Bitcoin Net Taker Volume Spikes as Billions Exit Derivatives, What Going On?

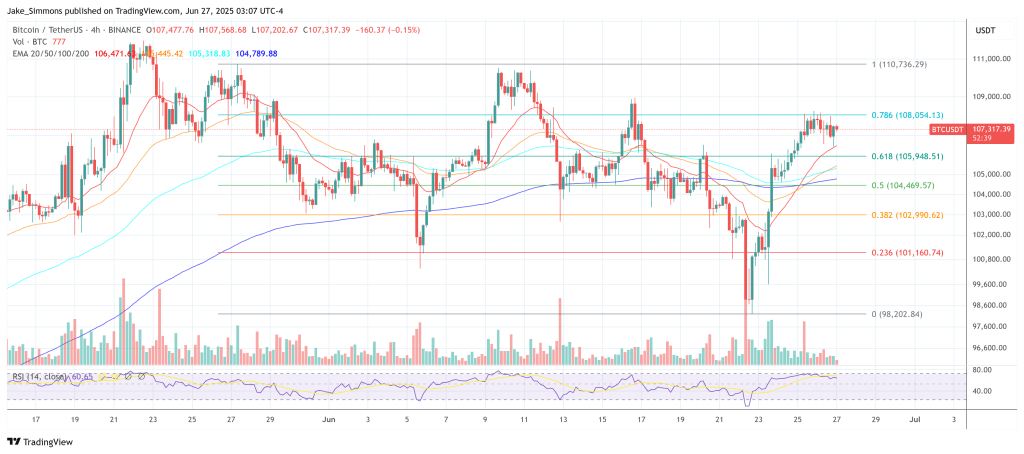

Bitcoin has regained some upward momentum , with its market price currently hovering around $107,155 at the time of writing. This marks a 0.4% decrease in the past 24 hours, and a 4.3% drop below its all-time high of $111,000, set in May.

Despite the rebound, analysts are closely watching for potential shifts in momentum as a number of market indicators and macroeconomic signals suggest a more cautious short-term outlook .

Among the recent developments drawing attention is a sharp rise in Net Taker Volume on Binance, along with significant stablecoin outflows from derivative platforms.

CryptoQuant analyst Amr Taha noted in a recent market commentary that these changes could indicate increased speculative activity. While some traders interpret such surges as bullish signals, they often occur due to short liquidations or sudden retail buying rather than consistent organic demand.

Derivatives Activity and Fed Commentary Fuel Market Caution

On June 24, Binance’s Net Taker Volume crossed $100 million for the first time since early June. This level of activity, according to Taha, can sometimes signal buying momentum but may also point to forced closures of short positions, especially in high-leverage environments.

Taha emphasized that without strong capital inflows to back the movement, these bursts tend to be short-lived. Simultaneously, more than $1.25 billion in stablecoin liquidity has exited derivative exchanges, marking the largest capital outflow from these platforms since May.

These outflows reduce the base for opening new leveraged positions, potentially dampening future market momentum. Taha also pointed to external economic cues, particularly a recent statement by US Federal Reserve Chair Jerome Powell.

During his testimony before Congress, Powell signaled that rate cuts may be on the table depending on upcoming economic conditions. While looser monetary policy is often viewed as favorable for risk assets like Bitcoin, the shift also reflects underlying uncertainty .

The analyst also mentioned that the Swiss Franc, traditionally seen as a safe-haven currency, has also surged against the US dollar, suggesting that some investors are leaning risk-off amid broader macroeconomic developments.

Market Structure Remains Firm, But Momentum Is Slowing

Separately, another CryptoQuant analyst known as Crypto Dan offered a different perspective using a bubble chart model that visualizes trading volume trends across exchanges.

According to Dan, Bitcoin is currently experiencing a “cooling” phase. This implies reduced trading activity without dramatic spikes in volume, often seen as a sign that the market is consolidating rather than overheating.

He noted that while BTC remains close to its all-time high, the path forward may depend on macroeconomic catalysts such as confirmed interest rate cuts or regulatory clarity.

Featured image created with DALL-E, Chart from TradingView

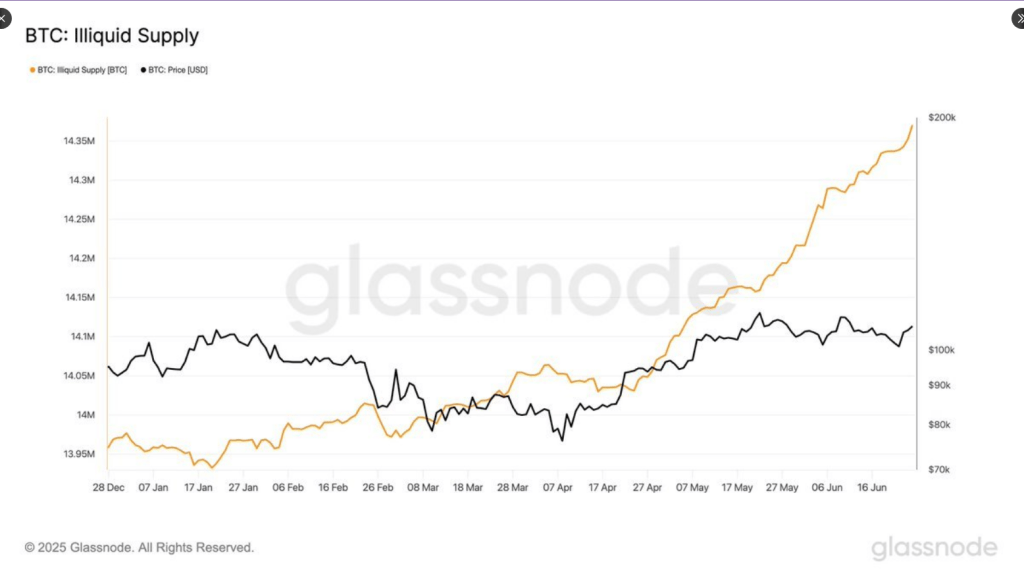

Bitcoin Lockdown: 14 Million BTC Now In Cold Storage As Holders Dig In

According to on-chain analytics firm Glassnode, more than 14 million Bitcoin have sat idle in wallet...

Top Analyst Predicts New Bitcoin Peak Timeline And ‘Double Cycle Blowoff’

Veteran crypto analyst Bob Loukas has delivered a Bitcoin update suggesting that the asset could be ...

XRP Price Declines Back To $2 As Legal Dispute With SEC Continues

The XRP price experienced a significant decline on Thursday following new developments in the ongoin...