Ethereum Reclaims Key Support At $1,574 – Here’s The Next Price Target

Market prices of Ethereum (ETH) gained by over 4% in the past day, as the prominent altcoin broke out of a tight consolidation zone between $1,548 and $1,599. Despite some retracement in the last few hours, the growing bullish momentum in the ETH market shows signals of a sustainable price rally. Notably, renowned crypto analyst Ali Martinez has highlighted the potential next price target for the second-largest cryptocurrency.

ETH Bulls Set Sights On $1,810 Resistance

In an X post on April 12, Martinez shares an Ethereum price prediction using on-chain data from analytics company IntoTheBlock. Martinez’s post shows that Ethereum has now reclaimed a critical support level at a demand zone between $1,547 and $1,595. This zone represents a significant accumulation area, with approximately 5.48 million ETH held by 2.83 million addresses at an average purchase price of $1,574.

The resurgence in buying activity around this price region indicates a considerable trading volume which is critical to sustaining the current bullish momentum. At press time, Ethereum trades at $1,642 showing signs of resilience following its recent breakout.

If the price rally persists, Martinez explains the altcoin is headed for a strong resistance zone between $1,791.11 and $1,838.86. This area contains 1.61 million ETH held by 3.2 million addresses at an average price of $1,810. Notably, this zone is visualized in red indicating that many of these investors are “out of the money” and are likely to sell once prices recover— offering a potentially significant resistance to Ethereum’s ongoing rebound. If ETH bulls can surge past this resistance level, it could confirm a trend reversal for the altcoin following a consistent decline since the altcoin hit the $4,000 price zone in December 2024.

Ethereum Market Overview

Generally, IntoTheBlock’s data shows 56.7% of ETH addresses are currently “in the money,” representing 8.3 million ETH worth about $13.24 billion. In contrast, 41.99% (6.14 million ETH) of holders are “out of the money,” suggesting the market sentiment still largely remains cautious.

Meanwhile, only 191,830 ETH (1.31% of total volume) is considered “at the money,” signaling minimal congestion around the current price level, which may favor a swift move in either direction.

At the time of writing, Ethereum continues to trade at $1,642 as earlier stated, with a price decline of 8.50% in the last week. Meanwhile, daily trading volume is down by 13.08% indicating a waning market interest which could be potentially harmful to the ongoing price rally.

On The Brink: Ethereum Challenges Descending Channel, Targets $3,000 Price

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is preparing for a poten...

Bitcoin At $1 Million? BPI Says One US Move Could Make It Happen

In the latest installment of the “Bitcoin Policy Hour,” a weekly podcast produced by the nonprofit B...

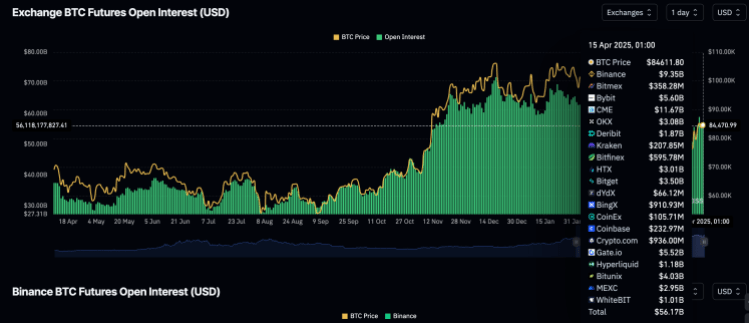

Is The Bitcoin Open Interest Too High Or Can The BTC Price Still Rally?

The Bitcoin open interest has remained on the high side despite the price declines, suggesting that ...