Markets Mauled: Recession Fears, Trump Tariffs Trigger Crypto, Stock Market Bloodbath

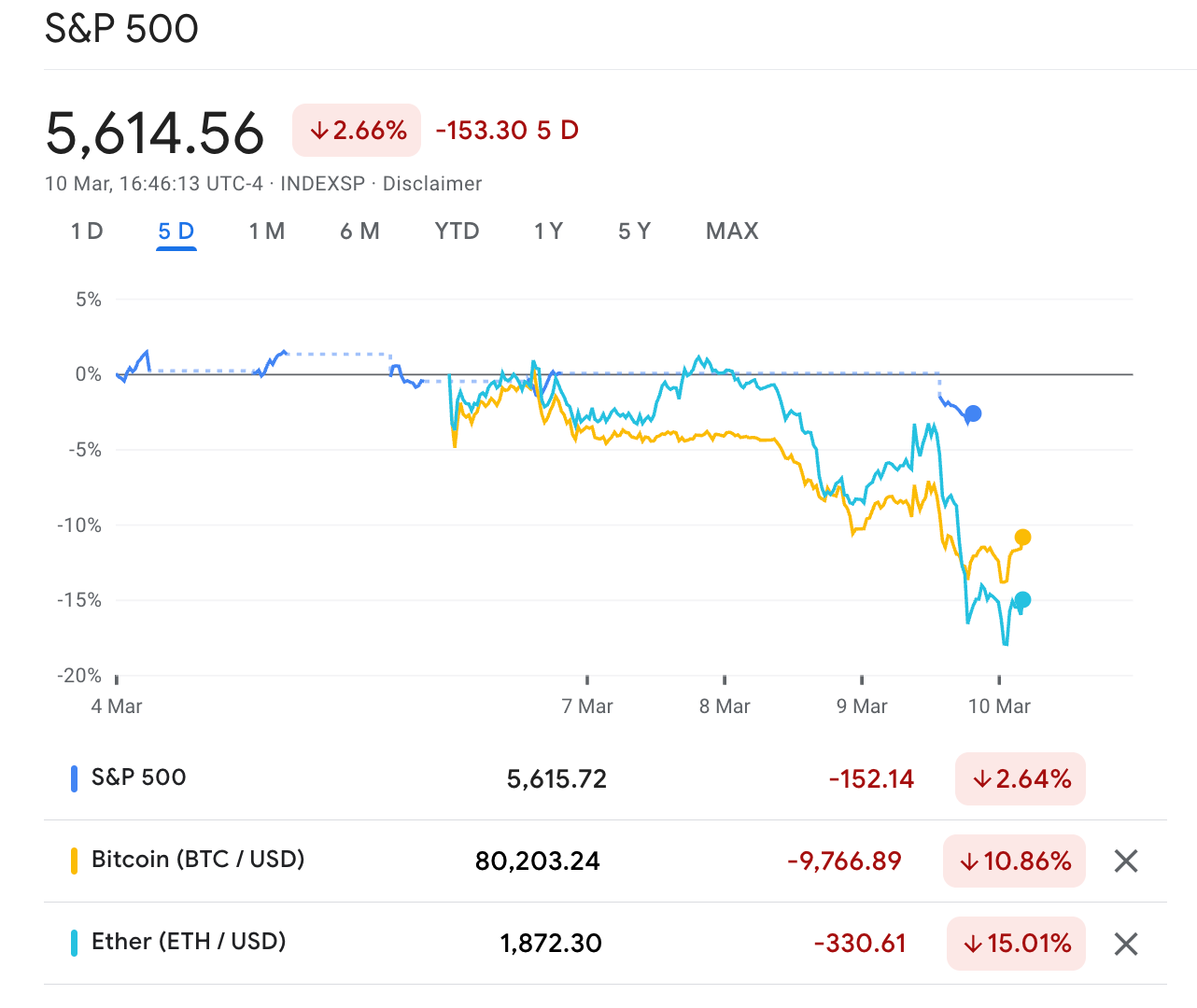

A wave of anxiety swept through global markets on Monday, as recession fears and escalating trade tensions sparked a dramatic sell-off across both traditional equities and cryptocurrencies. The S&P 500 plummeted 3%, the Nasdaq Composite tumbled 4.3%, and the cryptocurrency market witnessed a significant correction, with Bitcoin dipping below $80,000 and Ethereum retreating to $1,900.

