Is RAY Price Up for Another Rally After a 600% Volume Surge?

The post Is RAY Price Up for Another Rally After a 600% Volume Surge? appeared first on Coinpedia Fintech News

Raydium is gaining renewed investor interest, all thanks to its strong fundamentals. As per recent stats, Raydium boasts a TVL of $1.86 billion and an impressive annual revenue of $655.9 million. What has caught the attention of many is that its capital efficiency metrics shine, it holds a Revenue/Market Cap ratio of 19.2% and TVL/Market Cap of 2.84x.

Moreover, with $67.2 million (11.9%) staked, investor conviction appears to be stout. As RAY’s price experiences a sharp intraday rebound, traders are closely watching to see whether this surge signals a broader recovery or short-term volatility. Join me as I derive the Raydium (RAY) price analysis for the near term.

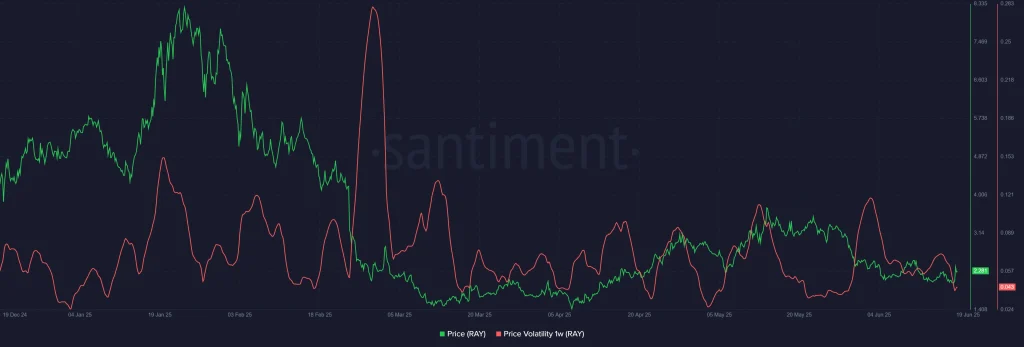

RAY Price vs Volatility: Weekly Comparison

Recalling numbers from the recent past, as of April 30, 2025, RAY traded at $2.84 with a 1-week price volatility of 0.0609. Fast forward to today, that is, June 19, RAY’s current price stands at $2.27, with a 20% decline from the earlier high.

However, despite this drawdown, the token has stabilized and rebounded nearly 10% in the past 24 hours, while weekly gains sit at a modest +1.05%. Volatility seems to have compressed slightly, as reflected in the tighter Bollinger Bands on the chart. This indicates a reduction in price swings and a potential build-up for a new directional move.

RAY Price Analysis: Bullish Break or Temporary Spike?

RAY’s recent price surge has injected fresh momentum into its price structure. The 4-hour chart reveals a breakout above the midline of the Bollinger Bands in 20 SMA at $2.15, suggesting bullish sentiment is taking hold. Price action pushed through resistance at $2.10 and briefly tested $2.64 before pulling back.

At present, the token is trading at $2.27, holding above key short-term support at $2.10. The 10% daily spike was catalysed by a 609% surge in intraday trading volume, which tallied to $401.19 million. A decisive breakout and close above $2.526 could pave the way for a further push toward the target at $2.854. The RSI stands at 58.34, hovering just below overbought territory, implying room for additional upside while still allowing caution for volatility.

Also read our Raydium (RAY) Price Prediction 2025, 2026-2030!

FAQs

A sharp uptick in volume and breakout above $2.10 support likely led to short-covering and fresh buying, pushing RAY up 9.9% in 24 hours.

It depends on whether RAY can close above $2.526 resistance with sustained volume. Otherwise, a retest of $2.10 support is possible.

Key levels include support at $2.10, resistance at $2.526, and a breakout target of $2.854.

Story (IP) Price Plunges While Trading Volume Spikes Over 200%; What’s Going On?

The post Story (IP) Price Plunges While Trading Volume Spikes Over 200%; What’s Going On? appeared f...

Is RXS the Best Low-Cap Bet for the 2025 Bull Market?

The post Is RXS the Best Low-Cap Bet for the 2025 Bull Market? appeared first on Coinpedia Fintech N...

Is Ruvi AI (RUVI) the New Ripple (XRP)? Experts Say Its Audited Token Might Reach The Charts Heights This Year

The post Is Ruvi AI (RUVI) the New Ripple (XRP)? Experts Say Its Audited Token Might Reach The Chart...