Institutional Confidence Grows as Bitcoin Accumulation Intensifies

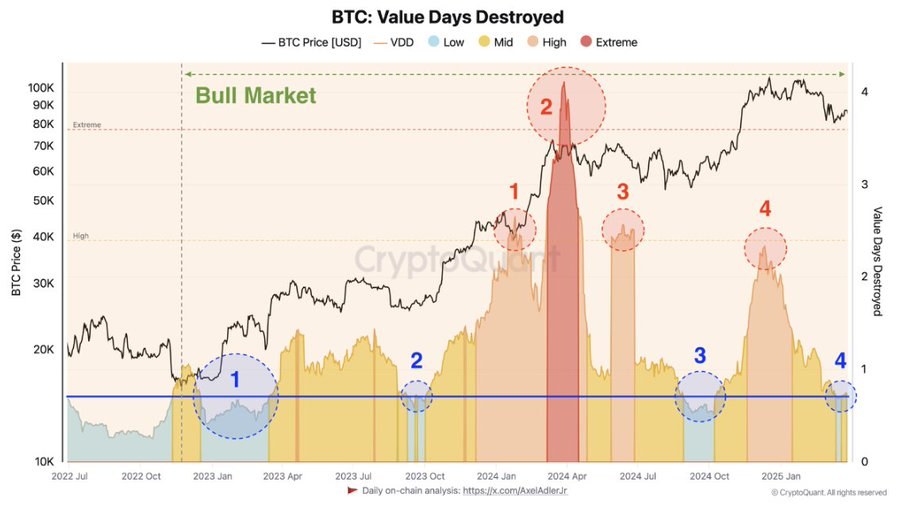

Experienced Bitcoin ($BTC) market participants have recently entered a noticeable accumulation phase. According to CryptoQuant data , these seasoned players experienced four distinct accumulation cycles in the BTC market: in January and October 2023, October 2024, and most recently, March 2025.

These accumulation periods are characterized by such low values in Value Days Destroyed (VDD) that are easily distinguishable before a bullish movement. CryptoQuant points out that there has been a shift in the market trends among these experienced traders.

While in the past, it actively traded at the highs of a given year, in January, April, July, and March 2025, these participants now firmly hold positions. A decline in the VDD indicator points to a shift towards a longer-term strategy of not liquidating positions for better profits in the short-term based on the current Bitcoin price.

Bitcoin Whale Numbers Reach Multi-Month High

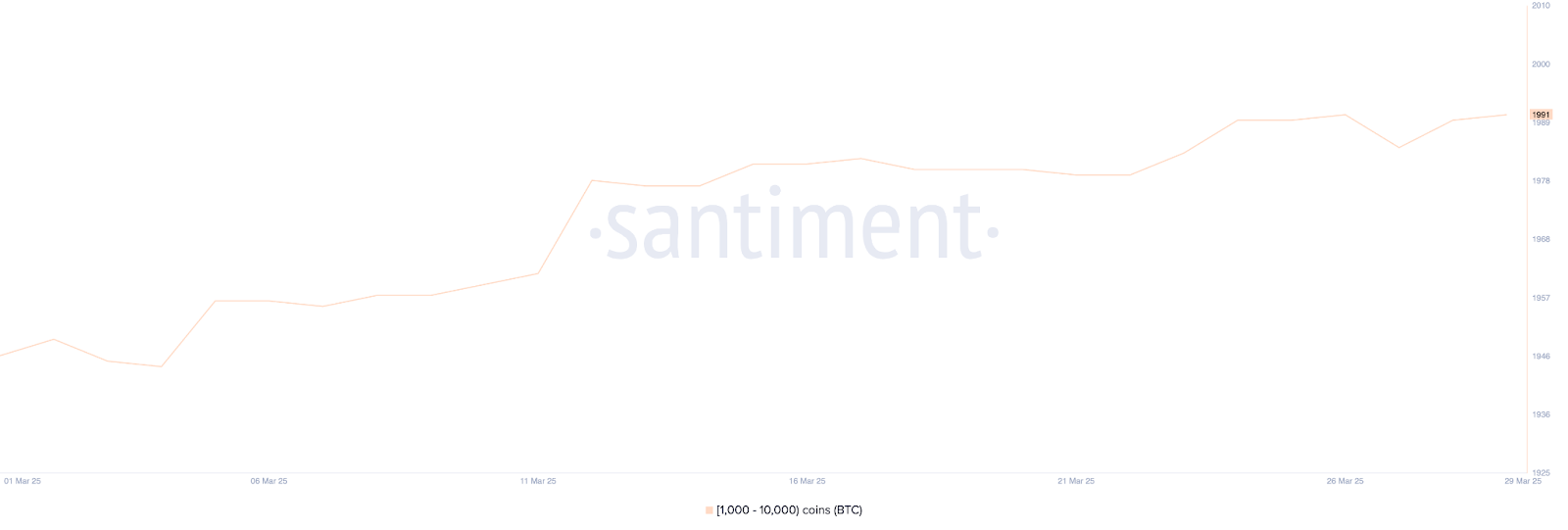

Also, data from Santiment highlight a growing activity among Bitcoin whales. Large Bitcoin investors owning more than 1,000 BTC have risen in the last few weeks.