The tech-heavy Nasdaq led the declines, dragged down by sharp losses in major technology stocks. Tesla experienced a catastrophic 14% drop, while the once-unstoppable "Magnificent Seven" – Apple, Microsoft, Alphabet, Amazon, Nvidia, and Meta – all saw their share prices fall between 2% and 5%.

The market downturn was ignited by growing concerns that the U.S. economy is teetering on the brink of recession. US President Donald Trump himself fueled these fears over the weekend, declining to rule out a recession this year, stating in a Fox News interview that the U.S. would experience a "period of transition" due to his administration's policies. This starkly contrasted with Commerce Secretary Howard Lutnick’s reassurances of "no recession," creating further uncertainty and unsettling investors.

"Nasdaq (-4%) and Bitcoin (-3.5%) suffered similar losses yesterday," observed BRN analyst Valentin Fournier. "Digital assets and traditional markets are becoming increasingly correlated and this is largely explained by the increased institutional adoption this cycle. As Bitcoin becomes a part of the risky pocket of more portfolios, risk-off sentiment extends from one market to the other and negative news from the stock market will result in a sell-off of digital assets."

Adding to the negative sentiment was Friday's jobs report , which, while indicating a currently stable labor market, hinted at potential weakening. Analysts are concerned that aggressive policies from the Trump administration, including increased deportations and government layoffs, could exacerbate job losses and trigger a more severe economic downturn.

The cryptocurrency market, which had shown resilience in recent weeks, proved unable to withstand the broader market turmoil. Bitcoin (BTC) plunged to around $78,000, while Ethereum (ETH) sank to approximately $1,900. Crypto-linked stocks also suffered heavy losses, with Coinbase (COIN) dropping 15% and MicroStrategy (MSTR), a major corporate Bitcoin holder, plummeting 17%.

"As tech stocks are sinking on fear of a recession, digital assets are down with bitcoin hitting a 4-month low. It is currently sitting on the 79K support zone we highlighted two weeks ago and from which it bounced to 94K on a Trump tweet," Fournier added, highlighting Bitcoin’s vulnerability amidst broader economic anxieties, even as it tests a crucial technical support level.

The market sell-off was further exacerbated by ongoing concerns about the unpredictable nature of the Trump administration's tariff policies. The recent implementation of tariffs, coupled with threats of further escalation, has rattled investors , raising fears of supply chain disruptions, increased costs for businesses, and a potential drag on economic growth.

