Bitcoin’s Dominance Could Kill Altseason Dreams, Analyst Warns

According to an analyst on X, Bitcoin’s grip on the market looks too strong for altcoins to break free any time soon. Bitcoin’s price ticked up to around $104,000 after climbing 0.4%. It had dipped briefly to $103,000 but buyers stepped in fast.

That push drove it back toward the $105K mark. At the same time, the US Federal Reserve held interest rates steady, keeping traders on alert for any ripple effects.

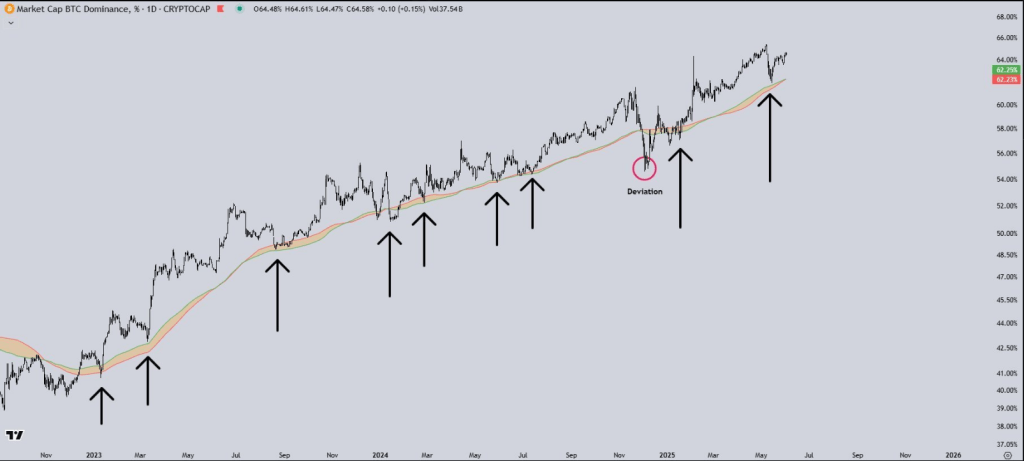

Bull Market Support Band Explained

Based on reports, the Bull Market Support Band sits between two key moving averages. One is a 20‑week simple moving average. The other is a 21‑week exponential moving average.

Together they form a zone that Bitcoin Dominance has used as a springboard all year. When dominance tests that area, it usually bounces higher instead of dropping further.

$BTC.D – As long as the Bitcoin Dominance continues to hold its Bull Market Support Band, there will be no altseason. pic.twitter.com/XCYDyuDxP2

— Luca (@CrypticTrades_) June 19, 2025

Historical Support Tests

Bitcoin Dominance fell from about 56% in June 2024 to 54% in July of that year but found support. It also slipped from 58% down to 56% between late December 2024 and January 2025.

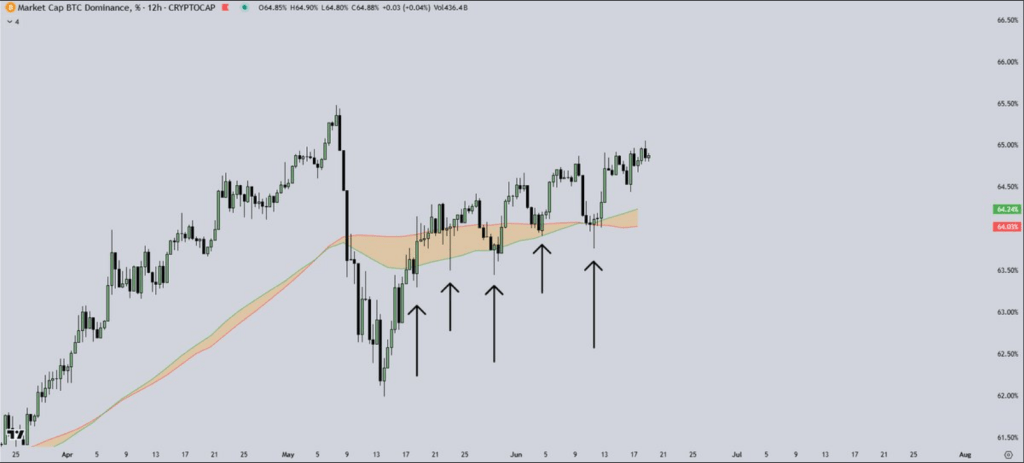

Each time, the support band held firm. More recently, dominance dipped to 61% on May 14 after peaking at 65% on May 7, only to recover to 64% in a matter of days.

