Bitcoin Outshines Gold By Over 13,000% — ‘Let The Numbers Speak’, Expert Says

Bitcoin has risen dramatically over the last 10 years against gold, with a rise of an incredible 13,693%, according to the financial statistics shared by crypto entrepreneur Ted.

The figures demonstrate the alarming divergence between the two assets from April 2015 and April 2025. In particular, this striking ascent of Bitcoin has caught the eye of investors spread around the globe.

Bitcoin Vs. Gold: From Equal Footing To Massive Gap

Ten years ago, gold and Bitcoin were at similar prices. In April 2015, Bitcoin moved between $200 and $250, whereas gold was ranging around $1,200 to $1,300 per ounce.

The fortunes of these investments have since become totally different. Bitcoin has soared to about $84,000 per coin, up some 33,500% in the ten-year period. The cryptocurrency briefly peaked at nearly $109,000 during the timeframe.

If someone tries to tell you gold is better than Bitcoin…

Just show them this:

In 2015, 1 BTC = 1 ounce of gold.

Today? That same Bitcoin is up 13,693% in 10 years.

Let the numbers speak. pic.twitter.com/8JipH5IsNr

— Ted (@TedPillows) April 17, 2025

Gold, on the other hand, has preserved its image of reliability over volatility, rather than offering spectacular gains. The precious metal increased by only 156% over the same period. From the market onlookers, gold’s worth proposition is still anchored on its consistent, inflation-proof behavior spanning very long timescales.

Historical Context Demonstrates Divergent Patterns Of Growth

Going back even farther shows an even greater disparity in the growth rates . According to a market analyst on social media platform X, the price of gold was only $20.67 per ounce in 1933. As for 2025, the price has gone up somewhat to around $3,330 an ounce, which is indeed a steep rise but a gradual increase over a period of almost a century.

Bitcoin has had a completely different history. From a price of $1 in 2011, it came up to $84,000 by 2025. With such rapid appreciation rates, both excitement and skepticism have been brought forth by financial analysts debating the worthiness of such growths.

Sheer Disparity In Size

Sheer Disparity In Size

According to analyst Belle, a stark contrast in the behavior is due to the sheer difference in the size of their market. Gold has roughly a market capitalization of a little over $22 trillion. Due to this great size, gold provides an element of stability, rendering the market less sensitive to individual transactions or flows of short-term investments.

GOLD added $1 trillion to its market cap in one day. That’s nearly the entire value of #Bitcoin right now.

This shows how massive traditional markets are & how early we still are with Bitcoin. Even a small shift into $BTC could send it flying. pic.twitter.com/YsjSgOZKjx

— Belle (@Bitt_Belle) April 17, 2025

Bitcoin’s market capitalization is at approximately $1.667 trillion—large but still only a fraction of gold’s. This reduced size makes Bitcoin more sensitive to capital flows. Gold recently saw an impressive $1 trillion rise in market capitalization over one day, but this was a much smaller percentage move than the same dollar flow would trigger in Bitcoin’s value.

Same Dollar Flow, Different Price ImpactMeanwhile, the math in terms of market capitalization generates intriguing price movement scenarios. Based on calculations reported, if Bitcoin were to get a $1 trillion boost in market capitalization—comparable to the recent one-day increase in gold—its price per unit might rise from $84,000 to $135,000.

Featured image from The Ledn Blog, chart from TradingView

Best Cryptos to Buy as Charles Schwab CEO Eyes Spot Bitcoin Trading by April 2026

Rick Wurster, Charles Schwab Corp. CEO, is planning to introduce spot Bitcoin trading for Schwab cli...

TRUMP Memecoin Explodes Past $8 Amid Token Unlock Pressure

The price of TRUMP has witnessed an exciting jolt of bullish momentum this weekend, outperforming mo...

Shiba Inu Sees $120 Million Weekly Surge—Whales Tighten Their Grip

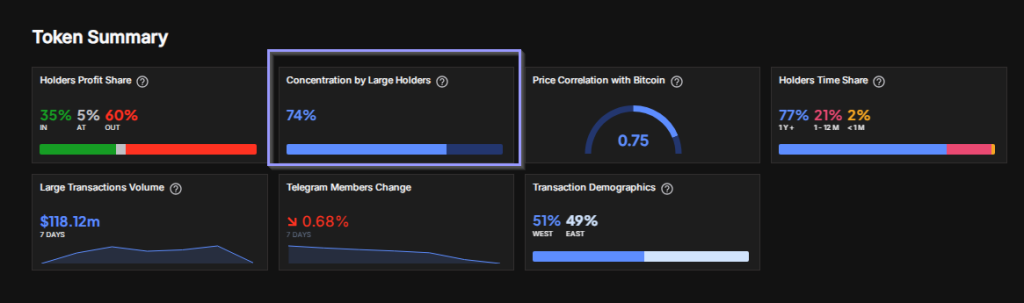

New blockchain information shows that large investors remain in control of the Shiba Inu crypto mark...