As of March 22, the number of whale addresses totalled 1,980 and by the end of the month, it increased to 1991. This may partly be due to a relatively small increase in daily cases, which yet is the highest amount recorded in more than three months.

Larger numbers of whales could be a potent signal of a bullish chart pattern, often associated with stock markets. They tend to be controlled by institutional investors and wealthy people with high capabilities of determining the price of BTC. The current increased accumulation by the whales could be a sign that these market influencers expect favorable market conditions in the future.

Open Interest and Spot Activity Support Accumulation Trend

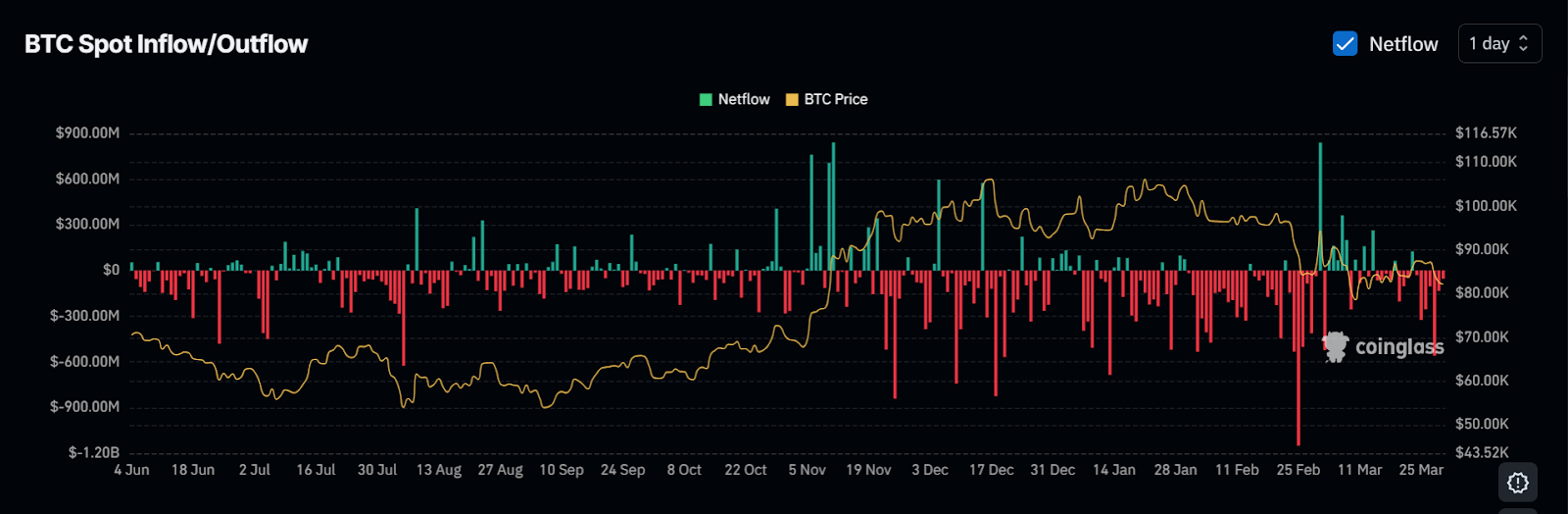

Additional data from Coinglass lends further credence to potential bullish outcomes. The Coinglass chart shows BTC’s open interest standing at around $80 billion, which follows BTC’s price which is slightly above $82k. In the past, high open interest levels signify an expectation of further substantial price movements in the future meaning higher chances of price appreciation.

Simultaneously, spot market flows reveal sustained outflows in exchanges, which reflects long-term speculative demand. Netflow data shows dominant red bars which indicate outflows, remain mainly elevated throughout March with no signs of sudden panic or profit taking selling.

As of this writing Bitcoin is currently trading at $82,144, registering a 24-hour increase of 0.03%. The price remained above $82,000 mark despite recent volatility, as the day’s high was briefly above $83,500 with a low of $82,110.

Currently, the market capitalization of Bitcoin is at $1,630,607,016 gaining 0.02% in the last 24-hours. However, the trading volume declined in the 24 hours to $14.35 billion, decreasing by 26.54%.

Crypto Projects See Rising TVL During the First Week of April

Crypto projects saw significant TVL growth in early April, showing rising liquidity, user engagement...

Pi Network Price Prediction: Why Pi Will Crash to All Time Lows By May 2025 & Coldware Will Bounce On The Back Of It

Pi Network is set to crash by May 2025 as Coldware rises with real utility, scalability, and growing...

SUI Crumbles 9.78% For A further Week Loss, Confidence Grows Stronger In Web3’s Latest Leader Coldware

SUI drops 9.78% as investor confidence shifts to Coldware, the rising Web3 leader known for its scal...