Top Crypto Stories This Week: From a Blockhead B.R.O Introduction to a Blockhead Bro Farewell

Unafraid to push against the grain, defy convention, break the mold, and bravely put our necks on the line for the benefit of your content consumption, Blockhead has never shied from expanding its offerings.

Loyal Blockhead readers will attest to how we embarked as a simple (albeit edgier than a razor blade) crypto news publication and have grown to be flushed with a suite of exciting products, including podcasts, newsletters, the odd trolling video (IYKYK), and even an entire research arm, AKA BRN .

Now, Blockhead is proud to announce the launch of Blockhead Research Office (B.R.O.) - a brand new subscription service that brings you the best in market intelligence, which happens in the backroom—behind closed doors, where the real players talk, share notes, and position themselves before the headlines hit.

B.R.O. is built for digital asset investors who don’t wait for the news to tell them what just happened – they already know what’s coming. It’s not another roundup of yesterday’s headlines or a repackaged Twitter thread. It’s what you’d hear if you were in the right room, at the right time, with the right people.

As part of the subscription, Back Room Operators (B.R.O.s) get:

? The Wire – The daily desk note that tells you what’s moving, why it matters, and how to play it. No noise, just signal.

? The Briefing – Your weekly macro cheat sheet, giving you the key global events and trends before the market reacts.

? The Docket – No-fluff project overviews so you know what’s worth paying attention to—and what’s just hype.

? The Ledger – A real-time view of B.R.O.'s model portfolio—our moves, our reasoning, and our strategy.

? The Townhall - Access to B.R.O. events, where the real conversations happen—off the record, in person, and with the right people.

For a limited time, we're offering Blockhead readers a 14-day free trial to check out exactly what's behind the door.

But as Blockhead embarks on a new journey with B.R.O., it simultaneously says bon voyage to a bro of its own. This Blockhead editorial skipper has been at the helm since day one, but the time has come for him to head towards other sunny shores.

Where it may take him remains a mystery, like the changing of the seasons and the tides of the sea. Nonetheless, you might catch him somewhere down the road, if you're lucky enough. After all, how many special people change?

Elsewhere in the world of crypto this week, things hardly matched the gravitas of Blockhead's developments, but we saw GameStop fully committing to a Bitcoin reserve, stablecoins dominating headlines in the US, and the U.S. Securities and Exchange Commission ( SEC ) dropping even more cases against the industry.

Just a day after announcing its foray into Bitcoin as a treasury reserve asset, GameStop unveiled plans for a significant $1.3 billion private offering of convertible senior notes.

The House of Representatives released its version of its stablecoin bill , Trump-backed World Liberty Financial announced plans to launch USD1, a stablecoin pegged to the US dollar, and the Wyoming Stable Token Commission is preparing to launch WYST, a state-backed digital currency.

Meanwhile, the SEC has officially closed a number of cases against the crypto industry, including Crypto.com , Kraken , and Consensys .

