Latest Tether Attestation Shows $1B+ Profit in Q1 2025, as Treasury Holdings Near $120B Milestone

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Tether has published its Q1 2025 attestation, revealing strong financial performance despite the crypto market turbulence during the quarter.

According to a

press release

today, the stablecoin giant recorded over $1 billion in operational profit during the first quarter, while its U.S. Treasury holdings neared a historic $120 billion, an all-time high for the company. The figures, verified by global accounting firm BDO, show Tether's increasing dominance.

Tether Sees $1B Profit in Q1 2025

Compared to Q4 2024, the latest figures show a mixed but largely favorable performance. While operational profit stood above $1 billion in Q1 2025, it was significantly lower than the prior quarter's exceptional $6 billion profit.

However, the Q4 2024 total included substantial unrealized gains from Bitcoin and gold, inflating the headline figure. The more modest Q1 result came from Treasury holdings yield, with

gold performance

nearly offsetting crypto market volatility.

Meanwhile, Tether's exposure to U.S. Treasuries continued to grow quarter-over-quarter, climbing from $113 billion in Q4 2024 to nearly $120 billion in Q1 2025.

This represents a consistent push to bolster liquidity and minimize risk through investments in short-term government debt. The company now sits among the world's top holders of U.S. Treasuries, using this portfolio to maintain the stability of its flagship token, USD₮.

Slower Figures But Robust Operational Condition

Notable, total assets as of March 31, 2025, stood at roughly $149.3 billion, with liabilities amounting to $143.7 billion, leaving a surplus of nearly $5.6 billion in excess reserves.

This figure, though lower than the $7 billion buffer reported at the end of Q4 2024, still shows strong risk management. The slight dip may be attributable to asset reallocation and changing market conditions but does not suggest a deterioration in financial health.

In addition,

USD₮ issuance increased

by about $7 billion during the quarter, a slower pace compared to the $23 billion issued in Q4 2024. However, the number of active user wallets grew by 46 million, a 13% quarter-over-quarter rise, indicating ongoing adoption and confidence in Tether's stability.

Tether's total liabilities continue to be nearly entirely tied to digital tokens issued. Importantly, this confirms the company's commitment to maintaining a fully reserved model.

Specifically, the firm's reserves have consistently been backed by cash and cash equivalents at a high ratio, with the remainder spread across gold, Bitcoin, and proprietary investments not included in token backing.

Further, the company has now allocated more than $2 billion to emerging sectors like renewable energy, artificial intelligence, and data infrastructure. Notably, the Q1 2025 report also marked Tether's first under

