Stablecoins: A New Haven Amid Tariff Panic

Stablecoins represented a segment within the highly volatile digital asset landscape that experienced a nuanced expansion amid the wild global market fluctuations observed in recent months.

Stablecoins , frequently likened to cash, have served as a refuge for cryptocurrency investors amid the ongoing market fluctuations.

Backed by cash and Treasury bills and usually pegged one-to-one to the dollar or other fiat currencies, Stablecoins serve as highly liquid safe havens for investors aiming to exit crypto tokens without the need to convert them into traditional currencies.

Even as US Treasuries have taken a significant hit from a renewed weakening of the US dollar after President Trump's criticism of the Federal Reserve, there are ongoing concerns about a trade war.

US Treasuries have been trading similarly to risk assets and emerging market assets in recent weeks.

Still, crypto traders successfully navigated the market fluctuations by utilizing stablecoins.

Stablecoin transaction volumes eclipsed Visa's for the first time in 2024.

— Will (@WClementeIII) April 16, 2025

Stablecoins are also now a top 15 holder of US treasuries, & with fewer foreign buyers of our debt, the US will likely keep leaning into them.

Stablecoin volumes/supplies = up only. (h/t @bitwiseinvest ) pic.twitter.com/kANYfiRF7N

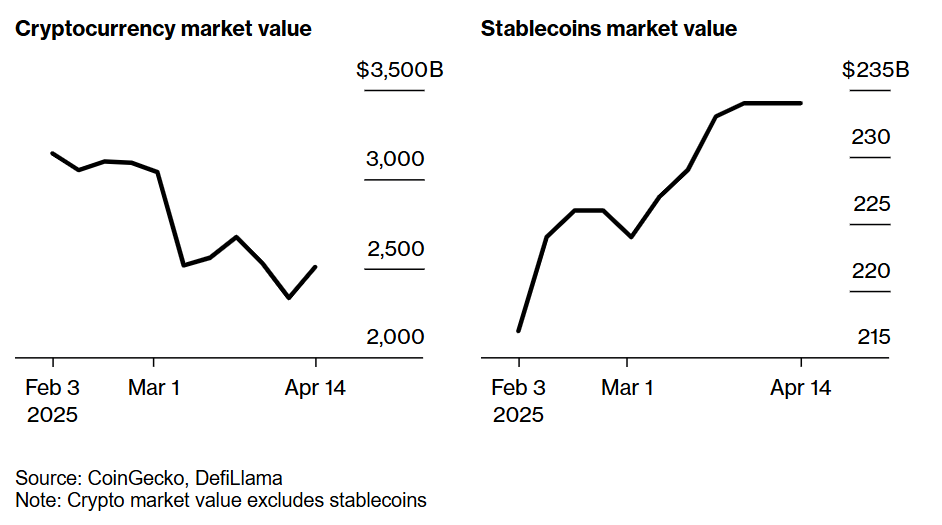

Data from DefiLlama and CoinGecko indicates that the total market value of stablecoins has achieved a new peak of around $234 billion, reflecting a 4.5% rise since the end of February.

Conversely, the total value of all other cryptocurrencies declined 7%, bringing it down to $2.5 trillion. According to Mercuryo data, the proportion of crypto transactions involving stablecoins increased from 37% in early January to 47% in the first week of April.

Stablecoins Grow Amid Market Turmoil

DefiLlama reports that more than 200 stablecoins exist, with USDT (Tether) and USDC (Circle) dominating the landscape, holding 62% and 26% of the market share, respectively.

As reported by CoinGecko , the market value of USDC has increased 8%, surpassing $60 billion, since the end of February, whereas USDT experienced a rise of 1.6%.

As the value of US Treasuries, typically considered the most secure financial asset, experienced significant volatility, stablecoins emerged as a safe haven within the cryptocurrency markets.

Although the longer end of the US government bond curve drew significant attention during this period of market volatility, investors and lawmakers evaluating stablecoin legislation must remember that these coins are supported by short-dated Treasuries.

If there is such a thing as a "safe" asset, we must take this into account.

Stablecoin Market to Hit $2 Trillion

Standard Chartered Bank forecasts that the stablecoin market could expand tenfold to potentially reach $2 trillion in the three years following the expected enactment of US legislation designed to establish a regulatory framework for cryptocurrencies.

A recent paper released last week by experts at the London-based bank indicates that stablecoin issuers would be required to allocate an extra $1.6 trillion in short-term Treasuries, matching the total volume of new T-bills expected to be sold during that timeframe.

The current valuation of the entire cryptocurrency market stands at approximately $2.68 trillion.

The recent worldwide trade tariffs implemented by President Trump have caused significant fluctuations in the US government debt market.

The increased demand for dollar-denominated assets, such as T-bills, favours the Trump administration.

Implementing the levies has raised concerns among investors, who fear that inflation risks and potential sell-offs by foreign holders may lead to US debt requiring a higher premium.

Standard Chartered is a prominent financial institution that emphasizes its commitment to cryptocurrency and presents a highly positive forecast for Bitcoin.

According to the financial services firm's projections, the price could potentially hit $500,000 by the end of 2028.

Bitcoin was last changing hands at around $94,000.

Stablecoins in Stable Condition?

Earlier this year, US legislators from both sides of the aisle introduced the GENIUS Act, an acronym for "Guiding and Establishing National Innovation for US Stablecoins."

This legislation aims to create a framework of rules and guidelines governing stablecoins within the United States.

As reported by Standard Chartered, the bill is progressing toward enactment following its approval by a Senate committee in March. It carries Trump's endorsement.

Tether Holdings SA, the issuer of the largest stablecoin, USDT, stands out as one of the most significant holders of US Treasury bills.

Tether has announced a revenue of $13 billion for the previous year, primarily driven by the interest accrued from its reserve bonds.

Experts suggest that a rise in demand for Treasuries could be a potential solution to the risks associated with tariff concerns threatening dollar dominance.

In late March, World Liberty Financial, the cryptocurrency venture associated with President Donald Trump, announced its plans to create a stablecoin.

World Liberty Financial reports that short-term US Treasuries, dollar deposits, and cash equivalents will fully back the USD1 token.

Elsewhere

Blockcast

Licensed to Shill: Current State of Ethereum, Hidden Road Acquisition, Next Gen of Fintech

This week, host Takatoshi Shibayama is joined by Nikhil Joshi, chief operating officer, Emurgo , and Lisa JY Tan, founder and founding economist, Economics Design , to discuss the latest news and developments in the crypto industry.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found on Podpage , with guests like Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our most recent shows.

BRN Daily View [Massive ETF Inflows Signal Institutional Return, But Short-Term Reversal Likely After Breakout] 23/05/2025

Your daily access to the backroom...

Solana's Corporate Adoption Accelerates as Galaxy Digital Swaps $100M ETH for SOL

These moves could potentially catalyze broader market adjustments and further accelerate the corpora...

Justin Sun’s Bold Bet: TRX ETF Filing With SEC Signals a New Era for Web3

In an industry often defined by volatility and visionaries, Justin Sun once again finds himself at t...