Cryptos Yet to Cement Store of Value Status

Cryptocurrencies are not immune to the ripple effects that geopolitical events have on the financial markets.

The latest escalation in tensions between Iran and Israel hit Bitcoin and other cryptocurrencies similar to risk assets.

Geopolitical risks often tend to bring out a herd mentality among investors and it is no different in crypto markets.

The Middle East crisis brings with it a debate on the safe haven status of digital assets into question, with Bitcoin and other riskier assets coming under stress as the war escalates into a wider regional conflict.

This year, cryptos have behaved like risk assets and safe haven bets as well.

During the April sell-off in global markets after US President Donald Trump announced the so-called 'reciprocal tariffs,' hiking import levies to the highest in over a century, cryptos initially fell but then recovered to rise in tandem with gold, a widely popular safe haven asset.

And when stocks recovered after Trump's pause on those tariffs, cryptos surged again in line with risk assets.

However, the Israel-Iran war is showing us a different trading pattern.

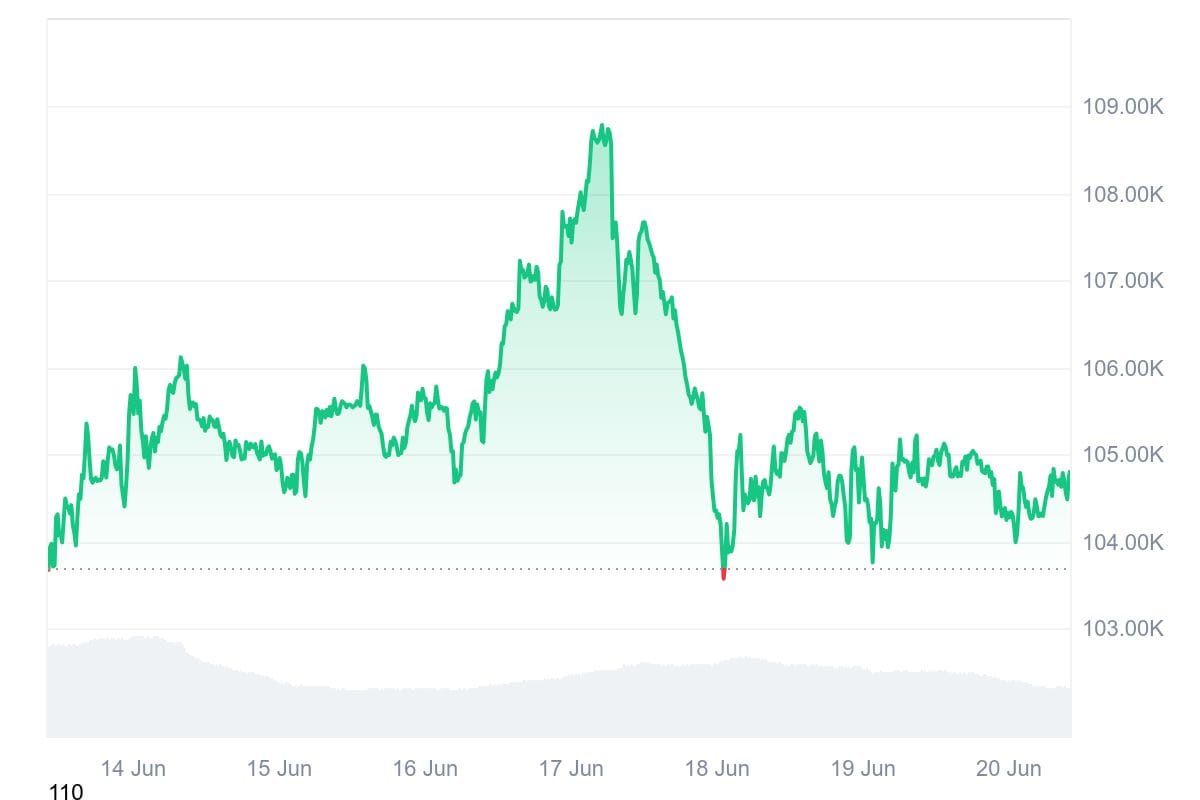

Cryptos have experienced a decline and are now trading as risk assets. Concerns that the conflict could spread to other oil-producing nations and pull the US into war have put markets on edge around the world.

Worries about international trade and skyrocketing oil costs saw the crypto market tumble this week, which is only the beginning of the effects of this unpredictability.

But there is some good news: cryptocurrency prices have begun to recover. Importantly, they managed to ride out past geopolitical shocks, such as the US sanctions after Russia invaded Ukraine in March of 2022.

Keep in mind that geopolitical conflicts can have a major impact on Bitcoin and other digital assets.

In times like these, investors typically flock to tried-and-true safe havens like gold, while the more volatile cryptocurrency market may see brief downturns.

Still, the broader cryptocurrency industry has proven to be quite resilient when confronted with geopolitical events. Although market fluctuations are common, the market has a history of quickly regaining its footing during downturns.

The possible reason for the longevity of cryptocurrencies is their decentralized structure.

Since cryptocurrencies function on decentralized networks, they are not directly affected by geopolitical events, unlike traditional assets that are linked to particular governments or institutions.

While those views seem conflicting, the resilience of cryptos is a marked difference now.

In previous years, such events have had a bigger impact on cryptos, and this time around digital assets have shown some resistance to a deeper sell-off.

The other advantage of cryptos during a crisis is the shift in investors' sentiment towards fiat currencies versus cryptos.

During times of crisis, investors' actions can change drastically. Many seek ways to protect their assets as tensions rise, and this has led to a surge in interest in accepting cryptocurrency as payment.

Digital money's decentralized structure instils confidence while letting consumers avoid the potentially vulnerable traditional banking system.

The unpredictable nature of cryptocurrency prices, however, is not without its drawbacks.

Although many are interested in using cryptocurrency as a payment method, the current market volatility caused by the Israel-Iran crisis shows that these currencies aren't immune to the dangers associated with geopolitical unpredictability.

Cryptocurrencies and global stability will continue to have a complex relationship as geopolitical events impact the financial sector.

The intrinsic volatility of these digital assets makes them more like risky assets than traditional havens, even though they may have certain safe-haven attributes.

It is crucial for crypto businesses to understand how these tensions impact market dynamics. They can protect themselves from the effects of geopolitical instability by implementing effective risk management strategies and maintaining a high level of knowledge.

For now, cryptos are yet to ascertain their status as safe havens during extreme geopolitical events.

Global Uncertainty Puts Cryptos in a Tight Spot

Amid global rate pivots and economic ambiguity, crypto investors find little clarity. Central bank c...

Blockcast 67 | The Intersection of AI & Blockchain Technology ft. Node Foundry

The co-founders discuss Node Foundry's revenue models, market strategies, and their focus on "helpin...

Semler Scientific Appoints Bitcoin Strategist, Sets Target for 105,000 BTC by 2027

Healthcare company plans aggressive Bitcoin accumulation strategy with new director overseeing treas...