Can Dogecoin Realistically Reach $3? Analyst Weighs In

In a broadcast on X, independent market analyst Kevin (@Kev_Capital_TA) dissected the perennial retail question that resurfaces every bull cycle: can Dogecoin plausibly climb to the psychologically charged level of $3 per coin?

From the outset Kevin resisted the audience’s invitation to dispense the kind of sensationalist price targets that animate algorithm-curated social feeds. “Can it? Yeah, it can,” he acknowledged , before striking the cautionary tone that would frame the rest of the discussion:

“It’s really hard to say. I know that the popular thing to do, and it’ll probably get me more clicks and more engagement, is to create altcoin price prediction videos, but the reality is I don’t want to do that, because it’s impossible to do.”

How Dogecoin Could Reach $3

Kevin anchored his argument in macro fundamentals rather than chart-pattern wish-casting. If the Federal Reserve executes the dual rate cuts he expects in June and July — “there’s definitely rate cuts coming,” he asserted — and if loose monetary conditions send Bitcoin into the $220,000 to $250,000 range , then, in his view, “Doge can get to there.”

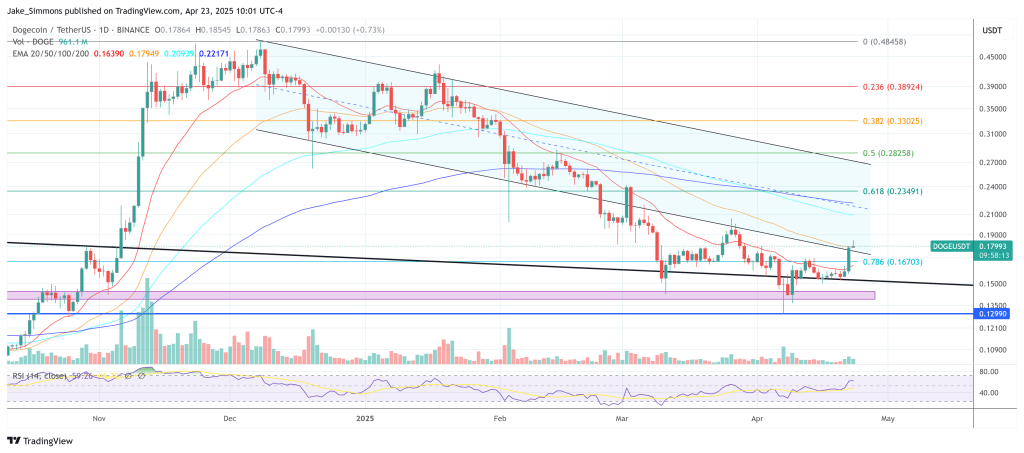

By “there,” Kevin was referring not merely to a return to the 2021 all-time high of roughly $0.74, but potentially to a Fibonacci-extension level frequently eyed by technical traders. “Dogecoin has hit in both cycles the 1.618 fib. The 1.618 fib is at $3.94,” he reminded listeners, adding that the level has a “100 percent hit rate of being hit in each bull market.”

Yet the analyst was equally emphatic that the inverse scenario — a tamer Bitcoin advance to the $120,000 to $130,000 area amid restrained policy easing — would cap Dogecoin near “previous all-time highs or $1.” The takeaway, Kevin insisted, is that alt-coins “are oscillators to Bitcoin [and] to monetary policy,” and that any deterministic forecast detached from macro conditions is a “fake answer.”

For market participants hoping to time an exit, Kevin advocated a sentiment-driven framework instead of fixating on absolute price points. “When sentiment gets into a euphoric stage and you have indicators on higher time frames super-overheated, you need to be taking profits.” He pointed to December 2024, when he reportedly trimmed spot holdings at $0.40, as an object lesson in disciplined risk reduction.

Asked whether a $3 print would defy historical precedent, Kevin invoked pattern repetition rather than probability theory. “To deny that it can happen would be stupid,” he said, but reiterated that the market will ultimately adjudicate. “My philosophy… is you track it as it comes.”

The Federal Open Market Committee ’s next meeting on 12 June could provide the first empirical test of the rate-cut thesis underpinning the bullish-case scenario. Until then, traders eyeing a parabolic move in Dogecoin may find themselves tethered less to price targets than to the shifting tides of monetary policy, Bitcoin dominance and retail sentiment — the very trifecta Kevin argues will dictate whether the most famous Shiba Inu in finance can make the leap from cents to dollars.

At press time, DOGE traded at $0.17993.

