Analyst Predicts 2,000% Cardano Rally: ‘Fractal Is Too Clean To Ignore’

Crypto-market commentator “Quantum Ascend” devoted a 8 June video to a single idea: the price structure that once catapulted Ethereum Classic to its bull-market peak is about to do the same for Cardano—and could deliver a twenty-fold advance if history “rhymes rather than repeats.”

Speaking to his followers, the analyst opened by noting that ADA’s weekly chart “looks so similar” to the multi-year pattern that preceded Ethereum Classic’s vertical move in early 2021. “They have the same market makers,” he asserted, pointing out that Cardano founder Charles Hoskinson had early involvement in both projects. “It’s almost like a cheat code for this thing.”

Cardano Set For 2,000% Explosion

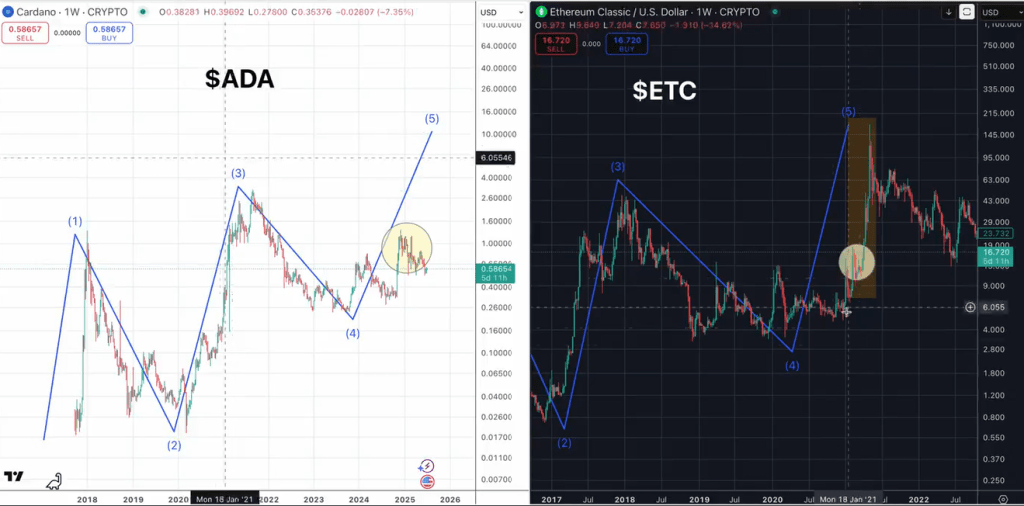

To illustrate the parallel, Quantum Ascend overlaid the two assets’ Elliott-wave counts. In his reading, Ethereum Classic completed its fifth impulsive wave during the last cycle, whereas Cardano is “waiting on that fifth wave” after a prolonged flag-shaped consolidation.

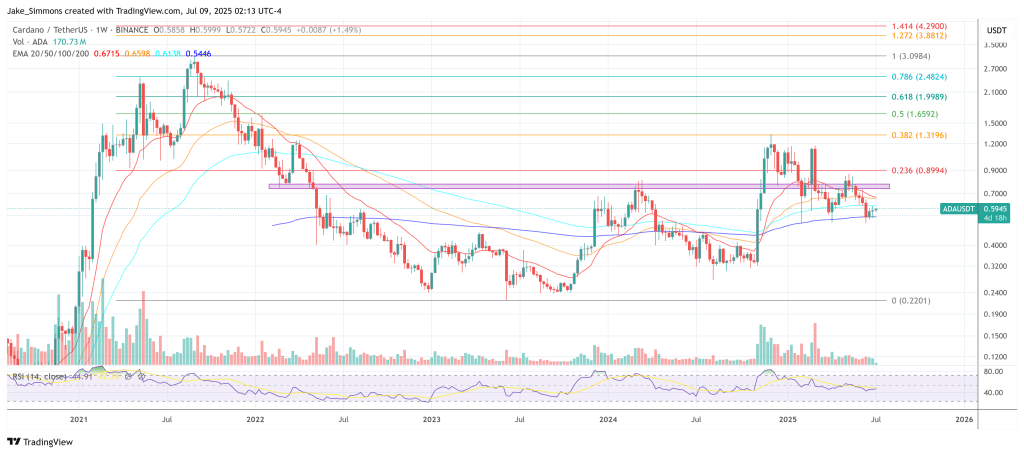

He then dropped a Fibonacci retracement on Ethereum Classic’s 2020–21 third-to-fourth-wave segment, showing the final thrust topped out “just shy of the 2.36”—and repeated the exercise on Cardano’s current structure , which has advanced to the same proportional level. “Come on, it’s not perfect,” he conceded, “but you guys see how similar these structures are.”

A second Fibonacci projection, stretching Cardano’s initial three-wave span to a full 1.618 extension, points to a conservative target “up around four bucks,” he said. But a more ambitious extrapolation of Ethereum Classic’s 3.618 climax would propel ADA into a zone between roughly 10.67 and 12.55—an area he calls his “primary” and “secondary” objectives.

From the current price such a run would exceed 2,000 percent. “That’s violent,” he remarked after flicking his cursor to the comparative surge on the ETC chart. “Hopefully you can see how clean this is, because I feel really good about Cardano getting up into that $10 level.”

Quantum Ascend argued that the temporal spacing is also lining up. Ethereum Classic’s listing in August 2016 meant its multiyear base completed roughly four and a half years later; Cardano’s analogous base , begun in late 2017, is now of similar duration, though “the whole chart has taken a little bit longer on the consolidation.” For him, that extension merely “loads the spring” for a sharper repricing once last season begins in earnest.

The analyst did allow for interim turbulence. In his scenario, ADA could hit the former all-time-high region around $3.12, “reject back down to $1.67” during a broader market-wide wave-four shake-out, and only then launch into a blow-off toward the upper Fibonacci cluster. Still, even that corrective loop reinforces the fractal : “Over here with Ethereum Classic it got to its last all-time high, rejected, and then went on one more big run.”

Quantifying his own risk appetite, Quantum Ascend told viewers he is “pretty hyped on Cardano” and wants the token “in my portfolio because it is one of my higher-conviction plays for what’s about to happen here.” He concluded by sketching three tiers of price objectives—$4.90 (conservative), $10.67 (primary) and $12.45 (secondary).

Whether altseason’s starting gun fires as cleanly as the fractal implies remains to be seen, but Quantum Ascend’s thesis hinges on a single proposition: when the same market makers move two historically linked assets through mirror-image patterns, ignoring the setup may prove costlier than betting against it.

At press time, ADA traded at $0.59.

Sei Network Unlocks Japan Market After Hitting $626M In TVL

US traders and DeFi fans have turned their eyes to Sei Network (SEI) after its Total Value Locked (T...

Pundit Says XRP’s Rise To $1,000 Will Happen A Lot Sooner Than Anticipated

XRP might be currently trading around $2, but its path to double and four digits may be faster than ...

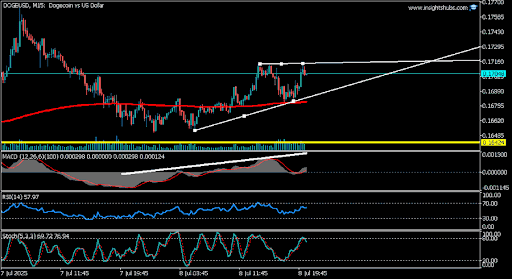

Is Dogecoin Prepping For Takeoff? Fib Reaction And Trend Support Say Yes

Dogecoin may be gearing up for its next breakout. After holding firm near $0.17 on the weekly chart,...