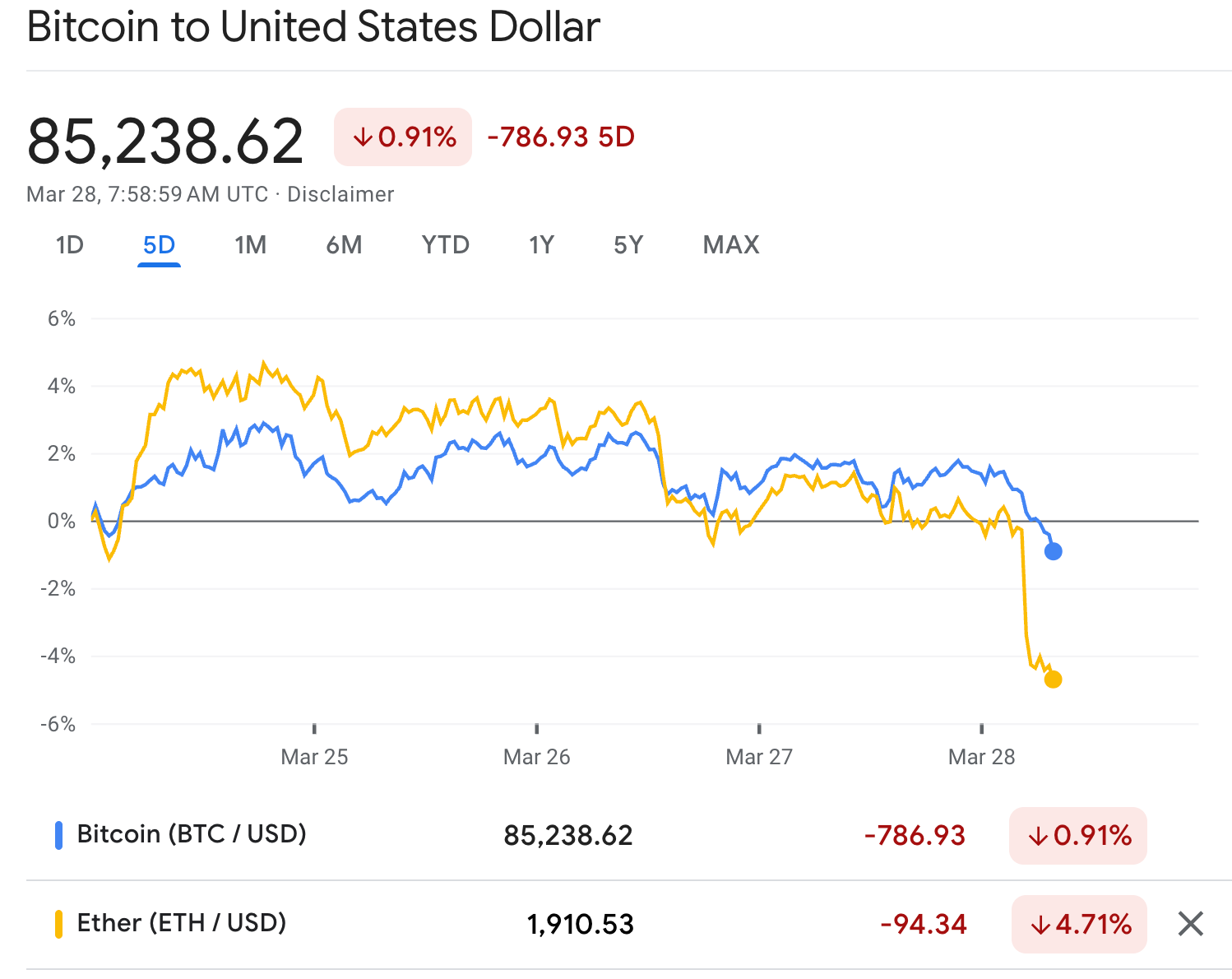

Over in the markets, neither Bitcoin nor Ethereum had a great week, slipping 0.91% and 4.71%, respectively.

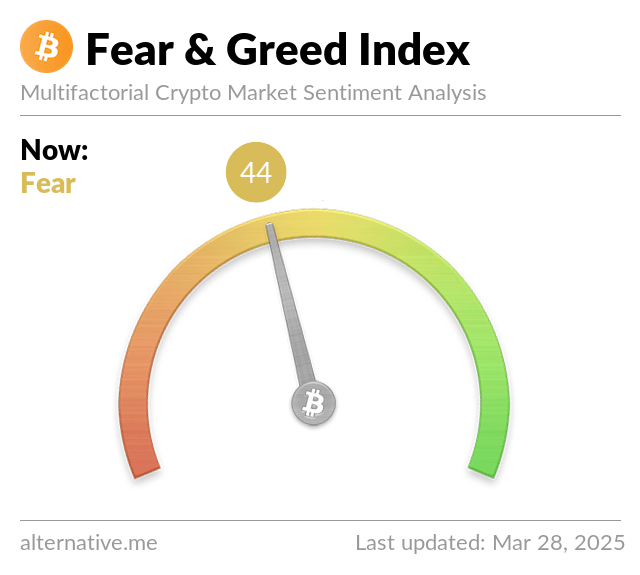

Alternative.me's Crypto Fear and Greed Index has risen from last week's 34, "Fear," to 44, also, "Fear." The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Welcome to the Blockhead Research Office (B.R.O.) – Your Edge Starts Here

For the past few years, we’ve made it our mission to bring sharp, independent coverage of the crypto markets to the world. We’ve kept it open, we’ve kept it real, and we’ve built something people actually trust.

Now, we’re taking it to the next level.

Better Returns Only – Because that’s the real goal. Not hype, just strategy.

US Stablecoin Galore: House of Representatives, Trump's World Liberty Financial, Wyoming State

Stablecoins are fast becoming the hottest trend in the US. The House of Representatives released its version of its stablecoin bill , Trump-backed World Liberty Financial announced plans to launch USD1, a stablecoin pegged to the US dollar, and the Wyoming Stable Token Commission is preparing to launch WYST, a state-backed digital currency.

SEC Drops Cases Against Crypto.com, Kraken, Consensys

The U.S. Securities and Exchange Commission ( SEC ) has officially closed a number of cases against the crypto industry, including Crypto.com , Kraken , and Consensys .

In a statement , Crypto.com revealed that the regulator had dropped its case and will not file enforcement against it.

“We are pleased that the current SEC leadership has made the decision to close its investigation into Crypto.com with no enforcement action or settlement,” said Nick Lundgren, Chief Legal Officer of Crypto.com.

GameStop Announces $1.3 Billion Debt Offering to Fund Bitcoin Acquisition

Just a day after announcing its foray into Bitcoin as a treasury reserve asset, GameStop Corp. (NYSE: GME) has unveiled plans for a significant $1.3 billion private offering of convertible senior notes.

GameStop explicitly stated the intention to use the net proceeds "for general corporate purposes, including the acquisition of Bitcoin in a manner consistent with GameStop’s Investment Policy," according to an announcement .

