Bitcoin Whales Realize Over $343 Million in Profits as Price Surges Above $94,000

- Bitcoin whales realized $343M in profits as BTC surged past $94K in April 2025.

- Active addresses declined despite Bitcoin’s price rise, signaling weaker network growth.

- Bitcoin exchange outflows dominated inflows, reflecting strong investor accumulation trends.

Bitcoin long-term holder whales recorded a major wave of realized profits as the cryptocurrency’s price crossed the $94,000 mark. Data from CryptoQuant indicates that on April 23, 2025, long-term whales realized $343.732 million in profits, coinciding with Bitcoin’s closing price of approximately $93,715.

The chart provided by CryptoQuant shows that realized profits were relatively muted in late March and early April. From April 6 to April 10, realized profits turned negative as Bitcoin’s price experienced volatility, falling below $80,000.

However, by mid-April, realized profits began trending upward alongside a steady price recovery. Bitcoin’s price climbed from around $76,000 on April 17 to over $93,000 by April 23, allowing long-term holders to realize gains strategically during the rally.

This profit-taking behavior highlights increased market activity among major holders as Bitcoin approached new highs for the year. Realized profit spikes are often monitored for indications of distribution phases, which can contribute to short-term volatility if major holders reduce their positions during periods of strength.

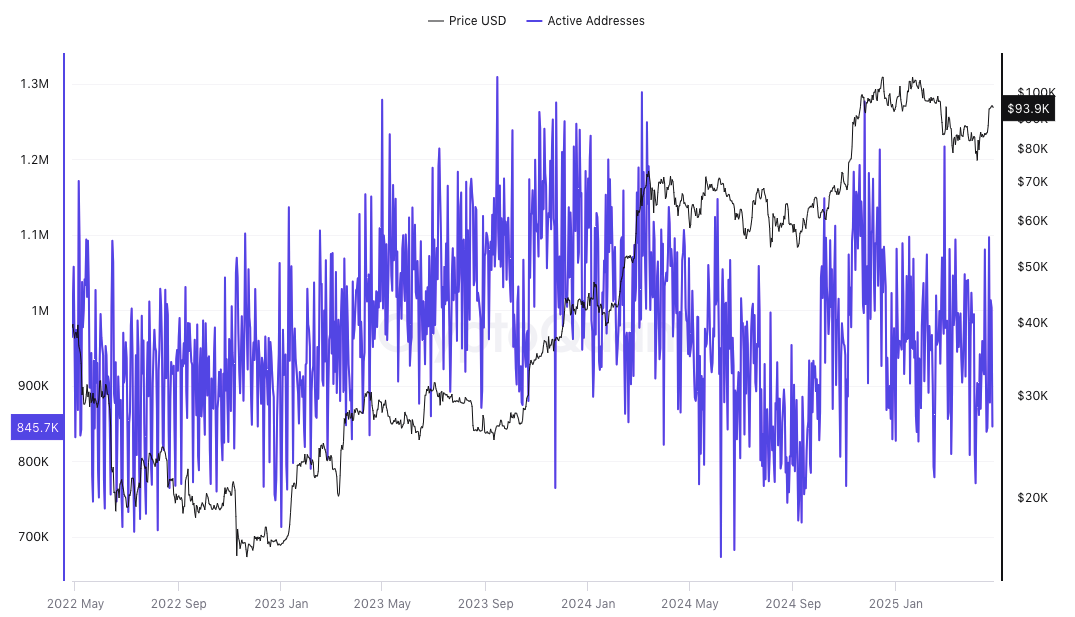

Active Address Volatility Signals Divergence from Price Growth

While Bitcoin’s price has risen since mid-2022, network activity measured by active addresses has not grown consistently. According to CryptoQuant’s chart, active Bitcoin addresses fluctuated between 800,000 and 1.2 million across the observed period.

