Nvidia Faces New Headwinds as U.S. Chip Ban Sparks Sell-Off and Technical Breakdown

- Nvidia hit by $5.5B charge after U.S. bans H20 chip exports to China over security concerns.

- NVDA stock drops 5% after-hours; technical charts suggest potential retest of $55 support.

- Export ban highlights rising regulatory risks for U.S. chipmakers targeting Chinese markets.

Nvidia Corporation (NASDAQ: NVDA) is under renewed pressure following the U.S. government’s decision to block exports of its H20 artificial intelligence chips to China. The export halt, confirmed by Nvidia in a regulatory filing, is expected to lead to a $5.5 billion earnings charge in Q1.

Investors reacted swiftly, leading to a steep after-hours decline despite gains earlier in the day. Broader concerns over revenue disruption and regulatory tightening began to weigh heavily on sentiment. The new restrictions target chips previously redesigned to comply with earlier U.S. export rules.

According to Nvidia, these semiconductors will now require special licenses due to national security concerns. The update comes amid heightened scrutiny of AI technologies and their possible military applications.

Stock Drops in After-Hours Despite Day Gains

On April 15, Nvidia shares closed the regular session at $112.20, marking a 1.35% gain. However, this upside reversed quickly in after-market trading. The stock fell 5.08% to $106.50 following the announcement of the indefinite chip ban. Data shows the price remained steady throughout the session but dropped sharply after 5:00 PM EDT when the policy update became public.

The sudden sell-off reflects the market’s sensitivity to regulatory changes affecting global supply chains. The $5.5 billion charge tied to halted exports adjusts Nvidia’s Q1 earnings outlook and introduces near-term uncertainty regarding its position in key Asian markets.

Technical Chart Points to Deep Support Levels

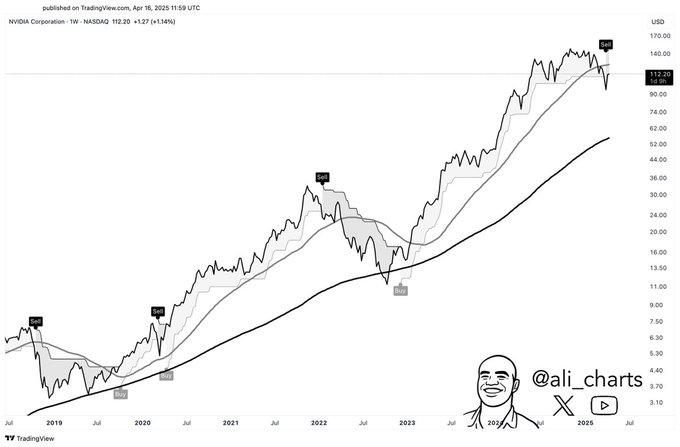

A recent analysis by technical market observers, including @ali_charts, points to a larger trend reversal underway. A “Sell” signal appeared in early 2025 on Nvidia’s weekly chart, shortly after the stock reached its all-time high above $160. Since then, NVDA has corrected over 30%, trading near the $106 mark.

The weekly chart highlights recurring support around the 200-week moving average, a level historically tested during major pullbacks. In the past, Nvidia has rebounded strongly from this long-term trendline. If the stock continues to drop, analysts suggest a potential retest of the $55 region, where the 200-week MA currently sits. This level acted as support during the 2019 and early 2020 consolidations.

It also shows the history of signals: “Buy” issued in 2022 produced an extended spike; “Sell” issued in 2021 – a local high. The current trend means there could be a shift to long-term support barring any event that may alter the current direction.

Export Ban Magnifies Regulatory Risk for Chipmakers

The president’s administration’s changing policies on advanced semiconductor exports have already affected several U.S.-based chipmakers, with Nvidia now among the most heavily impacted. The H20 chips had been adjusted to comply with past export control measures. The recent decision to block shipments indefinitely suggests a stricter interpretation of national security risk.

China is one of the largest consumers of

AI products

from Nvidia’s company, and these new barriers will impact both current sales and future business development. The ban specifies the product range the company had offered H20 chips as compliant devices, and it illustrates the issue of business in dynamic regulatory frameworks.

Dormant Crypto Whale Transfers 7,488 $ETH to FalconX Following 1.8-Year Inactivity

As per the data from Onchain Lens, a whale that has been inactive for 1.8 years has recently transac...

Blockchain Reporter Weekly News Review: Partnerships and Solana ETFs Define the Week

This deep look into top five blockchain and cryptocurrency news stories reflects the web3 sector’s r...

Hidden Road Secures FINRA License as $1.25B Ripple Acquisition Awaits Approval

Hidden Road secures FINRA license ahead of $1.25B Ripple deal, plans XRPL integration to expand fixe...