Ethereum Blasts Past $1,900 as On-Chain Signals Point to Institutional Buying

Ethereum has seen renewed upward momentum over the past week, aligning with the broader recovery across the cryptocurrency market. At the time of writing, ETH is trading at $1,989, having climbed 6.4% over the past seven days and registering a 6.7% increase in the last 24 hours.

This rebound comes after a period of relative stagnation and appears to be supported by notable on-chain and market developments that point toward growing investor interest and liquidity activity.

Recent insights from CryptoQuant analysts suggest that a confluence of exchange outflows and large stablecoin minting may be playing a role in Ethereum’s current trajectory.

Institutional Signals: Binance Outflows and Stablecoin Activity

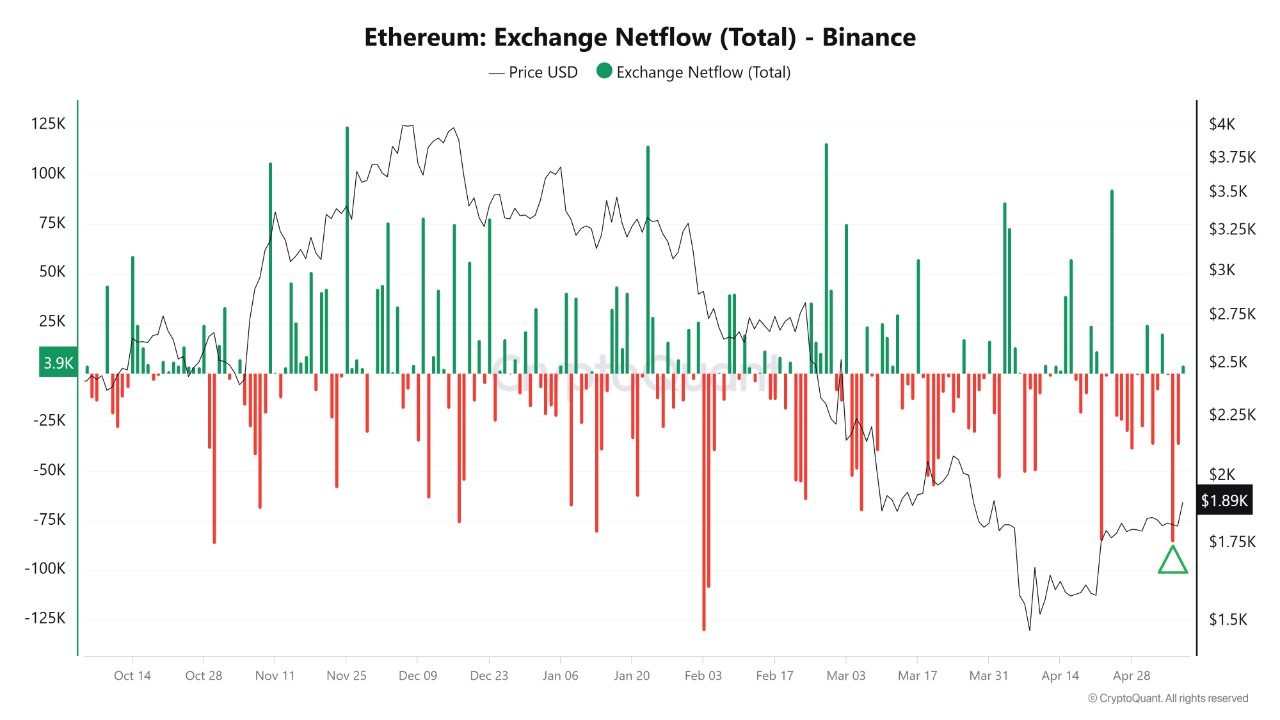

According to analyst Amr Taha, more than 85,000 ETH were withdrawn from Binance in the hours leading up to ETH’s surge above the $1,900 level. This level of outflow is one of the most significant in recent months and tends to indicate reduced sell-side liquidity .

When large amounts of ETH leave exchanges, it typically reflects investor intent to hold or deploy assets elsewhere, decreasing available supply for immediate sale and potentially setting the stage for upward price movements.

