Bitcoin To Face ‘One Last Speed Bump’ Before Rally To $140,000 – Analyst

Bitcoin (BTC) is attempting to reclaim a crucial level as support, which could propel its price to its local range high. A market watcher suggests that this week’s performance could set the tone for the rest of the month.

Bitcoin Retest Eyes Massive Rally

After losing the $106,800 level last week, Bitcoin has been trying to reclaim this crucial area as support. This recently lost level served as a key support for BTC following its rally to a new all-time high (ATH), with its price hovering between $106,800 and $109,700 before the market retracement.

However, the flagship crypto dropped over 8% from its $111,980 high amid last week’s pullback, hitting a 10-day low near the $102,000 support over the weekend. This week, BTC has recovered the $105,000 range and surged above the $106,500 mark before being rejected from the crucial horizontal level on Tuesday morning.

Despite the recent performance, Bitcoin recorded its highest monthly close in history, after ending May at $104,591, and remains within its local range between $103,000 and $110,000.

Analyst Crypto Jelle noted that as the cryptocurrency tries to reclaim the $105,000-$106,000 area, the 1.618 Fibonacci level suggests the next target sits around the $130,000 barrier.

Moreover, he highlighted Bitcoin’s performance this cycle, pointing out that it is displaying a similar performance to its Q4 2024 rally. Notably, the cryptocurrency recorded a trend breakout, followed by a “post-breakout chop” before surging to new highs.

Jelle suggested that Bitcoin is in the second stage, after recently breaking out of its early 2025 downtrend line. He also affirmed that Bitcoin’s Power of 3 (Po3) setup is “still in play” despite the rally pause, targeting the $140,000-$150,000 level during the formation’s price expansion phase.

Based on this formation, the cryptocurrency only has “one last speed bump,” reclaiming the previous ATH levels, before surging to a new high.

BTC’s Direction To Be Determined Soon?

Market watcher Daan Crypto Trades affirmed that the cryptocurrency will likely have an “interesting” week and month ahead, as its sideways move has allowed for “a ton of positions that have built up on both sides.”

According to the trader, this suggests there will be “a lot of fuel when price starts trending and breaks out of this local consolidation.”

Previously, he asserted that BTC tends to set the monthly high or low during the first week of the month, followed by a reversal in the other direction and a trend continuation until the new month.

Based on this, he considers that if Bitcoin doesn’t hold the current levels in the coming days, it could drop below the $100,000 mark, near the $98,000 support zone, before bouncing.

On the contrary, a significant price jump this week could indicate a price retest of the range lows during the rest of the month.

As of this writing, Bitcoin trades at $105,889, a 1% increase in the daily timeframe.

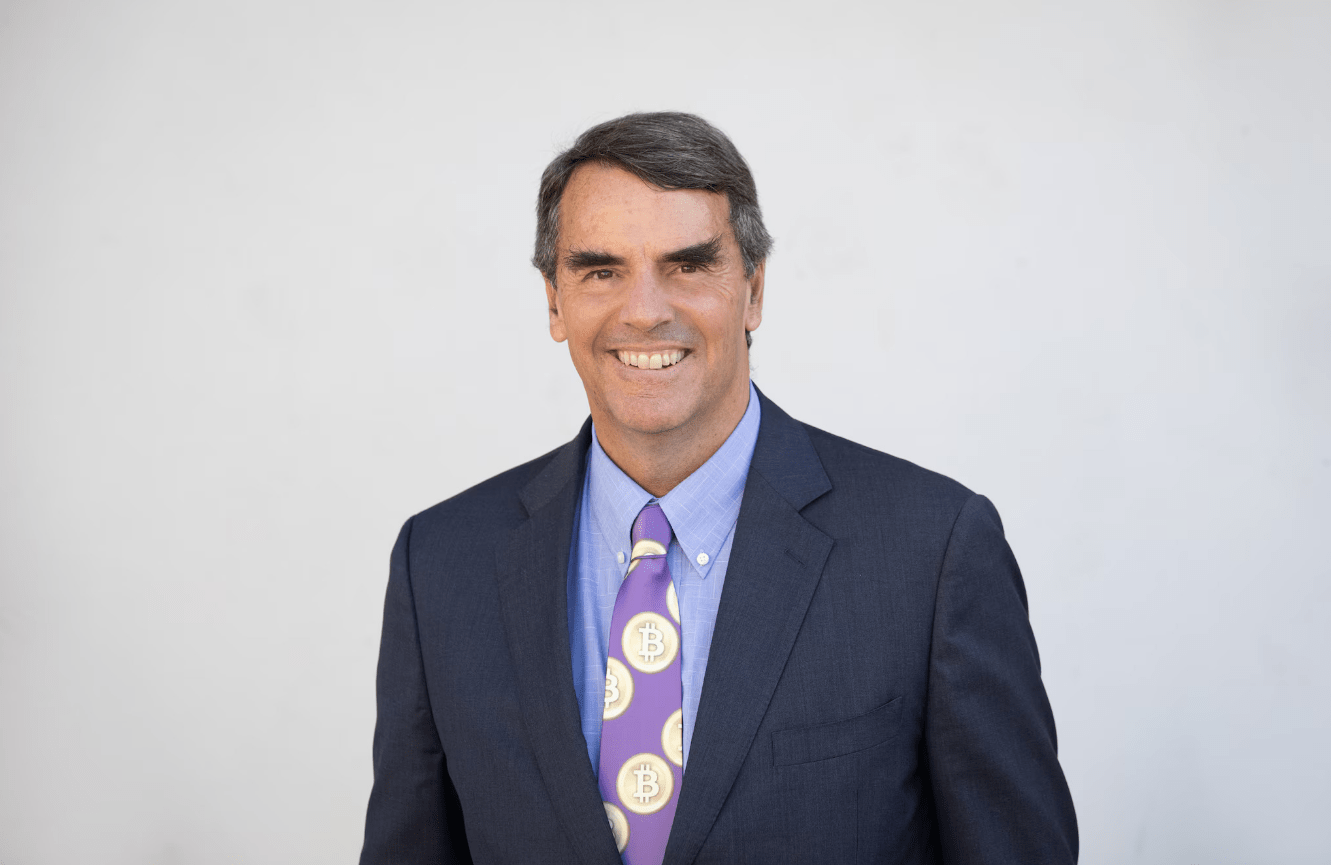

Bitcoin Could Break The Dollar — $250K Prediction Still In Play, Billionaire Says

Tim Draper, a Silicon Valley venture capitalist, has doubled down on his call for Bitcoin to hit $25...

Bullish Signs For Ethereum: Metrics Pointing To Upcoming Breakout

The Ethereum (ETH) price experienced a significant decline on Thursday, falling over 7% and approach...

Bitcoin Cycle Top Is In—$270,000 Delayed Until 2026, Says Analyst

Bitcoin’s majestic 2024-25 ascent may have stalled at the very moment many traders expected an early...