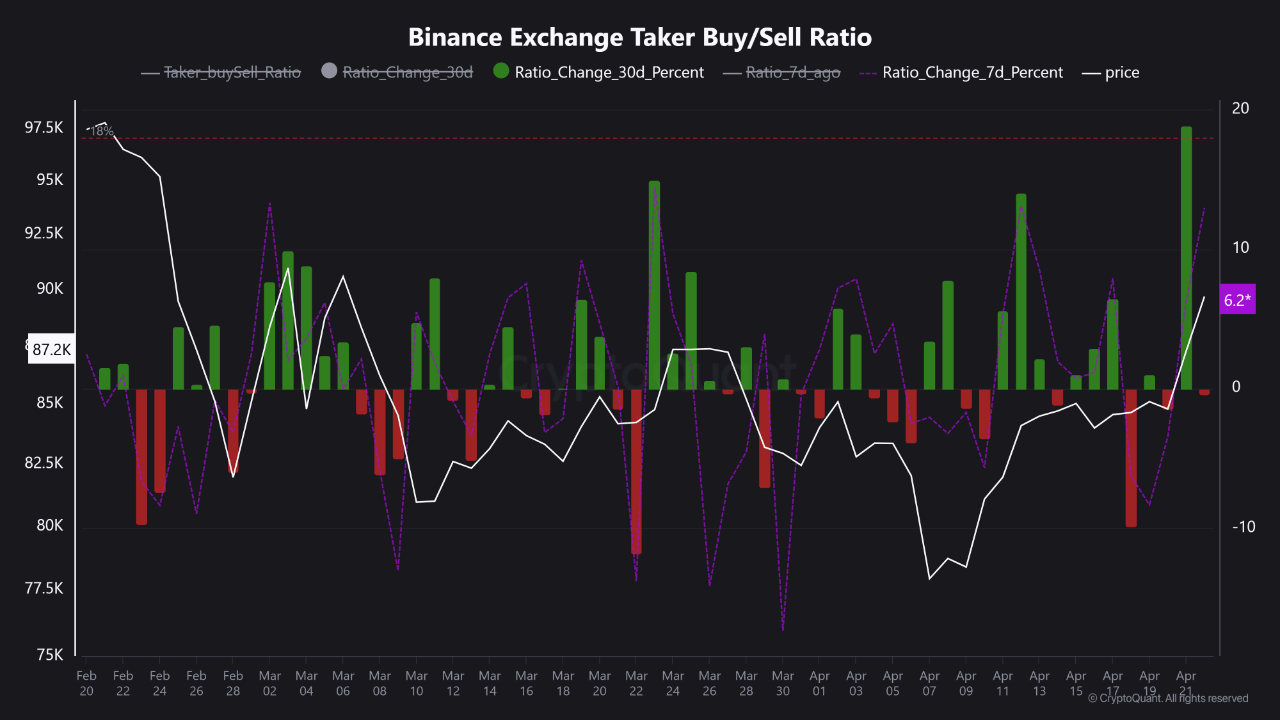

Bitcoin Buyers Take Control on Binance, But Funding Rates Flash a Warning

The Bitcoin market appears to have resumed its upward momentum, with BTC’s price trading above the p...