$BTC.D – As long as the Bitcoin Dominance continues to hold its Bull Market Support Band, there are no risks of this being a distribution range for $BTC .

pic.twitter.com/GS8r9jNIpB

— Luca (@CrypticTrades_) June 19, 2025

Other experts see a different picture. Bitcoinsensus warns dominance could “fall off a cliff” before any altcoin season kicks off. That view suggests a sudden drop, maybe giving altcoins their moment.

An analyst points to a possible double‑top pattern in dominance. If Bitcoin can’t clear resistance, money might flow into altcoins. But if dominance breaks higher, some believe Bitcoin could aim for a fresh record.

Limitations Of Dominance Metric

Limitations Of Dominance Metric

Dominance only measures Bitcoin’s share of total crypto market cap. It can slip if stablecoins flood in or if new tokens launch, even when altcoins aren’t rallying. And a rise in dominance can mean altcoins are selling off.

Traders should know that moving‑average support lines can fail in choppy markets. A pattern that works for months can break when the climate changes.

In the end, the Bull Market Support Band offers a clear trend line. It shows that Bitcoin is still the favorite for many investors. Yet relying on one technical tool can miss bigger moves driven by real‑world news or fresh blockchain data.

For now, though, Bitcoin’s dominance looks safe—unless something big shifts in the weeks ahead.

Featured image from Imagen, chart from TradingView

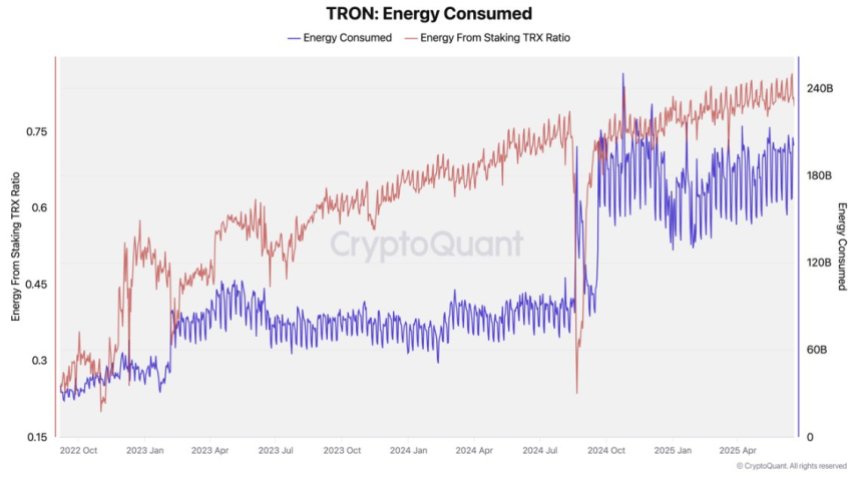

Tron Energy Usage Surges 108% – Smart Contract Activity Accelerates

Tron (TRX) has captured investor attention once again with major developments surrounding its future...

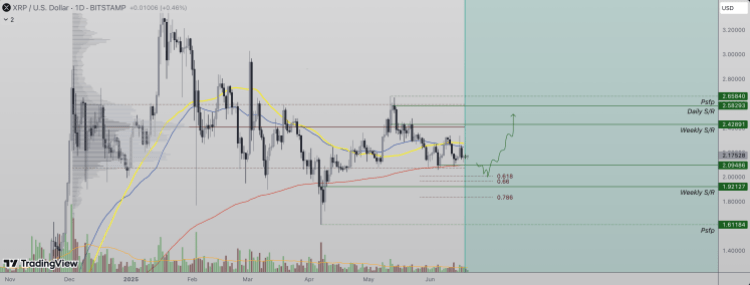

XRP Price Crash Tests Critical Support At $2.1, Will It Break?

After the market crash that sent the Bitcoin price falling toward $100,000, the XRP price also saw a...

BNB Price Breakout Could Trigger ATH Rally Repeat – Is $730 The Next Stop?

Amid the market performance, BNB is attempting to reclaim the $650 level. Some analysts believe that...