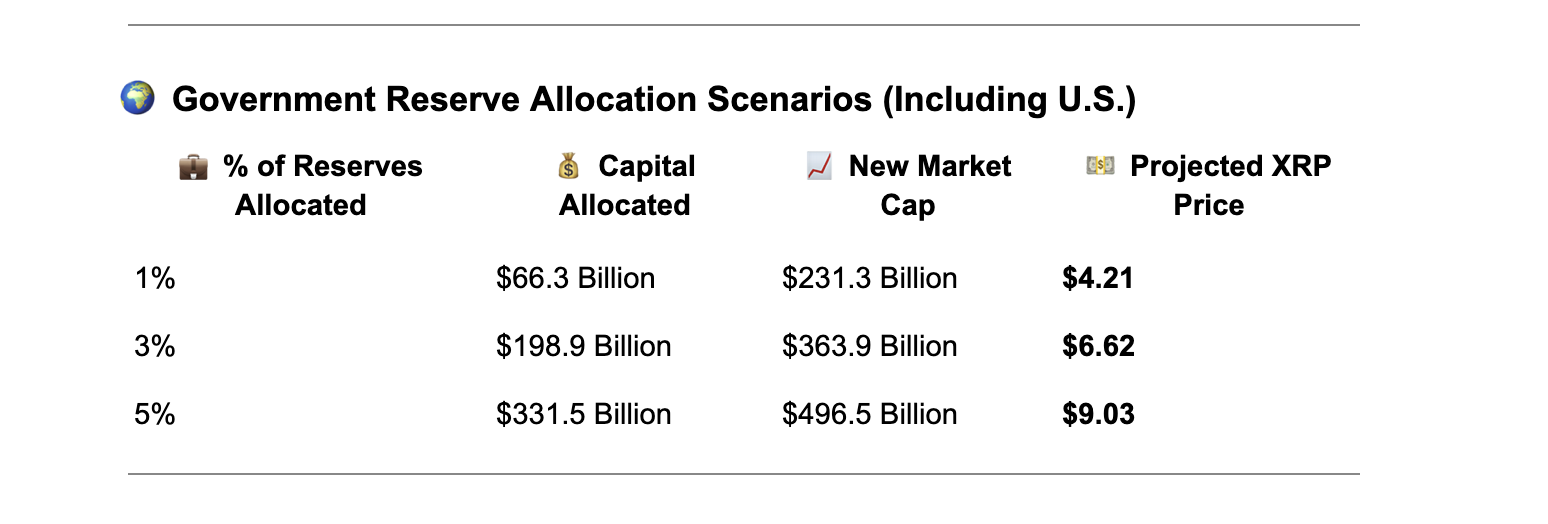

Here Is XRP Price If Governments Hold It as Part of Their Crypto Reserves

New projections show XRP could approach double-digit value if top global economies allocate just 5% ...