regulatory oversight in El Salvador

.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/503405.html

Related Reading

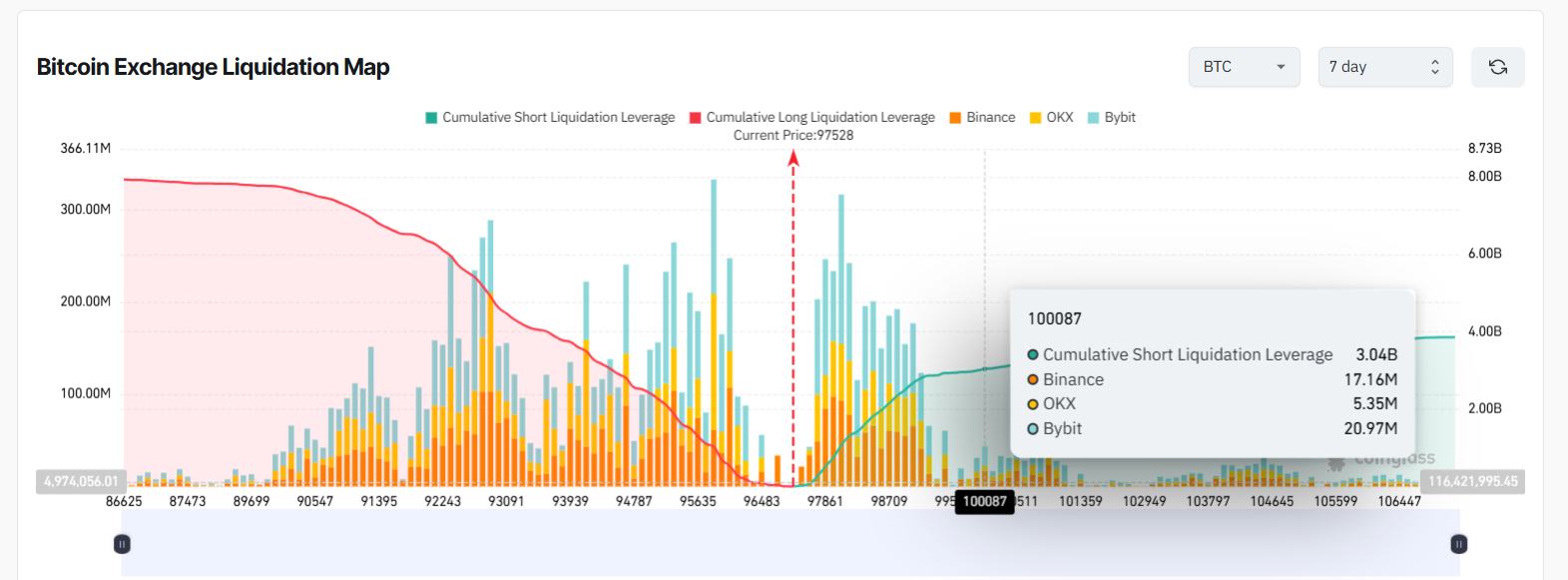

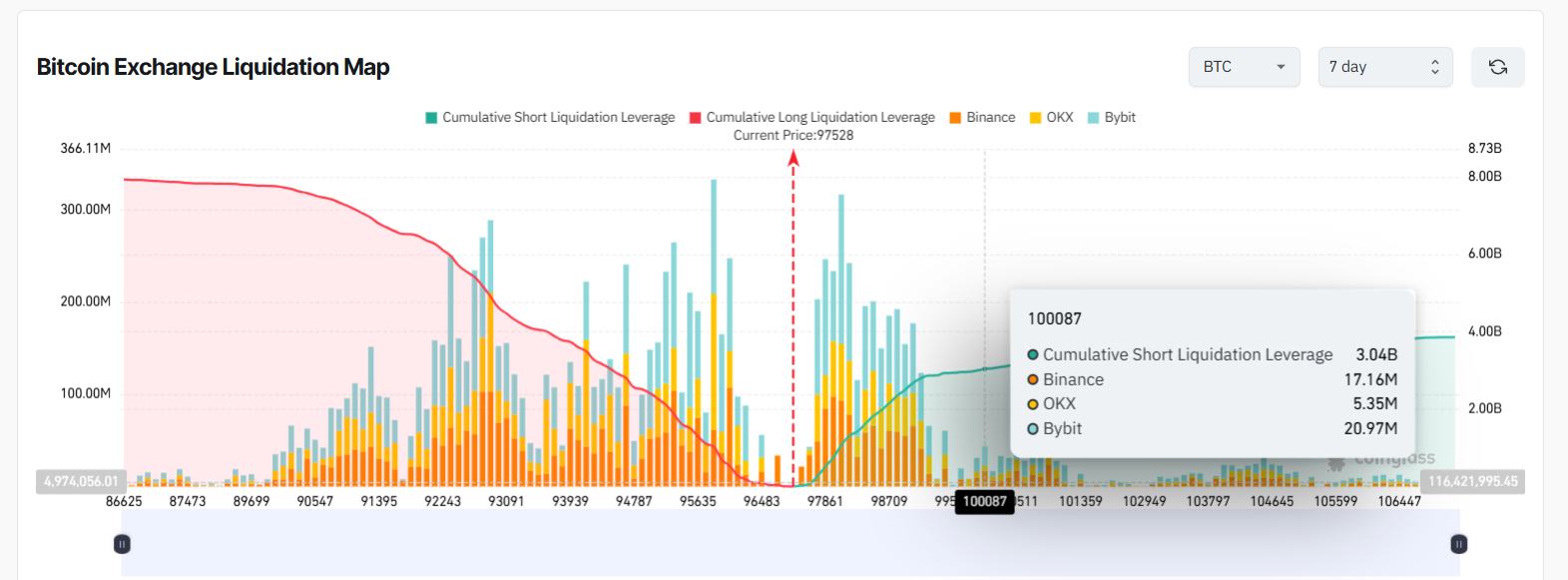

Over $3B in Bitcoin Shorts Set for Liquidation at $100K: Details

With bullish momentum now dominating the Bitcoin market, those betting against the uptrend are at ri...

Goldman Sachs Ramps Up Crypto Exposure, Eyes Tokenization Opportunities

Goldman Sachs is intensifying its involvement in the digital asset space, according to its head of d...

Bitcoin Dominance Hits New 4-Year Peak: Here’s What This Means for the Altcoin Season

Bitcoin dominance has claimed a high last seen in the previous bull run, leading to discussions arou...