Bitcoin’s price action continues to draw attention as it briefly surpassed $87,000 in today’s trading session, marking a notable 3.3% increase over the past 24 hours.

Though it has since slightly pulled back to around $86,815 at the time of writing, the asset’s gradual recovery since last week appears to be building a foundation for potential upward movement. Analysts now seem to be monitoring technical and on-chain trends as sentiment begins to lean toward a short-term bullish outlook.

Particularly, on-chain data platform CryptoQuant has highlighted notable shifts in market behavior, including insights into funding rates, investor positioning, and psychological resistance levels. Despite the gains, not all investor groups are experiencing profits, with short-term holders still facing unrealized losses.

Several Bitcoin Bullish Signals Identified

A recent analysis shared by CryptoQuant contributor EgyHash outlines several indicators suggesting that Bitcoin could be preparing for another upward leg. The analyst points out a significant $6 billion rise in open interest across derivatives markets over the past two weeks.

Open interest measures the total value of outstanding futures contracts, and its growth typically reflects increased participation or confidence in the direction of price movement. This metric, coupled with a rise in funding rates, indicates an uptick in long-position interest among traders.

Another key metric, exchange inflows, which track how much Bitcoin is being moved onto centralized exchanges, has declined notably during this same period.

When fewer coins are sent to exchanges, it can imply reduced intent to sell, as holders typically deposit assets to liquidate them. This reduction in exchange inflow has been interpreted as a decrease in selling pressure, potentially supporting a more stable price environment in the short term.

These on-chain metrics collectively hint at a market that may be gearing up for a continuation of its current trend, assuming external variables remain favorable.

New Investors In Profit While Short-Term Holders Face Struggle

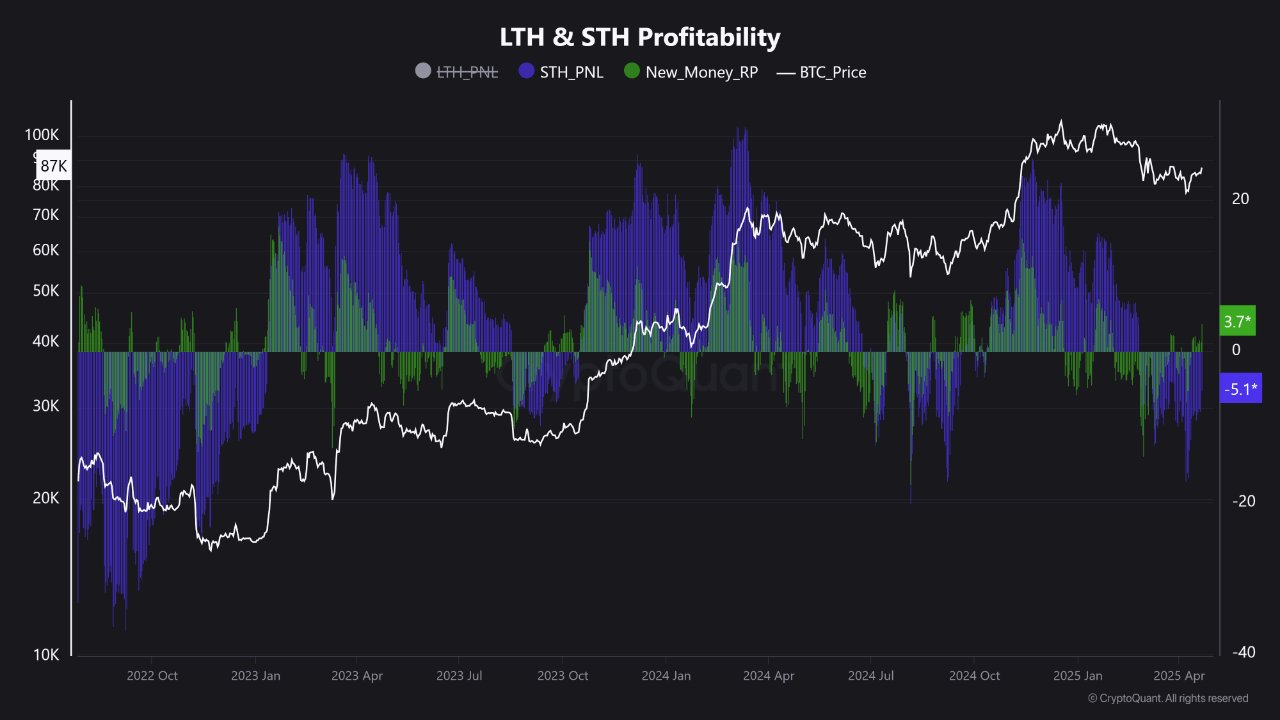

While certain metrics lean bullish, a deeper look at investor categories reveals diverging outcomes. Another CryptoQuant analyst, Crazzyblockk, points out that Short-Term Holders (STHs), or those who purchased BTC within the last six months, remain in an unrealized loss position.

Their average acquisition price stands at approximately $91,000, forming a key resistance level that may influence upcoming price movement. As long as Bitcoin trades below this level, latent sell pressure could persist, especially if upward momentum stalls .

Conversely, new investors — defined as those who entered the market within the past month — have recently returned to profit. With a realized gain of 3.73%, this group is showing signs of renewed confidence, potentially contributing to near-term price support.

However, according to the analyst, the current risk zone remains active until Bitcoin firmly closes above the $91,000 mark. Crazzyblockk wrote:

Until BTC closes above the $91K threshold, Short-Term Holders remain in loss. This may sustain latent sell pressure, especially if price momentum weakens — reinforcing the importance of a decisive breakout above STH realized price to neutralize this overhang.

Featured image created with DALL-E, Chart from TradingView