During early 2023, even as Bitcoin’s price remained below $30,000, active address counts stayed relatively high, signaling persistent network interaction during a market bottom. However, as Bitcoin advanced through late 2023 and into 2024, nearing a peak of approximately $100,000, active address counts did not increase in proportion to the price movement.

By April 2025, with Bitcoin trading near $93,900, active address activity has declined compared to previous periods of volatility. This divergence between network engagement and price strength suggests that a broad expansion in network participation may not fully support recent price increases.

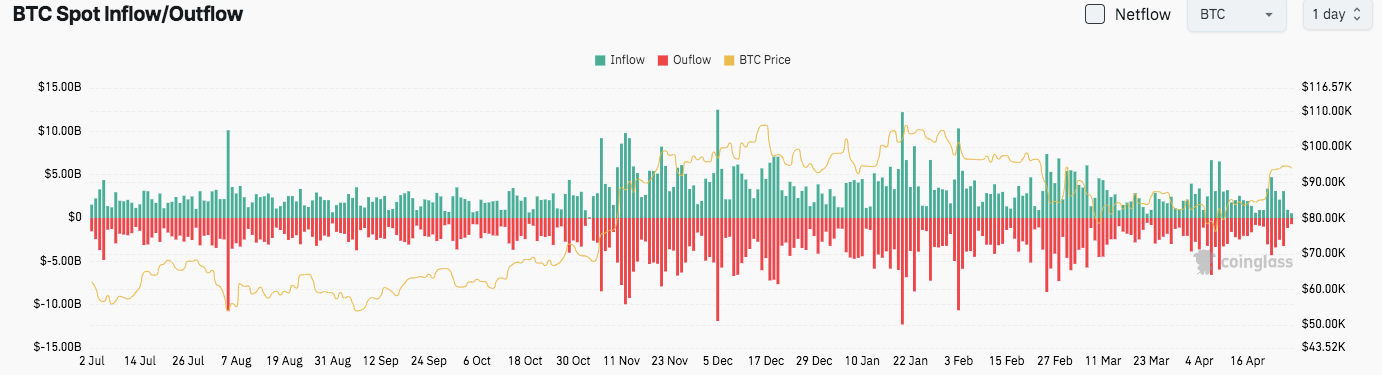

Exchange Flow Trends Reflect Accumulation Behavior

The statistics of Bitcoin inflow and outflow for Coinglass from July 2023 to April 2025 reflect outflow to be massively higher than the inflow. This time was characterized by more investors’ liquidity outflows than inflows, which indicated accumulation volumes.

The fluctuations show major influxes at intervals, especially during early August and December. This situation is most often linked to the period known as trading, which usually occurs when prices are volatile.

The rising yellow line on Coinglass’s chart shows that from mid-October 2023 through March 2024, Bitcoin’s price has gone up from approximately $30,000 to above the $100,000 mark. Therefore, it can also be inferred that even though accumulation often helped to increase Bitcoin’s price during this period further, it was not a major contributing factor.

Specifically, even up to the end of April 2025, Bitcoin was well above $90,000. Inflows and outflows have leveled off in the past weeks, suggesting that rapid accumulation or distribution has slowed down. Nevertheless, sustained net outflow over a longer time reflects investors’ reluctance to keep Bitcoin in an exchange and prefer keeping it in a cold wallet.

Altcoin Market Shows Similar Bottom Signal Seen in 2019: Michaël van de Poppe

Michaël van de Poppe reported that the altcoin market has displayed an important historical indicato...

TOKEN2049 Dubai Hits 15,000-Ticket Sell-Out – Largest Crypto Gathering of 2025

TOKEN2049 Dubai sells out with 15,000 attendees, featuring leaders like CZ and Eric Trump, marking t...

Crypto Whale Buys Massive Amount of $BTC and $ETH in OTC Transfer via Wintermute

A crypto whale has recently purchased 30K Ethereum ($ETH) and 600 Bitcoin ($BTC) worth $110M via the...