ETH Long Pays Off: Whale Earns $2.15M As Market Rises

The crypto market always amazes users with new surprises, innovations, and multiple opportunities that arise constantly. Today, a whale captured curiosity after earning $2.15 million by taking a highly leveraged 50x long position on Ethereum (ETH).

Whale longed ETH with 50x leverage

According to data reported by Lookonchain today, the whale sold 947 ETH for $1.95 million USDC and deposited them into Hyperliquid to long ETH with 50x leverage. He eventually conducted the high 50x leverage gamble – deposited $1.95 million USDC to long ETH. He longed on ETH at a price of $2059 while risked liquidation if ETH declines to $2,008.

With such a high leverage, this was a high-risk trade, yet with a high reward. The trade itself is not for the faint-hearted investors as it needs a well-calculated approach. It was a high-risk trade, with just a 2.48% price decline triggering liquidation. Fortunately, the market moved in his favor. As ETH price rose, his position expanded to 2595 ETH worth $5.37 million. He didn’t waste time, he closed his long position instantly and realized a profit of $2.15 million.

Lessons to learn

While critics believe that this whale might have benefited from insider information, his trading activities point out that he is just a smart trader. Lookonchain data shows that this whale is the one who made $6.8 million by going long on Bitcoin and Ethereum with 50x leverage before Trump’s executive order.

The whale is an intelligent trader and a master of market trends and updates. He executed his latest trade after President Trump announced the executive order to develop a crypto strategic stockpile. The timing defied a potential price downturn as he knew that Trump’s recent policy would as a catalyst for the market movement.

Leverage trading can be excellent approach that investors can use to supercharge their profits when trading assets. However, it is also a high-risk activity that can lead to massive losses if traders don’t utilise the right trading strategy.

Coinbase Premium Surges Despite Decline in $BTC Price Channel

The Coinbase premium index tracks the price diversity between Bitcoin ($BTC) price on Coinbase as we...

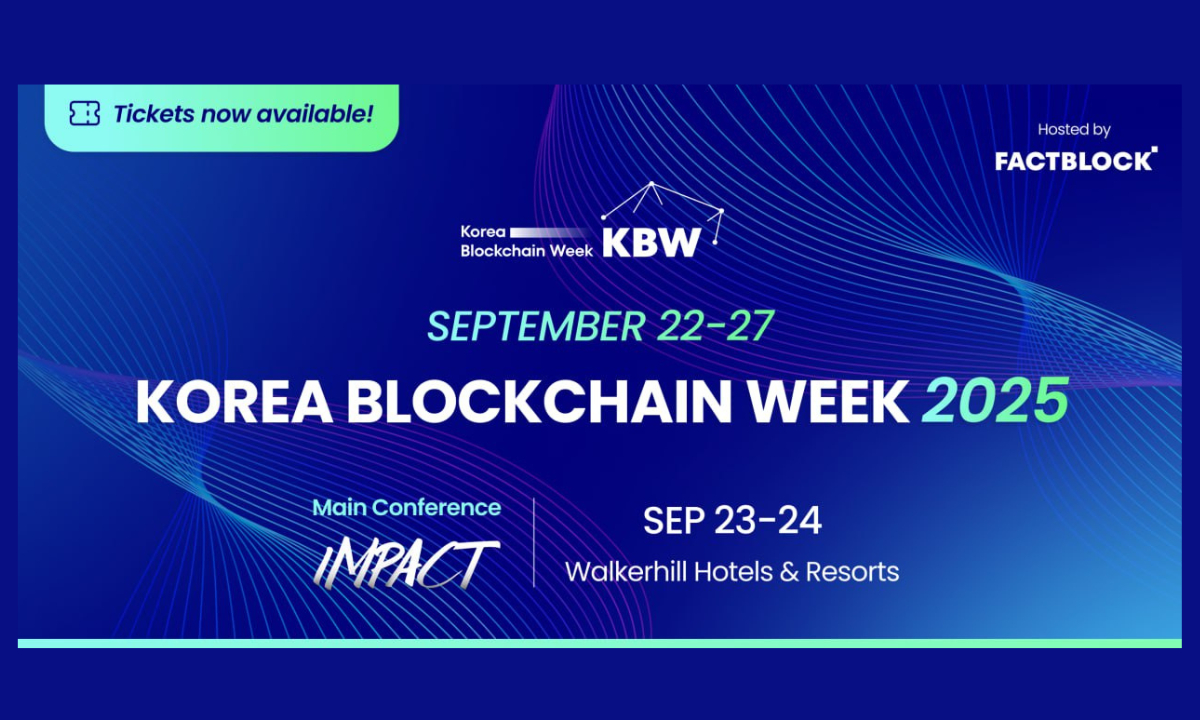

Korea Blockchain Week 2025 Returns to Seoul in September as Asia’s Premier Web3 Event

Seoul, South Korea, 12th March 2025, Chainwire...

Is Qubetics the Best Crypto for Huge Gains with a $14.9M Presale? SEI Hits a Key Breakout and Ethereum Faces Market Shifts

Qubetics presale surges past $14.9M, fueling speculation that it's the best crypto for huge gains in...