Bitcoin Inflows Overtake Gold as U.S. ETF Investors Realign Portfolios in 2025

- Bitcoin ETFs saw higher inflows than gold despite lower returns in 2025.

- U.S. equity ETFs attracted strong inflows despite posting negative YTD performance.

- Short-term bond ETFs gained traction as investors sought safety amid market uncertainty.

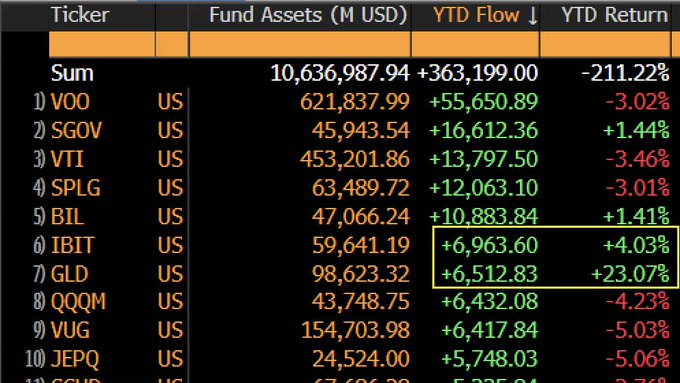

Investor activity in U.S.-listed exchange-traded funds (ETFs) displays changing patterns in 2025, as total year-to-date (YTD) inflows reached $363.2 billion across funds managing $10.64 trillion in assets.

The standout observation comes from the digital asset segment, where the BlackRock iShares Bitcoin Trust (IBIT) has drawn in $6.96 billion so far this year. This total surpasses the $6.51 billion in inflows recorded by SPDR Gold Shares (GLD), the leading gold ETF.

The difference in investor behavior is particularly noteworthy given GLD’s 23.07% YTD return compared to IBIT’s 4.03%. The inflow data suggests that despite gold ’s outperformance, a growing portion of capital continues to be directed toward Bitcoin-focused products.

Large Equity Allocations Persist Despite Market Pullbacks

The Vanguard S&P 500 ETF (VOO) has recorded the highest inflows of $55.65 billion among all ETFs. This move comes amid a year-to-date return of -3.02%, indicating continued investor commitment to broad-market U.S. equities despite recent underperformance.

Other equity-focused funds like the Invesco QQQM ETF and the Vanguard Growth ETF (VUG) have brought in about $6.4 billion each and another $4 billion has gone into banks and bank stocks. However, both have fallen from value, with YTD decline of -4.23 percent for QQQM and -3.22 percent for VUG.

Source: X

The data points to ongoing interest in long-term exposure to the equity market, even during periods of volatility. Despite negative short-term returns, these flows suggest a preference for passive indexing and large-cap growth positions.

Short-Term Bond Funds Attract Risk-Averse Capital

In the fixed-income space, investors show renewed interest in short-duration Treasury products. The iShares 0-3 Month Treasury Bond ETF (SGOV) collected $16.6 billion in inflows with a 1.44% return, while the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) brought in $10.88 billion and delivered an identical return.

This defensive strategy is consistent with broader market uncertainty, where downside protection remains a priority for some investor classes. The JP Morgan Equity Premium Income ETF (JEPI) a fund that duplicates the option returns of an ETF but without actually using options, also saw $5.75 billion of inflows.

Its YTD return, however, is -5.06%. Investors have been looking for alternative ‘income’ streams, yet, at least, the performance figures suggest that these strategies haven’t met expectations in this cycle.

Polygon and Conduit Introduce Agglayer CDK to Power the Next Generation of Web3 Chains

Polygon Labs, in partnership with Conduit, launched an improved Chain Development Kit (CDK) called A...

Bitcoin Hits $99,000, Indicating Growing Institutional Engagement and Investors’ Confidence

Bitcoin ($BTC) nears $99K with 44.7% volume surge, with rising market cap, and growing institutional...

Edge Matrix, CoLabs Partner to Fortify NFT Creators

The Edge Matrix and CoLabs partnership aims to strengthen non-fungible token (NFT) creators to conve...