Amid Bitcoin Hype, Seasoned Trader Predicts Sudden Drop To This Level

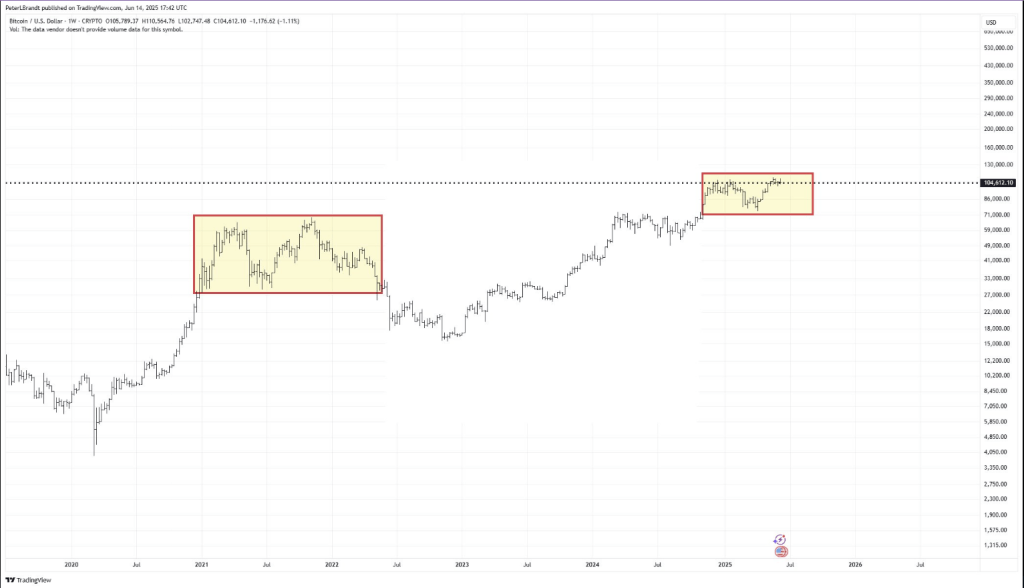

Bitcoin is at a crossroads again. Prices have been bouncing between $61,000 and $104,000 for about seven months. That range looks a lot like the $31,000–$64,000 sideways move before the sharp drop in early 2022. Traders and analysts are split over whether history is about to repeat itself or if fresh demand will keep Bitcoin aloft.

Price Stuck In Familiar Range

According to reports, Bitcoin’s stretch from $61k to $104k mirrors the 2020–2021 “distribution zone” when it traded between $31,000 and $64,000 for nearly a year. Back then, the slide came fast: Bitcoin peaked around $69,000 in November 2021, then sank to roughly $15,600 by November 2022. That was a nearly 78% plunge.

Breakouts Keep Falling Flat

Based on analysis from Michaël van de Poppe, Bitcoin tried and failed to stay above the $106k level this month. His chart showed a quick rejection at that barrier, triggering long‑side liquidations. The price slipped back to the $104k–$105k zone after the failed push higher. Traders see each unsuccessful breakout as a warning sign of distribution.

November 2021 all over again? pic.twitter.com/lIA6QFhD9S

— Peter Brandt (@PeterLBrandt) June 14, 2025

According to veteran trader Peter Brandt, strong fundamentals often shine brightest right before a market top. He pointed out that if today’s setup leads to a similar 78% drop from the $105k band, Bitcoin could fall toward $23,600. His simple math recalls last cycle’s move from around $69k down to $15,500.

Growing Demand Meets Technical BarriersBased on reports of spot ETFs and growing buys by institutions and governments, some believe the floor is firmer now. Huge investment flows into Bitcoin have never been higher. Yet technical hurdles remain. The inability to clear $105k makes some analysts cautious.

Long Term Signals Still Bullish

Long Term Signals Still Bullish

Trader Tardigrade noted that Bitcoin’s 50‑day and 200‑day simple moving averages recently formed a golden cross. In past cycles, that pattern led to gains of 50%, 125%, and 65%. It points to a possible rally if buyers step in around current levels.

What It Means For InvestorsBitcoin’s tug‑of‑war between caution and optimism is clear. On one side, pattern watchers warn of a big drop if support breaks. On the other, strong hands from big players may cushion any slide and spark a rally. Investors should keep an eye on $104k–$105k for signs of weakness or strength.

A break below could open the door to a move toward $23,500. Conversely, a clean break above $106k might signal the next leg up. Regardless, volatility looks set to stay high, so risk management remains key.

Featured image from Imagen, chart from TradingView

Ethereum Whales Feast While Retail Flees—ETH Ocean Just Got Hungrier

In the past month, big Ethereum wallets have been quietly piling on more Ether while small investors...

$8 Dogecoin? Analyst Says You’ll Regret Sleeping On This Chart

Cantonese Cat’s first livestream in weeks, broadcast on 15 June, devoted an extended segment to Doge...

Brace For Impact: Bitcoin Price Primed For Deep Correction Below $90,000

The Bitcoin price, while still holding above $100,000, has not exactly inspired confidence in the cr...