Nigeria Continues Search for Escaped Binance Exec Nadeem Anjarwalla

The battle between Binance and Nigeria isn't over yet. In what Nigeria Information Minister Mohammed Idris emphasised was a Binance problem rather than a crypto problem, the African nation is continuing its pursuit of British Kenyan Nadeem Anjarwalla.

SEC to Host Four More Crypto Round Tables

The US Securities and Exchange Commission’s ( SEC ) Crypto Task Force is hosting four additional roundtable discussions.

According to the regulator, the conversations will focus on key topics including tokenization and decentralized finance (DeFi), with the aim of engaging industry experts in an effort to shape the future of crypto regulations in the US.

Crypto Boom Fuels eToro's $4.5 Billion IPO Bid on Nasdaq

Online trading platform eToro has officially filed for an initial public offering (IPO) on the Nasdaq, aiming for a valuation of approximately $4.5 billion after a year of explosive revenue growth largely driven by the surge in cryptocurrency trading

BlackRock Launches European Bitcoin Fund

BlackRock has launched a new Bitcoin exchange-traded product (ETP) in Europe through its iShares fund service.

Managing over $4.4 trillion in ETFs globally, the world's largest asset manager has already amassed $58 billion in assets through its US Bitcoin ETF.

Now, the new iShares Bitcoin ETP ( IB1T ) is listed on stock exchanges in Germany, France, and the Netherlands.

Singapore's DigiFT is Tokenizing Stocks Including AAPL, TSLA, MSFT on its New On-Chain Fund

Singapore's DigiFT is launching the first fully tokenized on-chain index fund, featuring stocks including Apple, Tesla, Microsoft, Alphabet and Nvidia.

By tokenizing these assets, DigiFT eliminates the need for traditional intermediaries, offering institutional and professional investors unprecedented efficiency, speed, and flexibility in trading and managing their assets.

Kraken Explores $1 Billion Debt Raise in IPO Preparations

Cryptocurrency exchange Kraken is reportedly exploring raising up to $1 billion in debt to fuel its expansion plans as it gears up for a potential initial public offering (IPO) as early as the first quarter of next year.

According to a Bloomberg report citing individuals with knowledge of the matter, Kraken is working with financial giants Goldman Sachs and JPMorgan Chase on this potential debt raise.

Metaplanet, Strategy Buy More Bitcoin (Again)

Japanese Bitcoin treasury firm Metaplanet and Michael Saylor's Strategy (formerly MicroStrategy ) have ramped up their Bitcoin holdings.

According to reports , Metaplanet purchased an additional 150 BTC, bringing its total reserves to 3,350 BTC worth over $290 million.

Equities Soar on Tariff Flexibility Hints While Crypto Trades Mixed

Global markets presented a bifurcated picture on Tuesday, with US equities surging on signals of potential flexibility in US President Donald Trump's upcoming tariff announcements, while the cryptocurrency market displayed a more subdued and mixed performance.

Markets' Mantra: Bears Take Control as Risk-Off Tone Keeps Cryptos at Bay

Markets start the week on a risk-off note as traders navigate geopolitical uncertainties and indications that the impending next phase of Donald Trump's trade wars may be targeted.

Speculative digital assets were hit hard by a cryptocurrency drop on Sunday, with the sector bearing the brunt of the market selloff as investors reduced risk in response to US President Donald Trump's tariff rhetoric.

SEC Commissioner Supports Using NFTs to Raise Funds for Crypto Startups

SEC Crypto Task Force lead, Hester Peirce, has said that NFT-based fundraising projects like Stoner Cats and Flyfish Club should be exempt from securities regulations.

Peirce said that regulatory clarity could soon follow the agency's recent decision to declassify proof-of-work crypto mining within security laws.

Coinbase in "Advanced Talks" to Acquire Derivatives Exchange Deribit

Coinbase is set to acquire the world’s largest crypto derivatives exchange for Bitcoin and Ether options, Deribit .

According to Bloomberg , the companies have reached "advanced talks" in the deal and have notified regulators in Dubai about these discussions as Deribit holds a license in the region, which would be transferred to any acquirer.

Blockcast

Chris Yu co-founded SignalPlus in 2021 to address key gaps in the crypto options market, leveraging his experience as a trader and his insights into the market's early-stage potential.

In this Blockcast episode, Yu explains why he sees the state of crypto options resembling the FX options market around 2000 and why there is an opportunity to build infrastructure that could scale with the industry's growth.

Previous episodes of Blockcast can be found on Podpage , with guests like Samar Sen ( Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!

Subscribe on LinkedIn

Will Crypto Play a Role in Ending the Dollar's Dominance?

The world of finance is changing. As countries worldwide look for better ways to settle their financ...

Sei Foundation Pursues 23andMe Acquisition, Highlighting Data Privacy as a Core Objective

23andMe's recent bankruptcy filing has raised questions about the future of the company's extensive ...

Weak Rebound Meets Tariff Risks – Why We’re Sticking to a Cautious Strategy

Your daily access to the backroom....