Crypto Bombshell: Developer Claims XRP Could Hit $20,000

A new wave of debate is sweeping through crypto circles as some analysts suggest XRP could someday trade at $20,000 per coin. The price today sits near $2. That means a 10,000× jump from current levels.

According to reports, the idea first took shape in 2022, when game developer and XRP backer Chad Steingraber laid out a plan that leaned on big banks and tokenized assets.

Now, that bold forecast has resurfaced on social platform X, sparking fresh talk about where this digital token might head next.

“The Chad Steingraber Theory” – The Road to a $20K #XRP A Thread

from The Future…

I’m going to tell you a story and I’ll spin it so that all you need is an interest to learn what’s in store for all of us.

Grab a drink, grab a snack and let’s take a ride, shall we?

— Chad Steingraber (@ChadSteingraber) August 18, 2022

Rise Of Tokenized Assets

According to Steingraber, the first step involves issuing stablecoins and central bank digital currencies on the XRP Ledger.

Every time a new token launches there, it would need XRP to settle transactions. That could push up daily demand.

Today, only a handful of tokens sit on the XRP chain, but he sees that growing into the hundreds. If even 100 new coins adopt XRP settlements, demand could climb by billions of dollars each year.

It consists of three components:

1 – Assets built on the XRP Ledger (Stablecoins are the “utility”) 2 – XRP becomes a reserve asset to power the utility 3 – XRP is removed from public supply by institutions

This is how IT WILL.

https://t.co/d7ysY5euXc

— Chad Steingraber (@ChadSteingraber) June 28, 2025

Banks Holding XRP As Gold

Based on reports, the second driver is banks treating XRP like a reserve asset. Instead of just trading it on public exchanges, financial firms would stash XRP in private ledgers to back their own digital currencies.

He points to “many institutions” that have already floated plans to include XRP in their reserve piles. If each of those firms holds hundreds of millions of dollars in XRP, it could remove a large chunk of supply from open markets.

Institutional Absorption Of Supply

Institutional Absorption Of Supply

Here’s where the math gets eye‑popping. XRP’s total supply is capped at 100 billion. But Steingraber says roughly 20 billion tokens remain in public hands after accounting for locks, burns, and lost keys.

If big institutions lock away most of that, circulation could shrink to under 100 million. That would set the stage for a classic supply shock. He even predicts prices could surge from cents to thousands of dollars within hours once companies dive in.

Regulatory And Competition HurdlesDespite the excitement, there are clear roadblocks. XRP is still fighting the US Securities and Exchange Commission in court. A final loss could stall deals or scare off banks. At the same time, rival chains like Ethereum and Solana also host tokenized assets.

Those networks already see billions in daily volume. XRP would need to prove it offers something stronger or faster to win over big players.

A Long Shot With Big IfsThis forecast hinges on three big “ifs”: strong tokenization growth, banks stacking XRP as reserves, and a real supply squeeze on public markets.

If any one of those doesn’t materialize, the $20,000 mark drifts further away. Still, it makes for a gripping story. For now, XRP traders will watch legal filings and ledger activity with fresh eyes, wondering if this bold theory has any chance of coming true.

Featured image from Pixabay, chart from TradingView

Trump Backs Bitcoin in Latest White House Speech – Best Crypto to Buy Before the Next Bull Run

In Friday’s White House press conference, Donald Trump yet again declared his support for Bitcoin, c...

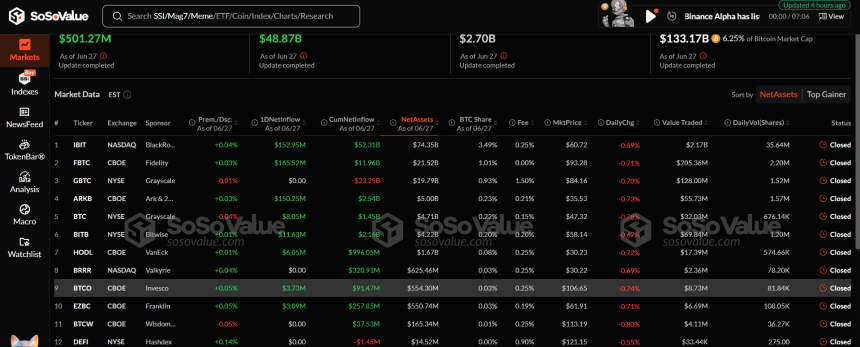

Bitcoin Spot ETFs Register $2 Billion Inflows As Institutional Demand Surges – Details

The US Bitcoin spot ETFs logged over $2 billion in net inflows last week, marking a three-week strea...

