Trump’s Truth Social Officialy Files For Bitcoin And Ethereum ETFs With NYSE

Trump Media and Technology Group Corp (TMTG) has officially filed for its second crypto exchange-traded fund (ETF), focusing on Bitcoin (BTC) and Ethereum (ETH), as detailed in a recent filing to the Securities and Exchange Commission (SEC).

Trump Media Files For Second Crypto ETF

If the SEC approves this new investment product, it will trade on NYSE Arca, the electronic division of the New York Stock Exchange known for handling exchange-traded fund transactions.

This latest filing comes just eight days after TMTG submitted a prospectus with the Connecticut Attorney General through its Special Purpose Acquisition Company (SPAC) partner, Yorkville America.

Majority-owned by President Donald Trump, Trump Media is intensifying its efforts to promote financial products linked to blockchain technologies. The company aims to provide the public with regulated investment vehicles that offer exposure to the cryptocurrency market.

Recently, Trump Media announced its ambition to raise $2.4 billion, with the goal of becoming one of the largest corporate holders of Bitcoin. This move appears to be part of a broader strategy to diversify its business and attract a wider array of investors.

By launching multiple crypto-focused ETFs , Trump Media hopes to generate significant interest in its stock, potentially positioning itself as an appealing option for cryptocurrency enthusiasts.

However, with several crypto ETFs already available in the market, there are questions about how much investor interest these funds will garner. The success of the ETFs will likely hinge on their fee structures and how competitive they are compared to existing options.

Bitcoin To Hit $180,000-$250,000

As of now, Bitcoin is trading at $106,000, recovering 3% from a recent drop to $98,000. This volatility is largely attributed to the ongoing conflict between Israel and Iran, which has intensified over the past 12 days, impacting financial markets significantly.

Market analyst known as Mr. Wall Street recently shared his insights on social media platform X (formerly Twitter), reiterating his bullish targets for Bitcoin, which he believes will reach between $180,000 and $250,000 this year despite any external conflict.

Interestingly, Mr. Wall Street noted a significant shift in capital flows, with over $20 billion moving from gold to Bitcoin in the last two weeks alone.

This trend suggests that institutional investors and hedge funds are increasingly viewing Bitcoin as a more reliable store of value compared to gold, given Bitcoin’s fixed supply.

Additionally, Mr. Wall Street pointed out that the over-the-counter (OTC) desks are becoming less liquid, indicating that significant upward movement in Bitcoin’s price could be imminent.

A key indicator, the hash ribbon , recently flashed, signaling that Bitcoin often experiences a 10% correction before rallying by 50-125%. Mr. Wall Street believes that the recent dip to $98,000 constituted this correction, and he anticipates a substantial return on investment from current levels.

Moving forward, the analyst expects “continued noise” from the geopolitical landscape, but he believes that further escalation is unlikely. The recent market dip created a sense of peak fear, which historically precedes significant price breakouts, Mr. Wall Street said.

Featured image from DALL-E, chart from TradingView.com

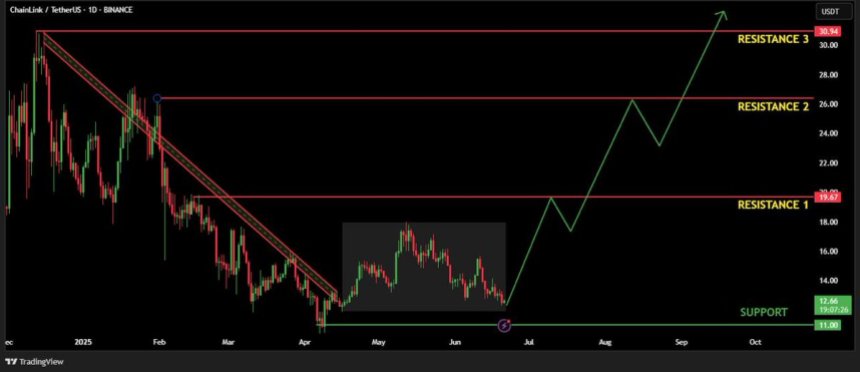

Chainlink Reclaims Key Structure – Quiet Accumulation Could Fuel $25–$30 Surge

Chainlink (LINK) is up 21% from its Sunday lows, gaining momentum in an otherwise uncertain macro an...

Bitcoin Price Could Rally To $110,000 ATH As These Macroeconomic Factors Align

The Bitcoin price surge above $106,000 this week has reignited bullish sentiment across the market, ...

Stablecoins Approach $250 Billion, Anchoring 8% Of Global Crypto

Based on reports, stablecoin issuance has kept climbing for the past 90 days, with billions of dolla...