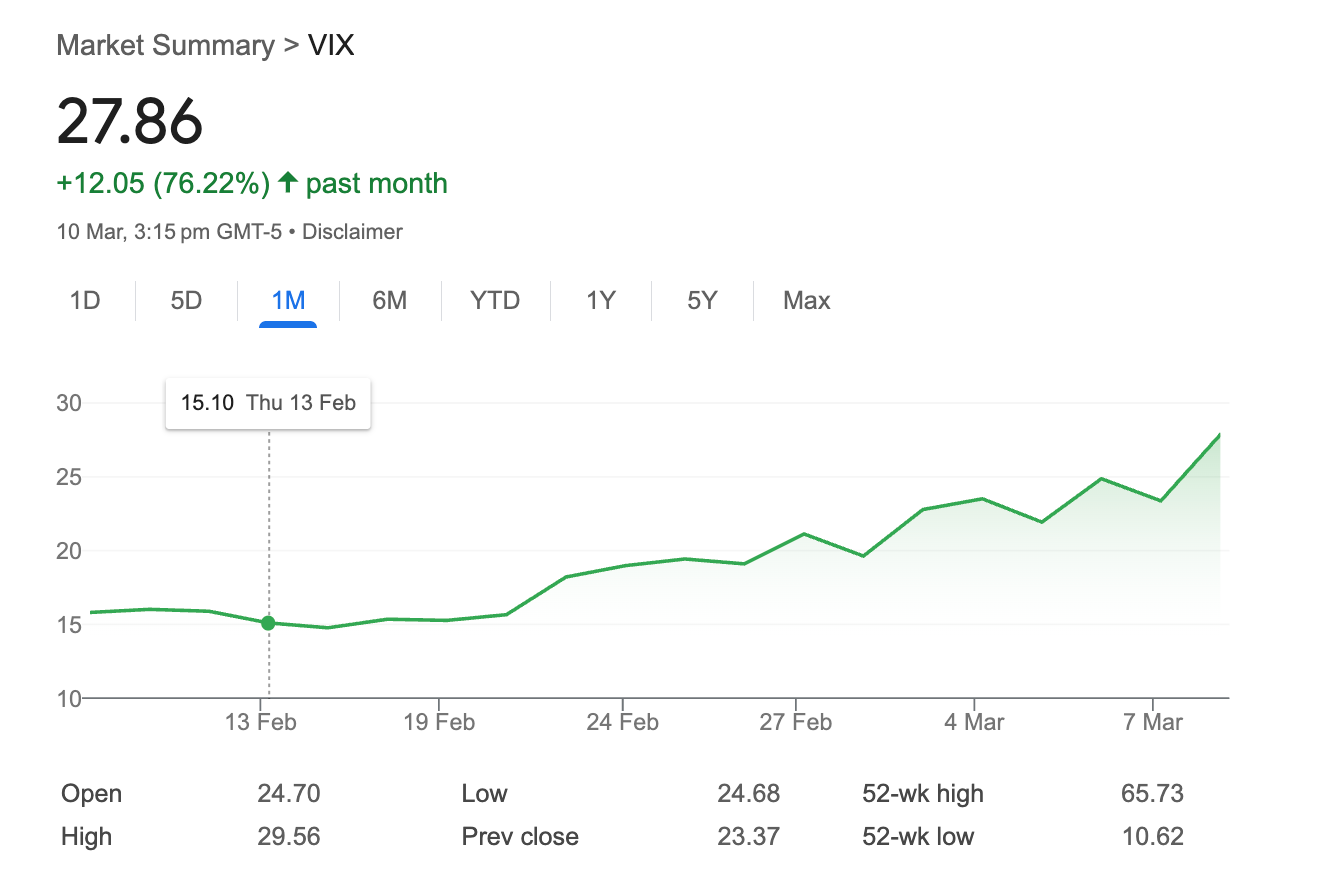

Investor risk aversion was palpable across markets. The Cboe Volatility Index (VIX), a key measure of market fear, surged to its highest level since December. Treasury yields declined as investors sought safer assets, and the WSJ Dollar Index hovered near its lowest level since early November.

While the major market indices recovered slightly from their session lows towards the close, the overall sentiment remains decidedly bearish. As Fournier concluded, "The market is currently hard to navigate as the lack of catalysts could lead to a continuation of the negative trend.”

Lummis Revives Bitcoin Act, Seeks to Legislate National Strategic Reserve

The move seeks to solidify President Trump's recent executive order directing the creation of such a...

Sony's Soneium Blockchain Integrates Mini-Apps Into LINE, Targeting 200 Million Users in Web3 Push

The collaboration, announced Wednesday, aims to significantly expand the reach and accessibility of ...

OKX Slams "Misleading" Bloomberg Article Tying it to Bybit Hack Investigation

OKX denies EU probe over ByBit hack, calling claims misleading. It froze hacked funds, blamed ByBit'...