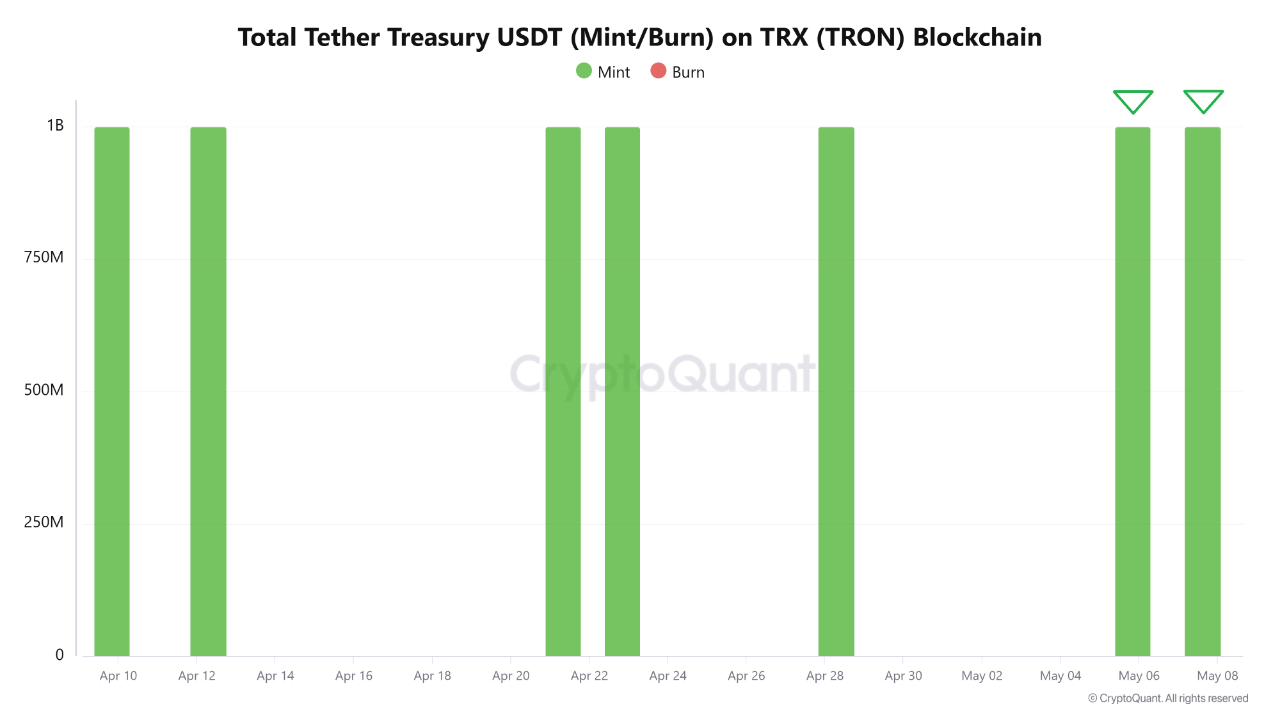

Taha also highlighted that on May 7, Tether Treasury minted $1 billion in USDT on the TRON blockchain. Such events often precede capital deployment into the crypto market, especially from institutional or over-the-counter (OTC) entities.

While the minted USDT does not necessarily enter ETH directly, the timing, coinciding with the ETH price breakout, suggests a strong possibility that some of this liquidity found its way into Ethereum or related trading pairs.

These movements combined point to a bullish setup, with reduced exchange reserves and increased capital inflows forming favorable conditions for continued price appreciation.

Ethereum Liquidity and Exchange Behavior May Shape Short-Term Trajectory

Adding to this narrative, CryptoQuant analyst Darkfost noted a sharp uptick in stablecoin inflows to Binance, with May 6 marking the highest single-day inflow since April.

Stablecoins like USDT and USDC are frequently used as a gateway for crypto trading, and inflows to exchanges often suggest that investors are preparing to make purchases .

This pattern is often observed at the onset of market rallies, as capital parked in stablecoins gets reallocated into more volatile assets such as ETH and BTC.

Darkfost explained that Binance currently holds the largest stablecoin reserves among all major centralized exchanges. Since November 2024, the trend in reserves has steadily increased, highlighting the exchange’s central role in market activity .

A large reserve base signals growing user activity and amplifies the potential impact of new capital entering the market. As this liquidity is gradually deployed, it may act as a catalyst for further price movements across major assets.

Featured image created with DALL-E, Chart from TradingView

Sovereigns Are Buying Billions Of Bitcoin, Says Anthony Scaramucci

Bitcoin blasted back through the psychologically charged $100,000 threshold for only the second time...

XRP Analyst Marks XDC For 3,350% Take-Off As Bullish Metrics Emerge

XRP analyst Egrag Crypto, who is well-known for offering bullish predictions about the altcoin, has ...

Chainlink Holds Strong At $15.29 Support – Is A New Breakout Imminent?

Chainlink (LINK) continues to showcase resilience, holding firm within a well-established uptrend as...