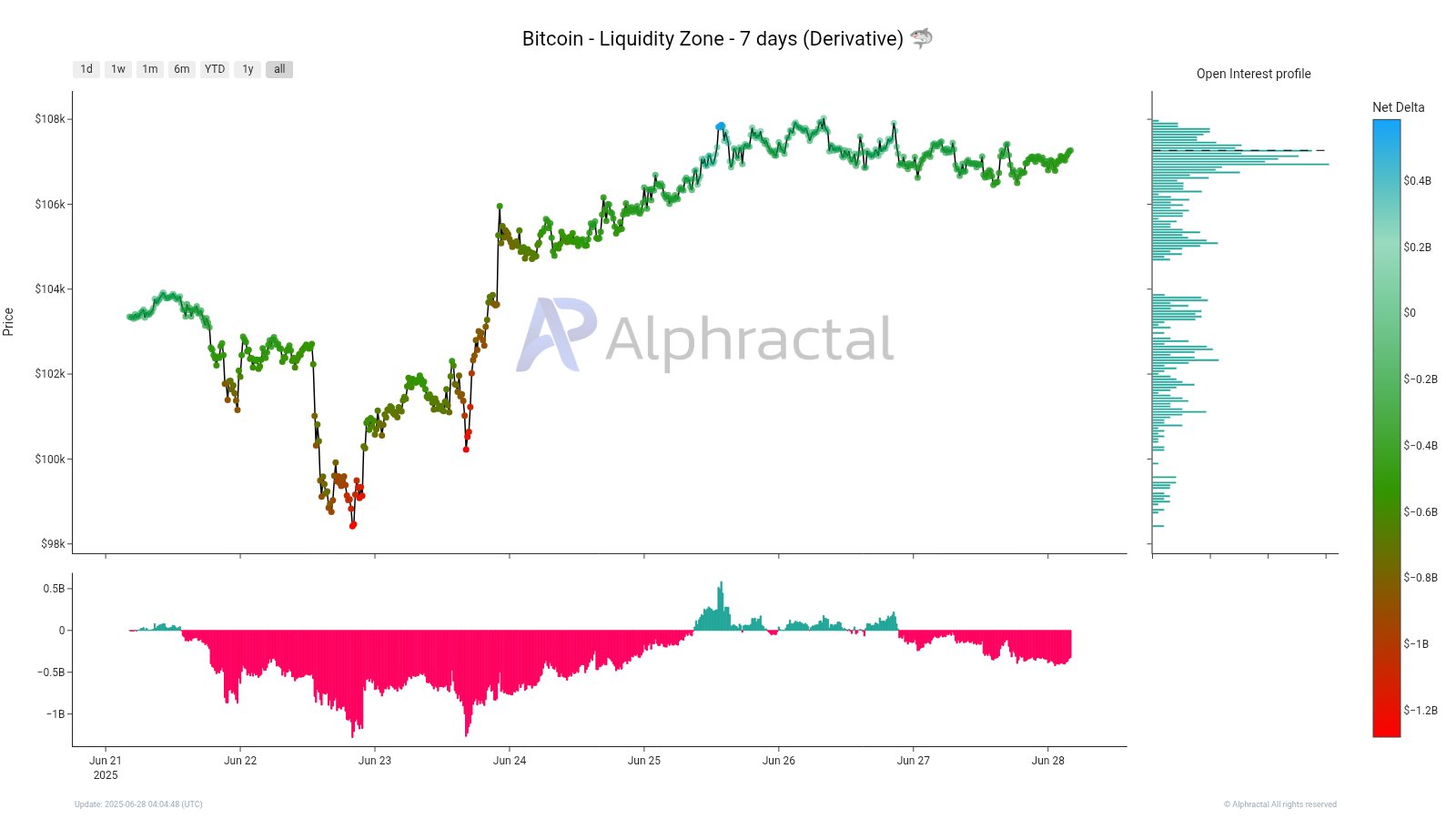

Bitcoin Bears Are Taking Fresh Market Positions, But Are They Safe?

After an eventful start to the week marked by a sharp downward swing below $100,000, the Bitcoin pri...