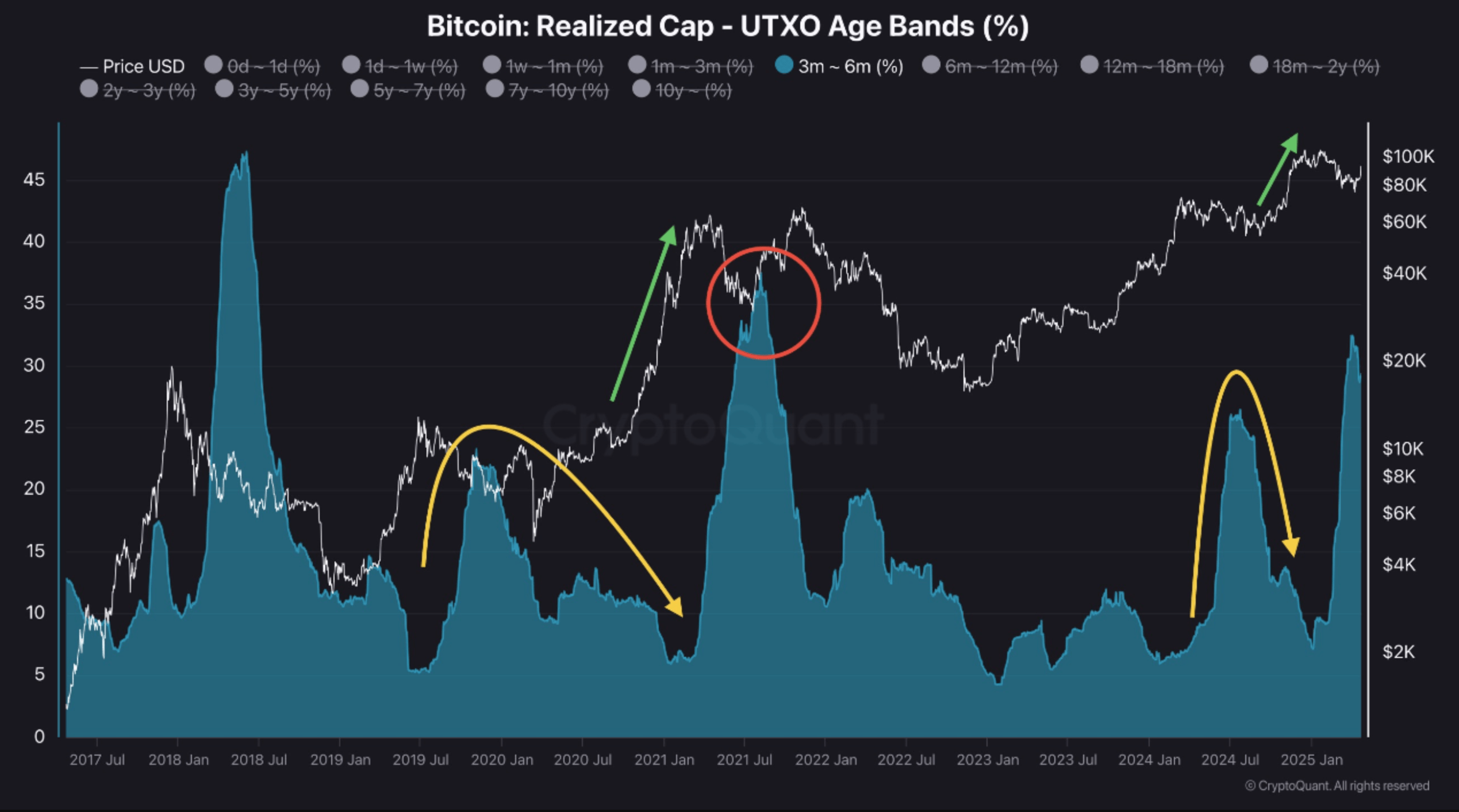

Bitcoin Surpasses Realized Price Of Recent Buyers — Rally Incoming Or Double Top?

Recent positive price action has propelled Bitcoin (BTC) above the short-term holders’ realized pric...

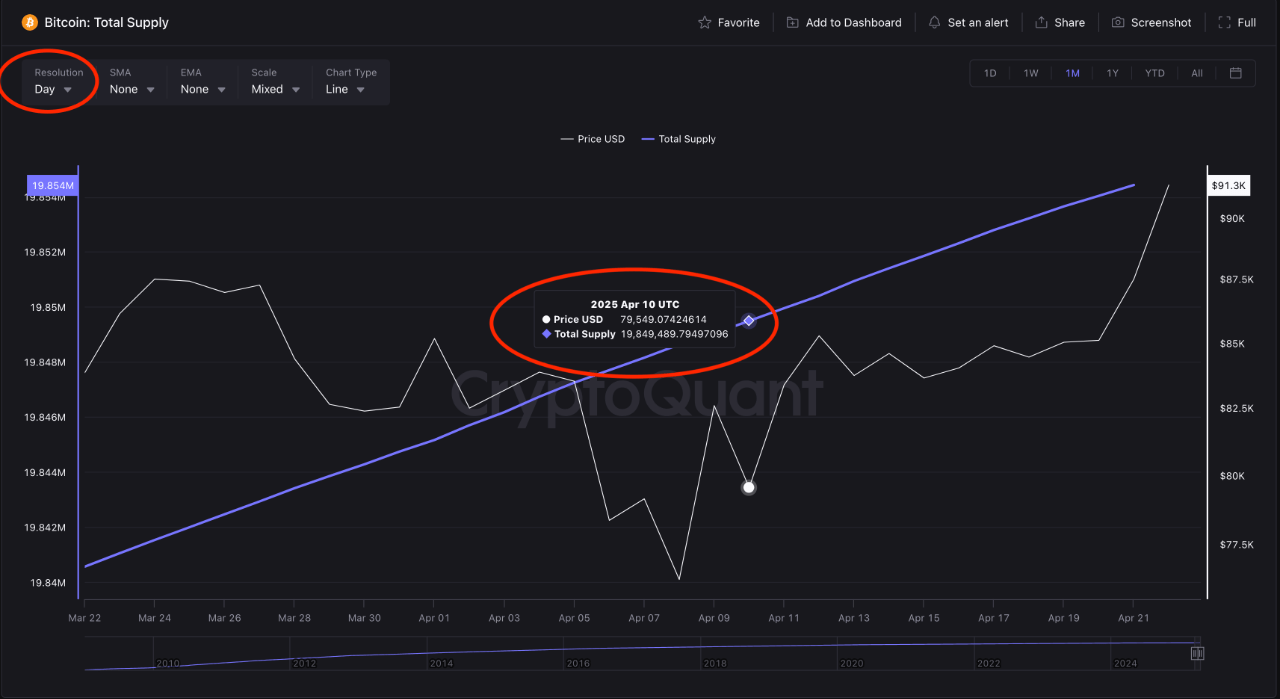

Post-Halving Twist: Why Bitcoin’s Actual Supply May Be Lower Than Expected

Bitcoin has reclaimed significant ground after a steep correction earlier this month, now trading ab...