Bitcoin Price Analysis: Crucial Support and Resistance to Watch Now

The post Bitcoin Price Analysis: Crucial Support and Resistance to Watch Now appeared first on Coinpedia Fintech News

At the start of this month, the price of Bitcoin was at the $82,539 level. Since then, the BTC price has declined by over 3.27%. However, currently, Bitcoin is showing a small sign of recovery as it is slowly inching back to the crucial $80K level. Meanwhile, on-chain indicators suggest panic selling by short-term holders, which some analysts believe is a long-term buying opportunity. With key resistance and support levels now in focus, the market could be on the edge of a major move. Curious to know more. Read on!

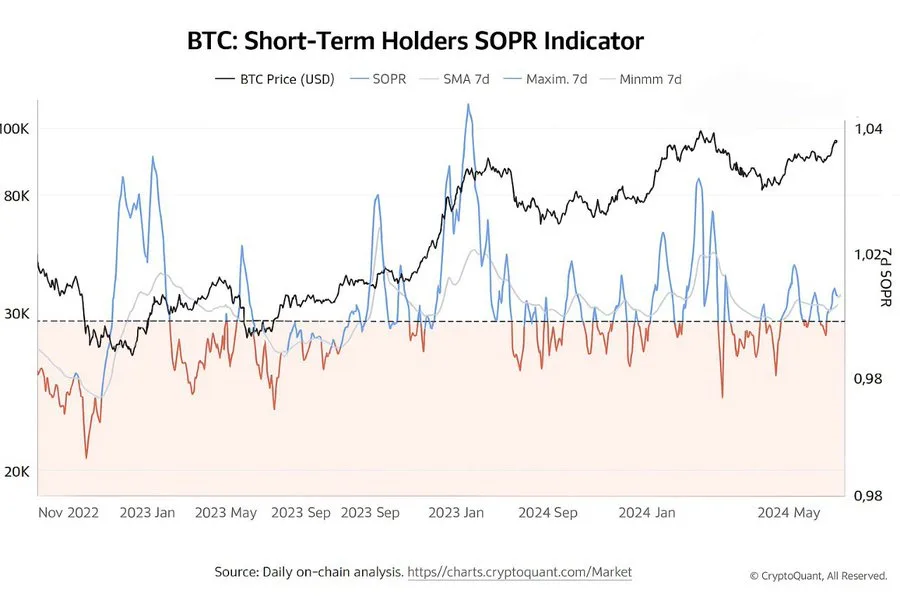

Bitcoin SOPR Signals Panic Selling – A Bullish Indicator?

The BTC Short-Term Holders SOPR indicator value is currently trending downwards. In other words, the BTC Short-Term Holders SOPR indicator shows panic selling.

The indicator shows if short-term cryptocurrency holders (who have held their coins for less than 155 days) are selling at a profit or a loss.

If the SOPR value is less than 1, they are selling at a loss.

This implies that a large number of short-term holders are selling their coins at a loss.

Flashback to Past BTC Dips: History Repeats for Patient Investors

A crypto analyst, identified as FOUR Crypto Spaces on X, draws a comparison between the current BTC market dip and the $60K dip in 2024 and the $26K dip in 2023.

He claims that dips often recover and lead to new highs.

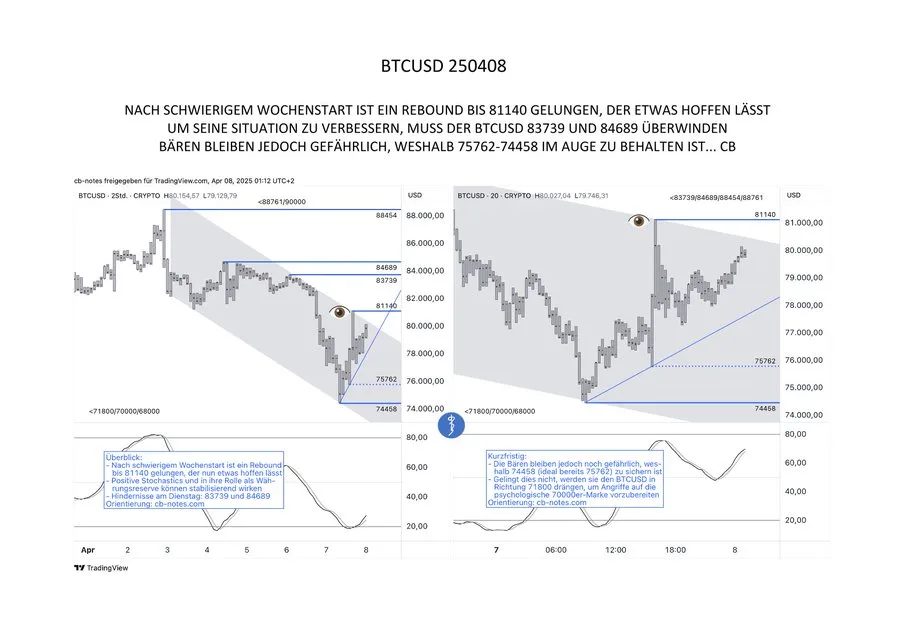

BTC Price Action: Key Resistance and Support Levels

Since the start of yesterday, the Bitcoin market has grown by nearly 1.82%. Currently, the price of Bitcoin stands at $79,839 – just 0.17% below the crucial $80K level.

- Also Read :

- US DOJ Disbands Crypto Enforcement Unit Amid Major Policy Shift

- ,

A German BTC analyst, identified as cb on X, states that $83,739 and $84,689 are key levels BTC needs to break to continue going up.

On April 6, the BTC market plummeted as low as $77,212, due to extreme market volatility.

The analyst warns that if Bitcoin drops below the range of $75,762 and $74,458, it could signal more downside risk.

Even though bearish pressure is present in the market, the recent bounce offers confidence to buyers.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per Coinpedia’s BTC price prediction, 1 BTC could peak at $169,046 this year if the bullish sentiment sustains.

With increased adoption, the price of 1 Bitcoin could reach a height of $610,646 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $5,148,828.

By 2050, a single BTC price could go as high as $12,436,545.

Canary Capital Files for Staked TRX ETF With U.S. SEC

The post Canary Capital Files for Staked TRX ETF With U.S. SEC appeared first on Coinpedia Fintech N...

Official Trump Unlocks 40M Tokens Worth $300M: What Next For TRUMP?

The post Official Trump Unlocks 40M Tokens Worth $300M: What Next For TRUMP? appeared first on Coinp...

BNB Price Breakout Above $600? On-Chain Metrics Hint at Bullish Momentum

The post BNB Price Breakout Above $600? On-Chain Metrics Hint at Bullish Momentum appeared first on ...